Supercuts 2007 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193

|

|

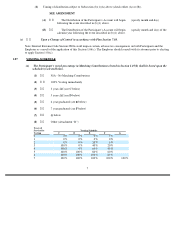

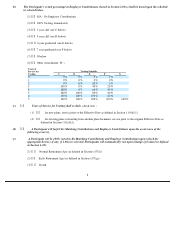

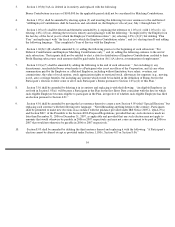

(b)

The Participant’s vested percentage in Employer Contributions elected in Section 1.05(c) shall be based upon the schedule

(s) selected below.

(1) 32N/A - No Employer Contributions

(2) 32100% Vesting immediately

(3) 323 year cliff (see C below)

(4) 325 year cliff (see D below)

(5) 26 year graduated (see E below)

(6) 327 year graduated (see F below)

(7) 32G below

(8) 32Other (Attachment “B”)

(c) 32 Years of Service for Vesting shall exclude (check one) :

(1) 32

for new plans, service prior to the Effective Date as defined in Section 1.01(d)(1).

(2) 32

for existing plans converting from another plan document, service prior to the original Effective Date as

defined in Section 1.01(d)(2).

(d) 32

A Participant will forfeit his Matching Contributions and Employer Contributions upon the occurrence of the

following event (s):

(e)

A Participant will be 100% vested in his Matching Contributions and Employer Contributions upon (check the

appropriate box(es), if any; if 1.06(c) is selected, Participants will automatically vest upon Change of Control as defined

in Section 1.12):

(1) 2 Normal Retirement Age (as defined in Section 1.07(f)).

(2) 32 Early Retirement Age (as defined in Section 1.07(g)).

(3) 2 Death.

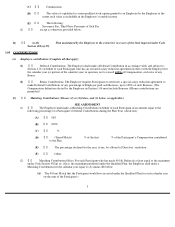

8

Years of

Service for

Vesting Schedule

Vesting

C

D

E

F

G

0

0

%

0

%

0

%

0

%

1

0

%

0

%

0

%

0

%

2

0

%

0

%

20

%

0

%

3

100

%

0

%

40

%

20

%

4

100

%

0

%

60

%

40

%

5

100

%

100

%

80

%

60

%

6

100

%

100

%

100

%

80

%

7

100

%

100

%

100

%

100

%

100

%