Supercuts 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

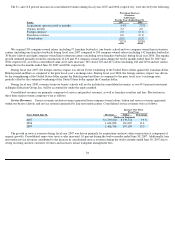

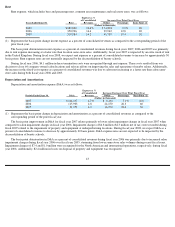

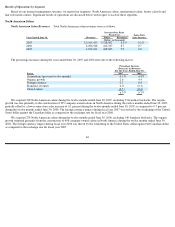

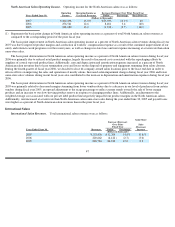

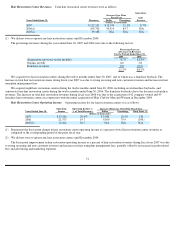

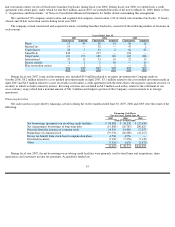

The percentage increases during the years ended June 30, 2007 and 2006 were due to the following factors.

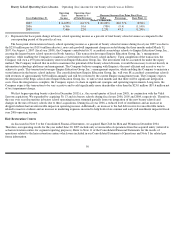

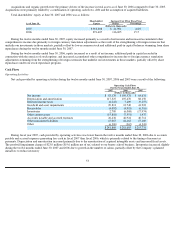

We acquired 16 international salons during the twelve months ended June 30, 2007, including four franchise buybacks. The organic

growth was due to the construction of 25 company-owned international salons during the twelve months ended June 30, 2007 and the

additional week in the fiscal year 2007 reporting period as compared to the fiscal year 2006 reporting period, partially offset by a same-store

sales decrease of 0.6 percent for the twelve months ended June 30, 2007. The foreign currency impact during fiscal year 2007 was driven by

the weakening of the United States dollar against the British pound and the Euro as compared to the exchange rates for fiscal year 2006.

We acquired 12 international salons during the twelve months ended June 30, 2006, including two franchise buybacks. The organic

growth stemmed from the construction of 33 company-owned international salons during the twelve months ended June 30, 2006, partially

offset by a same-store sales decrease of 3.0 percent during the twelve months ended June 30, 2006. The foreign currency impact during fiscal

year 2006 was driven by the strengthening of the United States dollar against the British pound and the Euro as compared to the exchange rates

for fiscal year 2005. The decrease in franchise revenues was primarily due to the closure and sale of 116 franchise salons during fiscal year

2006.

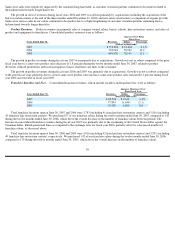

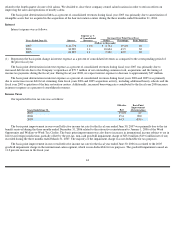

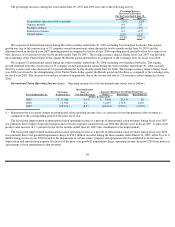

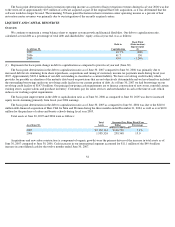

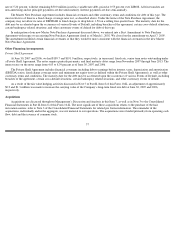

International Salon Operating Income (Loss). Operating income (loss) for the international salons was as follows:

(1)

Represents the basis point change in international salon operating income (loss) as a percent of total international salon revenues as

compared to the corresponding period of the prior fiscal year.

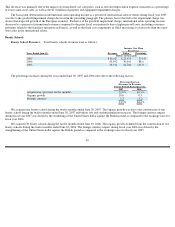

The basis point improvement in international salon operating income as a percent of international salon revenues during fiscal year 2007

was primarily due to improved product margins and severance expenses incurred in fiscal 2006 that did not occur in fiscal 2007. A same-store

product sales increase of 7.1 percent for the twelve months ended June 30, 2007 also contributed to the improvement.

The basis point improvement in international salon operating income as a percent of international salon revenues during fiscal year 2006

was primarily due to the goodwill impairment charge of $38.3 million recorded during the three months ended March 31, 2005, offset by a $1.0

million charge in fiscal year 2006 related to the impairment of certain salons’ property and equipment which contributed to an increase in

depreciation and amortization expense. Exclusive of the prior year goodwill impairment charge, operating income decreased 280 basis points as

a percentage of total international salon revenues.

48

Percentage Increase

(Decrease) in Revenues

For the Years Ended June 30,

2007

2006

Acquisitions (previous twelve months)

2.6

%

1.8

%

Organic growth

4.4

2.0

Foreign currency

8.5

(3.9

)

Franchise revenues

0.3

(0.5

)

Closed salons

(1.0

)

(2.1

)

14.8

%

(2.7

)%

Operating

Operating Income

(Loss) as

Increase (Decrease) Over Prior Fiscal Year

Years Ended June 30,

Income (Loss)

% of Total Revenues

Dollar

Percentage

Basis Point

(1)

(Dollars in thousands)

2007

$

17,548

6.9

%

$

3,986

29.4

%

80

2006

13,562

6.1

31,695

174.8

1,410

2005

(18,133

)

(8.0

)

(40,612

)

(180.7

)

(1,910

)