Supercuts 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

newly formed company, Empire Education Group, Inc. The cosmetology schools we contributed comprised substantially all of the beauty

schools segment (Refer to Note 11 to the Consolidated Financial Statements). This transaction closed on August 1, 2007 (fiscal year 2008) and

we now own a 49.0 percent minority interest in Empire Education Group, Inc. Empire’s management team will operate and manage the

combined business. Our investment in Empire Education Group, Inc. is accounted for under the equity method.

We realized that in order to maximize the potential of the beauty school division, it would be necessary to invest heavily in information

technology platforms and management. We believe merging with Empire is the most efficient and accretive way for us to achieve our goals.

This transaction leverages Empire Education Group, Inc.’s management expertise, while enabling the Company to maintain a vested interest in

the beauty school industry. The consolidated new Empire Education Group, Inc. will own 88 accredited cosmetology schools with revenues of

approximately $130 million annually and will be overseen by the current Empire management team.

We will be able to add significant value to the venture with our strong education and marketing programs coupled with the ancillary

benefits that the Vidal Sassoon Academies (which are not part of this transaction) and Horst Rechelbacher (the founder of Aveda and a beauty

industry icon) will provide. In addition, we will have double the number of qualified graduates who will have placement opportunities at our

Regis operated salons.

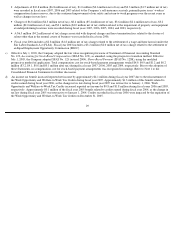

We recorded a $23.0 million pre-tax ($19.6 million after tax), non-cash goodwill impairment charge as a result of the transaction. We

expect the integration of the Regis schools into Empire Education Group, Inc. to take several months and that there will be significant

integration costs. Once the integration is complete, we expect to share in significant synergies and operating improvements. Long-term, we

expect this transaction to be very accretive and to add significantly more shareholder value than the $23.0 million ($19.6 million net of tax)

impairment charge.

CRITICAL ACCOUNTING POLICIES

The Consolidated Financial Statements are prepared in conformity with accounting principles generally accepted in the United States of

America. In preparing the Consolidated Financial Statements, we are required to make various judgments, estimates and assumptions that could

have a significant impact on the results reported in the Consolidated Financial Statements. We base these estimates on historical experience and

other assumptions believed to be reasonable under the circumstances. Estimates are considered to be critical if they meet both of the following

criteria: (1) the estimate requires assumptions about material matters that are uncertain at the time the accounting estimates are made, and

(2) other materially different estimates could have been reasonably made or material changes in the estimates are reasonably likely to occur

from period to period. Changes in these estimates could have a material effect on our Consolidated Financial Statements.

Our significant accounting policies can be found in Note 1 to the Consolidated Financial Statements contained in Part II, Item 8 of this

Form 10-K. We believe the following accounting policies are most critical to aid in fully understanding and evaluating our reported financial

condition and results of operations.

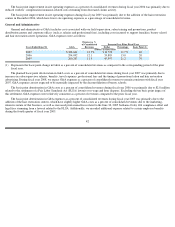

Cost of Product Used and Sold

Cost of product used in salon services is determined by applying estimated gross profit margins to service revenues, which are based on

historical factors including product pricing trends and estimated shrinkage. In addition, the estimated gross profit margin is adjusted based on

the results of physical inventory counts performed at least semi-annually and the monthly monitoring of factors that could impact our usage

rates estimates. These factors include mix of service sales, discounting and special promotions.

32