Supercuts 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

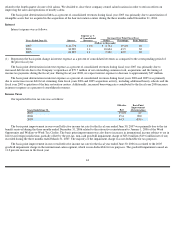

levels in fiscal year 2007. Receivables increased during the twelve months ended June 30, 2007 primarily due to credit card receivables and

increased student enrollment in the beauty school segment as compared to June 30, 2006.

During fiscal year 2006, depreciation and amortization increased primarily due to the amortization of intangible assets that we acquired in

the acquisition of the hair restoration centers during December 2004 and the amortization of intangibles acquired in conjunction with recent

beauty school acquisitions. Also, losses on the disposal of property and equipment (which is included in depreciation and amortization) from

salons which were closed during the fourth quarter contributed to the increase. The asset impairment charge was primarily due to impairment

charges for underperforming salons and the impairment of a minority investment in a privately held company. SFAS No. 123R requires that the

cash retained as a result of the tax deductibility of increases in the value of stock-based arrangements be presented as a cash outflow from

operating activities and a cash inflow from financing activities in the Consolidated Statement of Cash Flows (shown as Excess tax benefit from

stock-based compensation plans). In periods prior to the three months ended September 30, 2005, and the Company’s adoption of SFAS

No. 123R, the tax benefit realized upon exercise of stock options was presented as an operating activity (included within accrued expenses) and

totaled $9.1 million for the year ended June 30, 2005.

During fiscal year 2005, accounts payable and accrued expenses increased primarily due to an increase in inventory, as well as the timing

of advertising expenses and income tax payments. Inventories increased due to growth in the number of salons, as well as lower than expected

same-store product sales. The asset and goodwill impairment was primarily comprised of a goodwill impairment charge of $38.3 million

resulting from a write-off related to the international salon segment.

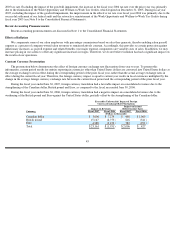

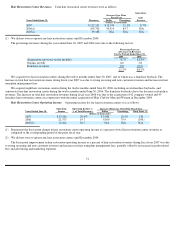

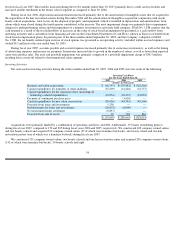

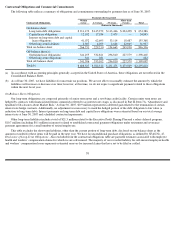

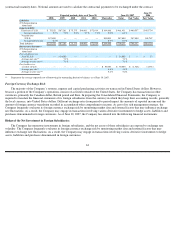

Investing Activities

Net cash used in investing activities during the twelve months ended June 30, 2007, 2006 and 2005 were the result of the following:

Acquisitions were primarily funded by a combination of operating cash flows and debt. Additionally, 155 major remodeling projects

during fiscal year 2007, compared to 170 and 205 during fiscal years 2006 and 2005, respectively. We constructed 420 company-owned salons

and two beauty schools and acquired 354 company-owned salons (97 of which were franchise buybacks), one beauty school and two hair

restoration centers (one of which was a franchise buyback) during fiscal year 2007.

We constructed 531 company-owned salons, two beauty schools and one hair restoration center and acquired 290 company-owned salons

(142 of which were franchise buybacks), 30 beauty schools and eight

54

Investing Cash Flows

For the Years Ended June 30,

2007

2006

2005

(Dollars in thousands)

Business and salon acquisitions

$

(68,747

)

$

(155,481

)

$

(328,566

)

Capital expenditures for remodels or other additions

(35,299

)

(41,246

)

(34,737

)

Capital expenditures for the corporate office (including all

technology

-

related expenditures)

(23,854

)

(30,455

)

(18,001

)

Payment of contingent purchase price

—

(

3,630

)

—

Capital expenditures for new salon construction

(30,926

)

(44,583

)

(48,360

)

Proceeds from loans and investments

5,250

—

—

Disbursements for loans and investments

(30,673

)

(6,000

)

—

Net investment hedge settlement

(8,897

)

—

—

Proceeds from sale of assets

97

730

846

$

(193,049

)

$

(280,665

)

$

(428,818

)