Supercuts 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

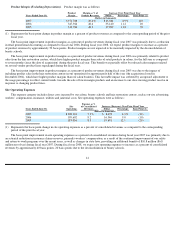

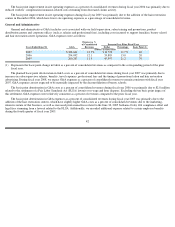

2005 tax rate. Excluding the impact of the goodwill impairment, the increase in the fiscal year 2006 tax rate over the prior year was primarily

due to the elimination of the Work Opportunity and Welfare-to-Work Tax Credits, which expired on December 31, 2005. During fiscal year

2005, excluding the impact of the goodwill impairment, the improvement in the effective tax rate over fiscal year 2004 was primarily due to the

successful settlement of our federal audit and the retroactive reinstatement of the Work Opportunity and Welfare-to-Work Tax Credits during

fiscal year 2005 (see Note 8 to the Consolidated Financial Statements).

Recent Accounting Pronouncements

Recent accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements.

Effects of Inflation

We compensate some of our salon employees with percentage commissions based on sales they generate, thereby enabling salon payroll

expense as a percent of company-owned salon revenues to remain relatively constant. Accordingly, this provides us certain protection against

inflationary increases, as payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may

increase pricing in our salons to offset any significant increases in wages. Therefore, we do not believe inflation has had a significant impact on

the results of our operations.

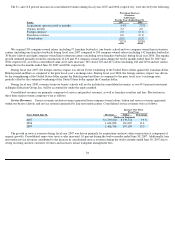

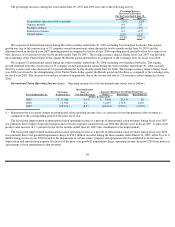

Constant Currency Presentation

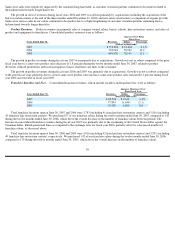

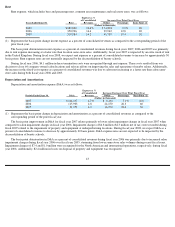

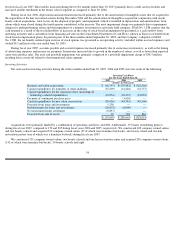

The presentation below demonstrates the effect of foreign currency exchange rate fluctuations from year to year. To present this

information, current period results for entities reporting in currencies other than United States dollars are converted into United States dollars at

the average exchange rates in effect during the corresponding period of the prior fiscal year, rather than the actual average exchange rates in

effect during the current fiscal year. Therefore, the foreign currency impact is equal to current year results in local currencies multiplied by the

change in the average foreign currency exchange rate between the current fiscal period and the corresponding period of the prior fiscal year.

During the fiscal year ended June 30, 2007, foreign currency translation had a favorable impact on consolidated revenues due to the

strengthening of the Canadian dollar, British pound and Euro, as compared to the fiscal year ended June 30, 2006.

During the fiscal year ended June 30, 2006, foreign currency translation had a negative impact on consolidated revenues due to the

weakening of the British pound and Euro against the United States dollar, partially offset by the strengthening of the Canadian dollar.

45

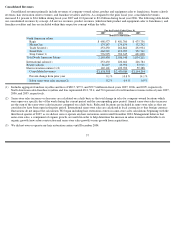

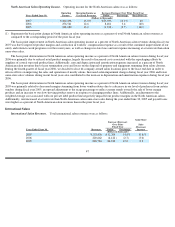

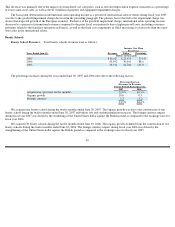

Favorable (Unfavorable) Impact of Foreign

Currency Exchange Rate Fluctuations

Impact on Revenues

Impact on Income

Before Income Taxes

Currency

Fiscal 2007

Fiscal 2006

Fiscal 2007

Fiscal 2006

(Dollars in thousands)

Canadian dollar

$

3,606

$

7,274

$

608

$

1,060

British pound

15,167

(6,753

)

616

(341

)

Euro

4,388

(2,472

)

782

(292

)

Total

$

23,161

$

(1,951

)

$

2,006

$

427