Supercuts 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

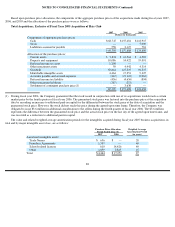

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

4.

FINANCING ARRANGEMENTS:

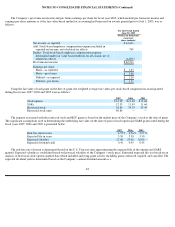

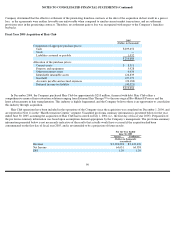

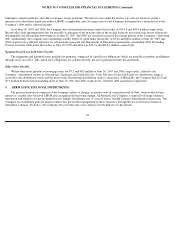

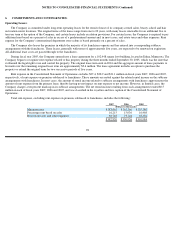

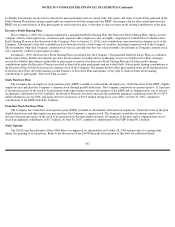

The Company’s long-term debt as of June 30, 2007 and 2006 consists of the following:

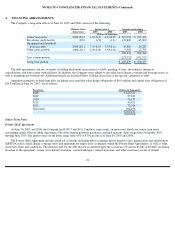

The debt agreements contain covenants, including limitations on incurrence of debt, granting of liens, investments, merger or

consolidation, and transactions with affiliates. In addition, the Company must adhere to specified fixed charge coverage and leverage ratios, as

well as minimum net worth levels. Additional details are included below with the discussion of the specific categories of debt.

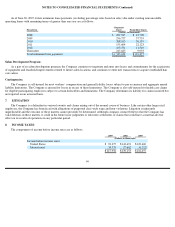

Aggregate maturities of long-term debt, including associated fair value hedge obligations of $0.9 million and capital lease obligations of

$34.8 million at June 30, 2007, are as follows:

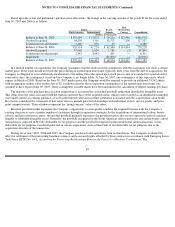

Senior Term Notes

Private Shelf Agreement

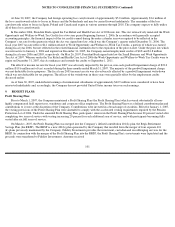

At June 30, 2007 and 2006, the Company had $189.7 and $191.0 million, respectively, in unsecured, fixed rate, senior term notes

outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from November 2007

through June 2013. The interest rates on the notes range from 4.03 to 8.39 percent as of June 30, 2007 and 2006.

The Private Shelf Agreement includes financial covenants including debt to earnings before interest, taxes, depreciation and amortization

(EBITDA) ratios, fixed charge coverage ratios and minimum net equity tests (as defined within the Private Shelf Agreement), as well as other

customary terms and conditions. The maturity date for the debt may be accelerated upon the occurrence of various Events of Default, including

breaches of the agreement, certain cross-default situations, certain bankruptcy related situations, and other customary events of default.

92

Maturity Dates

Interest rate %

Amounts outstanding

(fiscal year)

2007

2006

2007

2006

(Dollars in thousands)

Senior term notes

2008

-

2015

4.03

-

8.39

4.03

-

8.39

$

515,578

$

517,341

Revolving credit facility

2010

6.50

6.21

147,800

63,000

Equipment and leasehold

notes payable

2008

-

2011

7.55

-

8.67

7.33

-

8.16

35,885

29,223

Other notes payable

2008

-

2013

3.90

-

8.00

3.90

-

8.00

9,968

12,705

709,231

622,269

Less current portion

(223,352

)

(101,912

)

Long-term portion

$

485,879

$

520,357

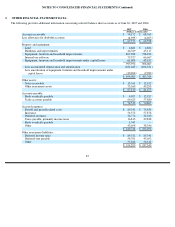

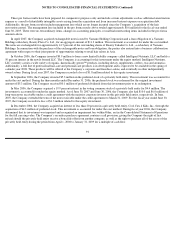

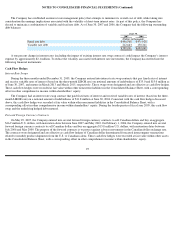

Fiscal year

(Dollars in thousands)

2008

$

223,352

2009

87,281

2010

75,175

2011

46,011

2012

72,914

Thereafter

204,498

$

709,231