Supercuts 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REGIS CORP

FORM 10-K

(Annual Report)

Filed 08/29/07 for the Period Ending 06/30/07

Address 7201 METRO BLVD

MINNEAPOLIS, MN 55439

Telephone 9529477777

CIK 0000716643

Symbol RGS

SIC Code 7200 - Services-Personal Services

Industry Personal Services

Sector Services

Fiscal Year 06/30

http://www.edgar-online.com

© Copyright 2013, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

REGIS CORP FORM 10-K (Annual Report) Filed 08/29/07 for the Period Ending 06/30/07 Address Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 7201 METRO BLVD MINNEAPOLIS, MN 55439 9529477777 0000716643 RGS 7200 - Services-Personal Services Personal Services Services 06/30 http://www.edgar-... -

Page 2

... SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2007 OR 32 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 0-11230 Regis Corporation (Exact name of Registrant as specified in its... -

Page 3

... Franchising Program Salon Markets and Marketing Salon Education and Training Programs Salon Staff Recruiting and Retention Salon Design Salon Management Information Systems Salon Competition Beauty School Business Strategy Hair Restoration Business Strategy Corporate Trademarks Corporate Employees... -

Page 4

... are targeted at the mass market consumer. The Company is organized to manage its operations based on significant lines of business-salons, beauty schools and hair restoration centers. Salon operations are managed based on geographical location-North America and international. The Company's North... -

Page 5

... hair restoration services will continue to increase as the overall population continues to focus on personal health and beauty, as well as convenience. Salon Business Strategy: The Company's goal is to provide high quality, affordable hair care services and products to a wide range of mass market... -

Page 6

...'s growth strategy is the acquisition of salons. With an estimated two percent world wide market share, management believes the opportunity to continue to make selective acquisitions persists. Over the past thirteen years, the Company has acquired 7,601 locations, expanding in both North America and... -

Page 7

... haircutting and fashion trends and provide consistent quality hair care services. Finally, the Company tracks salon activity for all of its company-owned salons through the utilization of daily sales detail delivered from the salons' point of sale system. This information is used to reconcile cash... -

Page 8

...'s salons, the Company employs full and part-time artistic directors whose duties are to train salon stylists in current styling trends. The major services supplied by the Company's salons are haircutting and styling, hair coloring and waving, shampooing and conditioning. During fiscal years 2007... -

Page 9

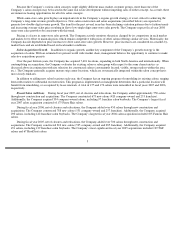

...the last five years, as well as the number of salons opened, closed, relocated, converted and acquired during each of these periods. COMPANY-OWNED AND FRANCHISE LOCATION SUMMARY NORTH AMERICAN SALONS: 2007 2006 2005 2004 2003 REGIS SALONS Open at beginning of period Salons constructed Acquired Less... -

Page 10

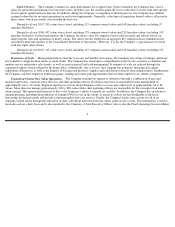

2007 2006 2005 2004 2003 SMARTSTYLE/COST CUTTERS IN WAL-MART Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open at beginning of period Salons... -

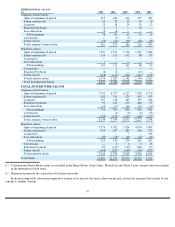

Page 11

INTERNATIONAL SALONS (1): 2007 2006 2005 2004 2003 Company-owned salons: Open at beginning of period Salons constructed Acquired Franchise buybacks Less relocations Salon openings Conversions Salons closed Total company-owned salons Franchise salons: Open at beginning of period Salons ... -

Page 12

.... During fiscal year 2008, the Company plans to open approximately 20 new MasterCuts salons. Trade Secret. Trade Secret salons are designed to emphasize the sale of hair care and beauty products in a retail setting while providing high quality hair care services. Trade Secret salons offer one of the... -

Page 13

... the customer mix. Service revenues represent approximately 88 percent of total company-owned strip center revenues. The average ticket is approximately $14. The average initial capital investment required for a new Supercuts salon typically ranges from $90,000 to $105,000, excluding average opening... -

Page 14

... for a prestigious full service hair salon. Salons are usually located on prominent high-street locations and offer a full range of custom hairstyling, cutting, coloring and waving, as well as professional hair care products. The initial capital investment required typically ranges between £400,000... -

Page 15

... for products and services, business hours, personnel management and capital expenditure decisions. However, the franchise agreements afford certain rights to the Company, such as the right to approve location, suppliers and the sale of a franchise. Additionally, franchisees are required to conform... -

Page 16

... services, which the Company believes will result in more repeat customers, referrals and product sales. The Company has full- and part-time artistic directors who train the stylists in techniques for providing the salon services and instruct the stylists in current styling trends. Stylist training... -

Page 17

... managers and stylists is competitive within the industry. Stylists benefit from the Company's high-traffic locations and receive a steady source of new business from walk-in customers. In addition, the Company offers a career path with the opportunity to move into managerial and training positions... -

Page 18

... fragmented and competitive. In every area in which the Company has a salon, there are competitors offering similar hair care services and products at similar prices. The Company faces competition within malls from companies which operate salons within department stores and from smaller chains of... -

Page 19

Following is a summary of the Company's beauty school locations: 2007 2006 2005 Beauty schools: Open at beginning of period Constructed Acquired Less relocations School openings Total beauty schools Hair Restoration Business Strategy: 54 2 1 (1 ) 2 56 24 2 30 (2 ) 30 54 11 - 13 - 13 24 In ... -

Page 20

...are hair transplants. The hair restoration centers employ a hub and spoke strategy for hair transplants. As of June 30, 2007, 13 locations were equipped and staffed to perform the procedure. Currently, a total of 31 hair restoration centers offer this service to their customers. The Company plans to... -

Page 21

... any unauthorized use, the Company's success and continuing growth are the result of the quality of its salon location selections and real estate strategies. Corporate Employees: During fiscal year 2007, the Company had approximately 62,000 full- and part-time employees worldwide, of which an... -

Page 22

... was also elected Director and Audit Committee Chair of Dress Barn, Inc., which operates a chain of women's apparel specialty stores. Kris Bergly has served as Executive Vice President of Regis Salons, Promenade Salon Concepts, Supercuts, Inc. and MasterCuts and Corporate Chief Operating Officer. He... -

Page 23

... served as Chief Operating Officer, SmartStyle Family Hair Salons since 2007. He served as Vice President, SmartStyle Family Hair Salons from 1999 to 2007 and in other roles with the Company since 1990. Corporate Community Involvement: Many of the Company's stylists volunteer their time to support... -

Page 24

... good standing with the U.S. Department of Education. The Company believes all of its existing schools are compliant. (d) Financial Information about Foreign and North American Operations Financial information about foreign and North American markets is incorporated herein by reference to Management... -

Page 25

... in laws. Due to the number of people we employ, laws that increase minimum wage rates or increase costs to provide employee benefits may result in additional costs to our company. Compliance with new, complex and changing laws may cause our expenses to increase. In addition, any non-compliance... -

Page 26

.... The Company operates all of its salon locations and hair replacement centers under leases or license agreements. Substantially all of its North American locations in regional malls are operating under leases with an original term of at least ten years. Salons operating within strip centers and Wal... -

Page 27

...Dow Jones Consumer Services Index in this analysis because the Company believes these two indices provide a comparative correlation to the cumulative total return of an investment in shares of Regis Corporation. The comparison assumes the initial investment of $100 in the Company's Common Stock, the... -

Page 28

... on April 26, 2007. The timing and amounts of any repurchases will depend on many factors, including the market price of the common stock and overall market conditions. Historically, the repurchases to date have been made primarily to eliminate the dilutive effect of shares issued in conjunction... -

Page 29

...955 $ 301,757 0.12 Revenues from salons, schools or hair restorations centers acquired each year were $108.0, $165.7, $181.2, $122.3, and $152.9 million during fiscal years 2007, 2006, 2005, 2004, and 2003, respectively. The following significant items affected both operating and net income: • An... -

Page 30

...-Work Tax Credits during fiscal year 2007. Approximately $1.3 million of this benefit related to credits earned during fiscal year 2006, as the change in tax law during fiscal year 2007 was retroactive to January 1, 2006. Work Opportunity and Welfare-to-Work Tax Credits increased reported net income... -

Page 31

... • Critical Accounting Policies • Overview of Fiscal Year 2007 Results • Results of Operations • Liquidity and Capital Resources MANAGEMENT'S OVERVIEW Regis Corporation (RGS) owns or franchises beauty salons, hair restoration centers and educational establishments. As of June 30, 2007, we... -

Page 32

... number of new locations in untapped markets domestically and internationally. However, the success of our hair restoration business is not dependent on the same real estate criteria used for salon expansion. In an effort to provide confidentiality for our customers, hair restoration centers operate... -

Page 33

.... Empire's management team will operate and manage the combined business. Our investment in Empire Education Group, Inc. is accounted for under the equity method. We realized that in order to maximize the potential of the beauty school division, it would be necessary to invest heavily in information... -

Page 34

...cash impairment loss was recorded during the three months ended March 31, 2007. Our fiscal year 2006 analysis indicated that the net book value of our European business and Beauty School business approximated their fair values. The fair value of our North American salons and hair restoration centers... -

Page 35

... the acquired hair salon brand. Residual goodwill further represents our opportunity to strategically combine the acquired business with our existing structure to serve a greater number of customers through our expansion strategies. Identifiable intangible assets purchased in fiscal year 2007, 2006... -

Page 36

...grant date using an option-pricing model. During fiscal years 2007, 2006, and 2005, stock-based compensation expense totaled $4.9, $4.9, and $1.2 million, respectively. Our specific weighted average assumptions for the risk free interest rate, expected term, expected volatility and expected dividend... -

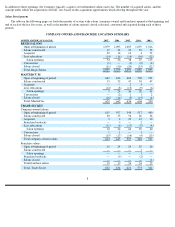

Page 37

... as noted. Results of Operations as a Percent of Revenues For the Years Ended June 30, 2007 2006 2005 Service revenues Product revenues Royalties and fees Operating expenses: Cost of service(1) Cost of product(2) Site operating expenses General and administrative Rent Depreciation and amortization... -

Page 38

... 30, 2007 2006 2005 (Dollars in thousands) North American salons: Regis MasterCuts Trade Secret(1) SmartStyle Strip Center(1) Total North American Salons International salons(1) Beauty schools Hair restoration centers(1)(3) Consolidated revenues Percent change from prior year Salon same-store sales... -

Page 39

... Franchise revenues Closed salons 4.4 % 3.2 1.0 0.0 (0.5 ) 8.1 % 7.5 % 4.0 (0.1 ) (0.1 ) (0.5 ) 10.8 % We acquired 354 company-owned salons (including 97 franchise buybacks), one beauty school and two company-owned hair restoration centers (including one franchise buyback) during fiscal year 2007... -

Page 40

... are primarily sales at company-owned salons, beauty schools, hair restoration centers, and sales of product and equipment to franchisees. Consolidated product revenues were as follows: Years Ended June 30, Increase Over Prior Fiscal Year Revenues Dollar Percentage (Dollars in thousands) 2007 2006... -

Page 41

... new international franchise salons during fiscal year 2005 as compared to the prior fiscal year. Gross Margin (Excluding Depreciation) Our cost of revenues primarily includes labor costs related to salon employees, beauty school instructors and hair restoration center employees, the cost of product... -

Page 42

... by our salons, beauty schools and hair restoration centers, such as on-site advertising, workers' compensation, insurance, utilities and janitorial costs. Site operating expenses were as follows: Site Operating Expense as % Increase (Decrease) Over Prior Fiscal Year of Consolidated Revenues Dollar... -

Page 43

...product distribution centers and corporate offices (such as salaries and professional fees), including costs incurred to support franchise, beauty school and hair restoration center operations. G&A expenses were as follows: Expense as % Increase Over Prior Fiscal Year of Consolidated Revenues Dollar... -

Page 44

... revenues to increase by approximately 30 basis points. Rent expense rates are not materially impacted by the deconsolidation of beauty schools. During fiscal year 2006, $4.1 million in lease termination costs were recognized through rent expense. These costs resulted from our decision to close... -

Page 45

...point deterioration in interest expense as a percent of consolidated revenues during fiscal year 2007 was primarily due to increased debt levels due to the Company's repurchase of $79.7 million of our outstanding common stock, acquisitions and the timing of income tax payments during the fiscal year... -

Page 46

...the average foreign currency exchange rate between the current fiscal period and the corresponding period of the prior fiscal year. During the fiscal year ended June 30, 2007, foreign currency translation had a favorable impact on consolidated revenues due to the strengthening of the Canadian dollar... -

Page 47

... salons, beauty schools and hair restoration centers. Significant results of operations are discussed below with respect to each of these segments. North American Salons North American Salon Revenues. Total North American salon revenues were as follows: Increase Over Prior Fiscal Year Dollar... -

Page 48

... point improvement in North American salon operating income as a percent of North American salon revenues during fiscal year 2007 was due to improved product margins and a reduction in workers' compensation expense as a result of the continued improvement of our safety and return-to-work programs... -

Page 49

... basis point improvement in international salon operating income as a percent of international salon revenues during fiscal year 2007 was primarily due to improved product margins and severance expenses incurred in fiscal 2006 that did not occur in fiscal 2007. A same-store product sales increase of... -

Page 50

... to the franchise operations in France), as well as the fixed cost components of G&A increasing at a faster rate than the samestore sales in the international salons. Beauty Schools Beauty School Revenues. Total beauty schools revenues were as follows: Increase Over Prior Fiscal Year Revenues Dollar... -

Page 51

... School Operating (Loss) Income. Operating (loss) income for our beauty schools was as follows: Operating (Loss) Income Operating (Loss) (Decrease) Increase Over Prior Fiscal Year Income as % of Total Revenues Dollar Percentage Basis Point (1) (Dollars in thousands) Years Ended June 30, 2007... -

Page 52

... in hair restoration operating income as a percent of hair restoration revenues during fiscal year 2007 was due to strong recurring and new customer revenues and increases in hair transplant management fees, partially offset by an increase in professional fees and advertising and marketing expenses... -

Page 53

... on-going cash requirements are to finance construction of new stores, remodel certain existing stores, acquire salons and purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital requirements. The basis point improvement in... -

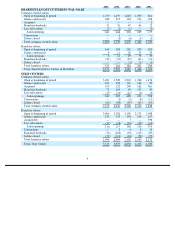

Page 54

...of the following: Operating Cash Flows For the Years Ended June 30, 2007 2006 2005 (Dollars in thousands) Net income Depreciation and amortization Deferred income taxes Goodwill and asset impairments Receivables Inventories Other current assets Accounts payable and accrued expenses Other noncurrent... -

Page 55

... Cash Flows For the Years Ended June 30, 2007 2006 2005 (Dollars in thousands) Business and salon acquisitions Capital expenditures for remodels or other additions Capital expenditures for the corporate office (including all technology-related expenditures) Payment of contingent purchase price... -

Page 56

... salons (139 of which were franchise buybacks), 13 beauty schools and 42 hair restoration centers during fiscal year 2005. The company-owned constructed and acquired locations (excluding franchise buybacks) consisted of the following number of locations in each concept: 2007 Constructed Acquired... -

Page 57

... options. The excess tax benefit from stock-based employee compensation plans was recorded in accordance with the provisions of SFAS No. 123R, as discussed above in conjunction with Operating Activities. New Financing Arrangements Fiscal Year 2007 During fiscal year 2007, we neither entered into... -

Page 58

... and $191.0 million, respectively, in unsecured, fixed rate, senior term notes outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from November 2007 through June 2013. The interest rates on the notes range from 4.03 to 8.39 percent as of... -

Page 59

... long-term debt). Interest payments on long-term debt and capital lease obligations were estimated based on our total average interest rate at June 30, 2007 and scheduled contractual repayments. Other long-term liabilities include a total of $21.3 million related to the Executive Profit Sharing Plan... -

Page 60

...ordinary course of business. These contracts primarily relate to our commercial contracts, operating leases and other real estate contracts, financial agreements, agreements to provide services, and agreements to indemnify officers, directors and employees in the performance of their work. While our... -

Page 61

...standby letters of credit stemming from our self-insurance program and Department of Education requirements surrounding Title IV funding. Dividends We paid dividends of $0.16 per share during fiscal years 2007, 2006 and 2005. On August 23, 2007, the Board of Directors of the Company declared a $0.04... -

Page 62

...the acquired business; the ability of the Company to maintain satisfactory relationships with suppliers; or other factors not listed above. The ability of the Company to meet its expected revenue growth is dependent on salon and beauty school acquisitions, new salon construction and same-store sales... -

Page 63

... These swaps were designated as hedges of a portion of the Company's senior term notes and are being accounted for as fair value hedges. During fiscal year 2003, the Company terminated a portion of a $40.0 million interest rate swap contract. The remainder of this swap contract was terminated during... -

Page 64

... (2,353 ) Represents the average expected cost of borrowing for outstanding derivative balances as of June 30, 2007. Foreign Currency Exchange Risk: The majority of the Company's revenue, expense and capital purchasing activities are transacted in United States dollars. However, because a portion... -

Page 65

.... The exposure to Canadian dollar exchange rates on the Company's fiscal year 2007 cash flows primarily includes payments in Canadian dollars from the Company's Canadian salon operations for retail inventory exported from the United States. The Company seeks to manage exposure to changes in the... -

Page 66

... June 30, 2007 Fair Value Forecasted Transactions (U.S.$equivalent in thousands) Inventory Shipments to Canadian Salons (U.S.$) Foreign Currency Forward Exchange Agreements (U.S.$equivalent in thousands) Pay $CND/receive $U.S.: Contract Amount Average Contractual Exchange Rate $ 5,621 $ 5,621... -

Page 67

... of Operations for each of the three years in the period ended June 30, 2007 71 Consolidated Statements of Changes in Shareholders' Equity and Comprehensive Income for each of the three years in the period ended June 30, 2007 72 Consolidated Statement of Cash Flows for each of the three years in... -

Page 68

... annual report on Form 10-K. The consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, incorporating management's reasonable estimates and judgments, where applicable. Management's Report on Internal Control... -

Page 69

..., Regis Corporation changed the manner in which it accounts for defined benefit arrangements effective June 30, 2007 and changed its method of accounting for share-based payments as of July 1, 2005. A company's internal control over financial reporting is a process designed to provide reasonable... -

Page 70

... to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. /s/ PRICEWATERHOUSECOOPERS LLP PricewaterhouseCoopers LLP Minneapolis, Minnesota August 29, 2007 69 -

Page 71

REGIS CORPORATION CONSOLIDATED BALANCE SHEET (Dollars in thousands, except per share data) June 30, 2007 2006 ASSETS Current assets: Cash and cash equivalents Receivables, net Inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Goodwill Other ... -

Page 72

REGIS CORPORATION CONSOLIDATED STATEMENT OF OPERATIONS (In thousands, except per share data) 2007 Years Ended June 30, 2006 2005 Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent Depreciation ... -

Page 73

...income Foreign currency translation adjustments Changes in fair market value of financial instruments designated cash flow hedges, net of taxes and transfers Stock repurchase plan Proceeds from exercise of stock options Stock-based compensation Shares issued through franchise stock incentive program... -

Page 74

... current assets Other assets Accounts payable Accrued expenses Other noncurrent liabilities Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Proceeds from sale of assets Purchases of salon, school and hair restoration center net assets, net of cash... -

Page 75

... and operated in malls, leading department stores, mass merchants and high-street locations. Beauty schools are typically located within leased space. The hair restoration centers, including both company-owned and franchise locations, are typically located in leased space within office buildings... -

Page 76

...-annually and the monthly monitoring of factors that could impact our usage rates estimates. These factors include mix of service sales, discounting and special promotions. Cost of product sold to salon customers is determined based on the weighted average cost of product to the Company, adjusted... -

Page 77

... Costs incurred to develop internal-use software during the application development stage are capitalized, while data conversion, training and maintenance costs associated with internal-use software are expensed as incurred. At June 30, 2007 and 2006, the net book value of capitalized software costs... -

Page 78

... accounted for under the cost method. The impairment charge was included in Other, net (other non-operating expense) in the Consolidated Statement of Operations and reduced the Company's investment balance to zero. Deferred Rent and Rent Expense: The Company leases most salon, beauty school and hair... -

Page 79

... are rendered or products are sold to franchisees. The Company recognizes revenue from initial franchise fees at the time franchise locations are opened, as this is generally when the Company has performed all initial services required under the franchise agreement. Consideration Received from... -

Page 80

... such as payroll, training costs and promotion incurred prior to the opening of a new location are expensed as incurred. Sales Taxes: Sales taxes are recorded on a net basis (rather than as both revenue and an expense) within the Company's Consolidated Statement of Operations. Income Taxes: Deferred... -

Page 81

...'s dilutive securities include shares issuable under the Company's stock option plan and long-term incentive plan, as well as shares issuable under contingent stock agreements. Diluted EPS is calculated as net income divided by weighted average common shares outstanding, increased to include assumed... -

Page 82

... No. 25, Accounting for Stock Issued to Employees (APB No. 25) and related Interpretations. Under the provisions of APB No. 25, no stock-based employee compensation cost was reflected in net income, as all options granted under those plans had an exercise price equal to the market value of the... -

Page 83

... value-based method of accounting had been used on awards granted prior to July 1, 2003, was as follows: For the Period Ended June 30, 2005 (Dollars in thousands, except per share amounts) Net income, as reported Add: Stock-based employee compensation expense included in reported net income, net of... -

Page 84

... benefit plans as of the end of the Company's current fiscal year (i.e., in the Company's fiscal year 2007 Annual Report on Form 10-K). SFAS No. 158 requires the impact of the initial adjustment be recorded as an adjustment of the ending balance of accumulated other comprehensive income... -

Page 85

...-dollar life insurance arrangement that provides a specified benefit to an employee that is limited to the employee's active service period with an employer. The EITF will be effective for fiscal years beginning after December 15, 2007 (i.e., fiscal year 2009). The Company is currently evaluating... -

Page 86

... leasehold improvements under capital leases Other assets: Notes receivable Other noncurrent assets Accounts payable: Book overdrafts payable Trade accounts payable Accrued expenses: Payroll and payroll related costs Insurance Deferred revenues Taxes payable, primarily income taxes Book overdrafts... -

Page 87

... reporting period. The weighted average amortization periods, in total and by major intangible asset class, are as follows: Weighted Average Amortization Period (in years) Amortized intangible assets: Brand assets and trade names Customer list Franchise agreements School-related licenses Product... -

Page 88

...2006 2005 (Dollars in thousands) Cash paid during the year for: Interest Income taxes, net of refunds Significant non-cash investing and financing activities include the following: $ 40,805 71,770 $ 35,098 32,544 $ 23,062 40,544 In fiscal years 2007, 2006, and 2005, the Company financed capital... -

Page 89

... the guaranteed stock price and the actual stock price on the last day of the agreed upon time frame, and was recorded as a reduction to additional paid-in capital. The value and related weighted average amortization periods for the intangibles acquired during fiscal year 2007 business acquisitions... -

Page 90

... represents the Company's opportunity to strategically combine the acquired business with the Company's existing structure to serve a greater number of customers through its expansion strategies. In the acquisitions of international salons, beauty schools and hair restoration centers, the residual... -

Page 91

... was recognized with respect to the Company's franchise buybacks. Fiscal Year 2005 Acquisition of Hair Club 2005 (Dollars in thousands) Components of aggregate purchase prices: Cash Stock Liabilities assumed or payable Allocation of the purchase prices: Current assets Property and equipment Other... -

Page 92

...line of professional hair-care and personal care products is in development and is expected to be available in the spring of calendar year 2008. These products will be offered at the Company's corporate and franchise salons, and eventually in other independently owned salons. During fiscal year 2007... -

Page 93

... $ 709,231 Senior Term Notes Private Shelf Agreement At June 30, 2007 and 2006, the Company had $189.7 and $191.0 million, respectively, in unsecured, fixed rate, senior term notes outstanding under a Private Shelf Agreement. The notes require quarterly payments, and final maturity dates range from... -

Page 94

...$0.9 and $1.3 million was made to increase the carrying value of the Company's long-term fixed rate debt at June 30, 2007 and 2006, respectively. Private Placement Senior Term Notes In fiscal year 2005, the Company issued $200.0 million of senior unsecured debt to approximately twenty purchasers via... -

Page 95

... of the current portion of the Company's long-term debt. Additionally, the Company had outstanding standby letters of credit under the facility of $54.6 and $60.6 million at June 30, 2007 and 2006, respectively, primarily related to its self-insurance program and Department of Education requirements... -

Page 96

... income within shareholders' equity. During the fourth quarter of fiscal year 2005, this cash flow swap and the underlying hedged debt matured. Forward Foreign Currency Contracts On May 29, 2007, the Company entered into several forward foreign currency contracts to sell Canadian dollars... -

Page 97

...(loss) gain transferred from other comprehensive income to earnings Unrealized net (loss) gain from changes in fair value of cash flow hedges $ (190 ) $ 50 (1,030 ) 1,416 $ (1,220 ) $ 1,466 $ 271 480 $ 751 As of June 30, 2007, the Company estimates, based on current interest rates, that less than... -

Page 98

... fiscal years 2007, 2006 or 2005. As a result, the fair value hedges did not have a net impact on earnings. Hedge of Net Investments in Foreign Operations The Company has numerous investments in foreign subsidiaries, and the net assets of these subsidiaries are exposed to exchange rate volatility... -

Page 99

... is committed under long-term operating leases for the rental of most of its company-owned salon, beauty school and hair restoration center locations. The original terms of the leases range from one to 20 years, with many leases renewable for an additional five to ten year term at the option of... -

Page 100

... salon locations, and continues to enter into transactions to acquire established hair care salons. Contingencies: The Company is self-insured for most workers' compensation and general liability losses subject to per occurrence and aggregate annual liability limitations. The Company is insured... -

Page 101

...the applicable United States (U.S.) statutory rate to earnings before income taxes, as a result of the following: 2007 2006 2005 U.S. statutory rate State income taxes, net of federal income tax benefit Tax effect of goodwill impairment Foreign income taxes at other than U.S. rates Work Opportunity... -

Page 102

..., the Company earned employment credits of $0.8 and $1.8 million during fiscal years 2006 and 2005, respectively. On May 26, 2007, President Bush signed into law the Small Business and Work Opportunity Tax Act of 2007. Whereas under the Tax Relief and Health Care Act of 2006 the Work Opportunity and... -

Page 103

.... Under the terms of the plan, eligible franchisees and their employees may purchase the Company's common stock. The Company contributes an amount equal to five percent of the purchase price of the stock to be purchased on the open market and pays all expenses of the plan and its administration, not... -

Page 104

... outside directors for a term not to exceed ten years from the grant date. The 2000 Plan contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through exercise of the options. Stock options are granted at not less than fair market value... -

Page 105

... of compensation cost for its incentive stock option plans, as well as pro forma information. 2004 Long Term Incentive Plan: In May of 2004, the Company's Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan received shareholder approval at the annual shareholders... -

Page 106

...deferred compensation contracts. Compensation associated with these agreements is charged to expense as services are provided. Associated costs included in general and administrative expenses on the Consolidated Statement of Operations totaled $4.0, $2.4, and $2.2 million for fiscal years 2007, 2006... -

Page 107

... amounts paid for expenses and administration of the plans, for the three years ended June 30, 2007, 2006 and 2005, included the following: 2007 2006 2005 (Dollars in thousands) Stock-based compensation Deferred compensation contracts Profit sharing plan Executive Profit Sharing Plan ESPP FSPP... -

Page 108

...Company's international salon operations, which are primarily in Europe, are located in malls, leading department stores, mass merchants and high-street locations. The Company's beauty schools are located in the United States and the United Kingdom. The Company's hair restoration centers are located... -

Page 109

... 30, 2007 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 110

... 30, 2006 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 111

... 30, 2005 Hair Salons Beauty Restoration Unallocated North America International Schools Centers Corporate (Dollars in thousands) Consolidated Revenues: Service Product Royalties and fees Operating expenses: Cost of service Cost of product Site operating expenses General and administrative Rent... -

Page 112

... Company's beauty schools segment (see Note 11). QUARTERLY FINANCIAL DATA (Unaudited) September 30 Quarter Ended December 31 March 31 June 30 (Dollars in thousands, except per share amounts) Year Ended 2007 Revenues Gross margin, including site depreciation Operating income(a) Net income Net income... -

Page 113

... the chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure. Management necessarily applied its judgment in assessing the costs and benefits of such controls and procedures, which, by their nature, can provide only reasonable... -

Page 114

... executive officer, chief financial officer, directors and executive officers. The Code of Business Conduct & Ethics is available on the Company's website at www.regiscorp.com , under the heading "Corporate Governance / Guidelines" (within the "Investor Information" section). The Company intends... -

Page 115

... options granted under the Regis Corporation 2000 Stock Option Plan and 1991 Stock Option Plan as well as shares granted through stock appreciation rights and restricted stock units under the 2004 Long Term Incentive Plan. Information regarding the stockbased compensation plans is included in Notes... -

Page 116

..., filed on December 26, 2006). Form of Employment and Deferred Compensation Agreement between the Company and certain executive officers. Schedule of omitted split-dollar insurance policies. (Filed as Exhibit 10(h) to the Company's Registration Statement on Form S-1 (Reg. No. 40142) and incorporated... -

Page 117

...(k) 10(l) 10(m) 10(n) 10(o)(*) Regis Corporation Executive Retirement Savings Plan and Trust Agreement dated March 1, 2007 between the Company and Fidelity Management Trust Company, as Trustee. Survivor benefit agreement dated June 27, 1994, between the Company and Myron Kunin. (Incorporated by... -

Page 118

...12, 2005.) Short Term Incentive Compensation Plan. (Incorporated by reference to Exhibit 10(ll) of the Company's Report on Form 10-K filed on September 9, 2005, for the year ended June 30, 2005.) Employment Agreement, dated February 8, 2007, between the Company and Paul D. Finkelstein. (Incorporated... -

Page 119

...duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. REGIS CORPORATION By /s/ PAUL D. FINKELSTEIN Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer By /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice... -

Page 120

REGIS CORPORATION SCHEDULE II-VALUATION AND QUALIFYING ACCOUNTS as of June 30, 2007, 2006 and 2005 (dollars in thousands) Description Balance at beginning of period Charged to costs and expenses Charged to Other Accounts Deductions Balance at end of period Valuation Account, Allowance for ... -

Page 121

... COMPENSATION AGREEMENT (this " Agreement "), is hereby amended and restated as of June 22, 2007 (the " Effective Date "), between REGIS CORPORATION , hereinafter referred to as the " Corporation ," and [***NAME***], hereinafter referred to as " Employee ." WHEREAS , this Agreement was initially... -

Page 122

...value) any compensation plan, bonus or incentive plan, stock purchase plan, stock option plan, life insurance plan, health plan, disability plan or other benefit plan or arrangement in which Employee is then participating; (d) any material breach by the Corporation of any provisions of the Agreement... -

Page 123

...DOLLARS***] Dollars Vested Monthly Benefit" shall be a percentage of Employee's Monthly Benefit determined on the basis of the number of Employee's completed years of service during which Employee has been a party to this Agreement or a prior deferred compensation agreement with the Company: Years... -

Page 124

...to time. 6. Deferred Compensation. The Corporation shall pay to Employee, if living, or to his or her designee(s) in the event of his or her death, the following sums upon the terms and conditions and for the periods hereinafter set forth: a] Payments upon Retirement. Commencing upon the last day of... -

Page 125

...any time for Cause, the Corporation shall have no obligation to make any payments to Employee under this Agreement and all future payments shall be forfeited. e] The Corporation is the owner and beneficiary of certain insurance policies on Employee's life and insuring against Employee's disability... -

Page 126

... vesting or for discounting, to Employee; (B) if Employee's employment with the Corporation terminates more than two years following a Change in Control, the Corporation, within thirty (30) days after such termination, shall commence payment of Employee's Monthly Benefit, without any reduction for... -

Page 127

...performance by the Corporation of its obligations hereunder, that during the term of this Agreement and during the further period that such payments to him or her are provided by this Agreement, he or she will not, directly or indirectly, own any interest in, render any services of any nature to, 7 -

Page 128

... by, or participate or engage in the licensed beauty salon business, except with the prior written consent of the Corporation. b] If Employee voluntarily terminates his or her employment with the Corporation, and Employee violates the restrictive covenant set forth in subparagraph a] above during... -

Page 129

... for the Corporation under the terms of this Agreement. As used in this Agreement, the term "successor" shall include any person, firm, corporation or other business entity which at any time, whether by merger, purchase, or otherwise, acquires all or substantially all of the capital stock or assets... -

Page 130

IN WITNESS WHEREOF , the parties hereto have duly executed this Agreement as of the day and year first above written. REGIS CORPORATION By: Paul D. Finkelstein, President [***NAME***] 10 -

Page 131

... the Plan is "unfunded and maintained primarily for the purpose of providing deferred compensation to a select group of management or highly compensated employees" under the Employee Retirement Income Security Act with respect to the Employer's particular situation. Fidelity Management Trust Company... -

Page 132

...Termination of Employment 7.04 - Separate Account 7.05 - Forfeitures 7.06 - Adjustment for Investment Experience 7.07 - Unforeseeable Emergency Withdrawals 7.08 - Change in Control ARTICLE 8 DISTRIBUTION OF BENEFITS PAYABLE AFTER TERMINATION OF SERVICE 8.01 - Distribution of Benefits to Participants... -

Page 133

... of Benefits 10.04 - Facility of Payment 10.05 - Information between Employer and Trustee 10.06 - Notices 10.07 - Governing Law ARTICLE 11 PLAN ADMINISTRATION 11.01 - Powers and responsibilities of the Administrator 11.02 - Nondiscriminatory Exercise of Authority 11.03 - Claims and Review Procedures... -

Page 134

...the Internal Revenue Code of 1986, as amended from time to time. (8) "Compensation" means for purposes of Article 4 (Contributions) wages as defined in Section 3401(a) of the Code and all other payments of compensation to an employee by the Employer (in the course of the Employer's trade or business... -

Page 135

-

Page 136

... performed; (B) Each hour for which the Employee is directly or indirectly paid, or entitled to payment, by the Employer or Related Employer (including payments made or due from a trust fund or insurer to which the Employer contributes or pays premiums) on account of a period of time during which no... -

Page 137

..., with respect to any Employee, the number of whole years of his periods of service with the Employer or a Related Employer (the elapsed time method to compute vesting service), subject to any exclusions elected by the Employer in Section 1.07(c). An Employee will receive credit for the aggregate of... -

Page 138

5 -

Page 139

... be reasonably required or appropriate in order to discharge its duties under the Plan. Participants will be furnished statements of their Account values at least once each Plan Year. The Administrator shall provide the Trustee with information on the amount credited to the separate account of each... -

Page 140

...be directed by the Employer or by each Participant, or both, in accordance with the Employer's election in Section 1.11(a). (a) All dividends, interest, gains and distributions of any nature that would be earned in respect of Fund Shares in which the Account is treated as investing shall be credited... -

Page 141

... Key Employee's termination of employment. Article 8. Distribution of Benefits . 8.01. Form of Distribution of Benefits to Participants and Beneficiaries . The Plan provides for distribution as a lump sum to be paid in cash on the date specified by the Employer in Section 1.06 pursuant to the method... -

Page 142

... method stated in the Trust Agreement for providing direction, whenever any Participant or Beneficiary is entitled to receive benefits under the Plan. The Administrator's notice shall indicate the form, amount and frequency of benefits that such Participant or Beneficiary shall receive. 8.05. Time... -

Page 143

-

Page 144

...; (g) To authorize the payment of benefits; (h) To comply with any applicable reporting and disclosure requirements of Part 1 of Subtitle B of Title I of ERISA; (i) To appoint such agents, counsel, accountants, and consultants as may be required to assist in administering the Plan; (j) By written... -

Page 145

10 -

Page 146

... 60-day period). The extension notice shall indicate the special circumstances requiring an extension of time and the date by which the Plan expects to render the determination on review. If the initial claim was for disability benefits under the Plan and has been denied by the Plan Administrator... -

Page 147

... the Plan is "unfunded and maintained primarily for the purpose of providing deferred compensation to a select group of management of highly compensated employees" under the Employee Retirement Income Security Act with respect to the Employer's particular situation. Fidelity Management Trust Company... -

Page 148

... Employer: Address: Phone Number: The Plan Administrator is the agent for service of legal process for the Plan. (c) (d) Plan Year End is December 31. Plan Status (check one): (1) (2) 32 Effective Date of new Plan: 2 Amendment Effective Date: 03/01/2007 Amendment to merge the Regis Corporation... -

Page 149

...listed in Attachment A will be eligible to participate in the Plan. Only those Employees in the eligible class described below will be eligible to participate in the Plan: All Company officers and all Highly Compensated Employees, as defined in Code Section 414(q), except those who the Administrator... -

Page 150

... stock option granted to an Employee by the Employer to the extent such value is includable in the Employee's taxable income. The following: Severance Pay, Third Party Payments of Sick Pay except as otherwise provided below: (b) 1.05 32 in the Section 401(a)(17). Plan maintained by the Employer... -

Page 151

... requirement(s) (Check the appropriate box(es). Options (B) and (C) may not be elected together): (A) (B) (C) (D) (E) 32 32 32 32 2 Is employed by the Employer on the last day of the Plan Year. Earns at least 500 Hours of Service during the Plan Year. Earns at least 1,000 Hours of Service... -

Page 152

... requirement(s) (Check the appropriate box(es). Options (B) and (C) may not be elected together): (3) (A) (B) 32 32 Is employed by the Employer on the last day of the Plan Year. Earns at least 500 Hours of Service during the Plan Year. Earns at least 1,000 Hours of Service during the Plan Year... -

Page 153

... Employee. (B) 32 (b) 2 Class Year Accounting (complete (1) and (2)). SEE AMENDMENT (1) Upon (check at least one; (A) must be selected if plan has contributions pursuant to section l.05(b) or (c)): (A) 2 Termination of employment with the Employer (see Plan Section 7.03); provided however... -

Page 154

... month and day) (specify month and day) of the (c) 2 Upon a Change of Control in accordance with Plan Section 7.08. Note: Internal Revenue Code Section 280G could impose certain, adverse tax consequences on both Participants and the Employer as a result of the application of this Section... -

Page 155

... Vesting Schedule E C D F G 0 1 2 3 4 5 6 7 (c) 32 0% 0% 0% 100 % 100 % 100 % 100 % 100 % 0% 0% 0% 0% 0% 100 % 100 % 100 % 0% 0% 20 % 40 % 60 % 80 % 100 % 100 % 0% 0% 0% 20 % 40 % 60 % 80 % 100 % 100 % Years of Service for Vesting shall exclude (check one) : (1) 32 for new plans, service... -

Page 156

... less than 12 months, receiving income replacement benefits for a period of not less than 3 months under an accident and health plan covering employees of the Employer. (specify 55 or greater) and completes (2) 2 1.08 PREDECESSOR EMPLOYER SERVICE 32 Service for purposes of vesting in Section... -

Page 157

... and/or Employer directions, as applicable. Note: The method and frequency for change of investments will be determined under the rules applicable to the selected funds. Information will be provided regarding expenses, if any, for changes in investment options. 1.12 RELIANCE ON PLAN An adopting... -

Page 158

EXECUTION PAGE (Fidelity's Copy) IN WITNESS WHEREOF, the Employer has caused this Adoption Agreement to be executed this 20th day of February, 2007. Employer By Title Employer By Title Regis Corporation /s/ Eric A. Bakken Eric A. Bakken Senior Vice President and General Counsel 11 -

Page 159

EXECUTION PAGE (Employer's Copy) IN WITNESS WHEREOF, the Employer has caused this Adoption Agreement to be executed this 20th day of February, 2007. Employer By Title Employer By Title Regis Corporation /s/ Eric A. Bakken Eric A. Bakken Senior Vice President and General Counsel 12 -

Page 160

... the following are the Employees who are eligible to participate in the Plan: Employer Regis Corporation By Title Date /s/ Eric A. Bakken Eric A. Bakken Senior Vice President and General Counsel February 20, 2007 Note: The Employer must revise Attachment A to add Employees as they become eligible... -

Page 161

Attachment B (a) 32The Participant's vested percentage in Matching Contributions elected in Section 1.05(b) shall be based upon the following schedule: (b) 32The Participant's vested percentage in Employer Contributions elected in Section 1.05(c) shall be based upon the following schedule: 14 -

Page 162

... Plan (the "Deferred Salary Plan") and the Regis Corporation Executive Profit Sharing Plan (the "Profit Sharing Plan") (collectively, the "Non-Qualified Plans"), each a nonqualified deferred compensation plan maintained for the benefit of a select group of management or highly compensated employees... -

Page 163

...who is not an officer of the Corporation, and (ii) any other remuneration paid by the Employer or a Related Employer, including without limitation, base salary, overtime, net commissions, the value of stock options, stock appreciation rights or restricted stock, allowances for expenses (e.g., moving... -

Page 164

..., if applicable; provided, however, that a distribution date may be adjusted as required by applicable law, including without limitation that, where required by Code Section 409A and the regulations promulgated thereunder, distributions to Key Employees that are due to termination of employment will... -

Page 165

TRUST AGREEMENT Between Regis Corporation And FIDELITY MANAGEMENT TRUST COMPANY Regis Corporation Executive Retirement Savings Plan TRUST Dated as of March 1, 2007 -

Page 166

... Options Available Investment Options Investment Directions Funding Mechanism Mutual Funds Trustee Powers Recordkeeping and Administrative Services to Be Performed General Accounts Inspection and Audit Effect of Plan Amendment Returns, Reports and Information Compensation and Expenses Directions and... -

Page 167

-

Page 168

... 15 16 (a) (b) (c) (d) (e) (f) 17 18 19 20 (a) (b) Insolvency of Sponsor Amendment or Modification Electronic Services General Performance by Trustee, its Agents or Affiliates Entire Agreement Waiver Successors and Assigns Partial Invalidity Section Headings Assignment Force Majeure Confidentiality... -

Page 169

... functions under the Plan; and WHEREAS, Regis Corporation (the "Administrator") is the administrator of the Plan; and WHEREAS, the Trustee is willing to perform recordkeeping and administrative services for the Plan if the services are purely ministerial in nature and are provided within a framework... -

Page 170

... which is the "administrator" of such Plan. " Agreement " shall mean this Trust Agreement, as the same may be amended and in effect from time to time. " Business Day " shall mean any day on which the New York Stock Exchange (NYSE) is open. " Code " shall mean the Internal Revenue Code of 1986, as... -

Page 171

... to others any of the Trust assets before all payment of benefits have been made to the Participants and their beneficiaries pursuant to the terms of the Plan. 4 Disbursements (a) Directions from Administrator If it is indicated in the Service Agreement that the Trustee will make distributions of... -

Page 172

... the Administrator's direction complies with the terms of the Plan or any applicable law. The Trustee shall not be responsible for: (1) making benefit payments to Participants under the Plan, (2) any Federal, State or local income tax reporting or withholding with respect to such Plan benefits, and... -

Page 173

... transfer of funds necessary to make such purchase). Exchanges of Permissible Investments shall be made on the same Business Day that the Trustee receives a proper direction if received before market close (generally 4:00 p.m. eastern time); if the direction is received after market close (generally... -

Page 174

... Trustee's regular business hours prior to the termination of this Agreement, by the Administrator or any person designated by the Administrator. Upon the resignation or removal of the Trustee or the termination of this Agreement, the Trustee shall provide to the Administrator, at no expense to the... -

Page 175

... plan administration as shown on the Service Agreement, as amended from time to time, shall be a charge against and paid from the appropriate plan Participants' accounts, except to the extent such amounts are paid by the Plan Sponsor in a timely manner. All expenses of the Trustee relating directly... -

Page 176

... designee. Fidelity shall provide such assistance for a period not extending beyond sixty (60) days from the termination date of this Agreement. Fidelity shall provide to Sponsor, or to any person designated by Sponsor, at a mutually agreeable time, one file of the Plan Data prepared and maintained... -

Page 177

... successor trustee or to deliver all Trust assets to the successor trustee. (c) Corporate Action Any successor of the Trustee or successor trustee, through sale or transfer of the business or trust department of the Trustee or successor trustee, or through reorganization, consolidation, or merger... -

Page 178

...under the terms of the Plan for the period of such discontinuance, less the aggregate amount of any payments made to Participants or their beneficiaries by Sponsor in lieu of the payments provided for hereunder during any such period of discontinuance. 14 Amendment or Modification This Agreement may... -

Page 179

...not limited to Fidelity Investments Institutional Operations Company, Inc. or its successor, and that certain of such services may be provided pursuant to one or more other contractual agreements or relationships. (b) Entire Agreement This Agreement contains all of the terms agreed upon between the... -

Page 180

... for maintaining for the Plan. 19 Confidentiality Both parties to this Agreement recognize that in the course of implementing and providing the services described herein, each party may disclose to the other confidential information. All such confidential information, individually and collectively... -

Page 181

...as a Massachusetts trust. The validity, construction, effect, and administration of this Agreement shall be governed by and interpreted in accordance with the ... under Section 514 of ERISA. (b) Trust Agreement Controls The Trustee is not a party to the Plan, and in the event of any conflict between the ... -

Page 182

... this Agreement to be executed by their duly authorized officers as of the day and year first above written. Plan Sponsor Name: Regis Corporation By: /s/ Eric A. Bakken Name: Eric A. Bakken Title: Date: Senior Vice President & General Counsel February 20, 2007 FIDELITY MANAGEMENT TRUST COMPANY By... -

Page 183

... this Agreement to be executed by their duly authorized officers as of the day and year first above written. Plan Sponsor Name: Regis Corporation By: /s/ Eric A. Bakken Name: Eric A. Bakken Title: Date: Senior Vice President & General Counsel February 20, 2007 FIDELITY MANAGEMENT TRUST COMPANY By... -

Page 184

...9th day of February, 2000, by and between Regis Corporation, a Minnesota corporation (the "Corporation"), and Myron Kunin ("Kunin"). WHEREAS , on May 7, 1997, the Corporation and Kunin entered into a Compensation and Non-Competition Agreement ("Agreement") providing for Kunin's continued services to... -

Page 185

... any time following a Change in Control, whether such termination is initiated by Kunin or by the Corporation (unless the termination is by the Corporation for cause), Kunin may, as an alternative to receiving continued annual compensation as provided in paragraph 2 of the Agreement, request payment... -

Page 186

...Internal Revenue Code and by any comparable and applicable state tax law (collectively, "Excise Taxes"), as a result of the payments provided in subparagraphs 7(a) and (b) above, and as a result of any accelerated vesting of Kunin's options to acquire shares of the Corporation, and shall further pay... -

Page 187

... conditions as shall be determined by the Committee, including the following: Limitations on Transferability . The issue prices for Restricted Stock and Restricted Stock Units shall be set by the (1) Committee and may be zero. Subject to the provisions of the Plan and the Agreement, during a period... -

Page 188

...Units granted hereunder but shall, to the extent provided in an Agreement, have the right to receive (with respect to such Restricted Stock Units) cash payments equivalent in value to the cash dividends payable on a like number shares of Common Stock. Unless otherwise determined by the Committee and... -

Page 189

... 33-89882) of Regis Corporation of our report dated August 29, 2007 relating to the consolidated financial statements and financial statement schedule and the effectiveness of internal control over financial reporting, which appears in the 2007 Annual Report on Form 10-K. /s/ PRICEWATERHOUSECOOPERS... -

Page 190

... 31.1 CERTIFICATION PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Paul D. Finkelstein certify that: 1. 2. I have reviewed this annual report on Form 10-K of Regis Corporation; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state... -

Page 191

..., summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. August 29, 2007 /s/ RANDY L. PEARCE Randy L. Pearce, Senior Executive Vice... -

Page 192

... with the Annual Report of Regis Corporation (the Registrant) on Form 10-K for the fiscal year ending June 30, 2007 as filed with the Securities and Exchange Commission on the date hereof, I, Paul D. Finkelstein, Chairman of the Board of Directors, President and Chief Executive Officer of the... -

Page 193

... with the Annual Report of Regis Corporation (the Registrant) on Form 10-K for the fiscal year ending June 30, 2007 as filed with the Securities and Exchange Commission on the date hereof, I, Randy L. Pearce, Senior Executive Vice President, Chief Financial and Administrative Officer of the...