Supercuts 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

2004 Long Term Incentive Plan:

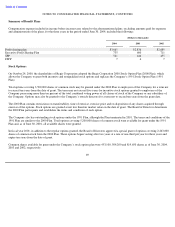

In May of 2004, the Company’s Board of Directors approved the 2004 Long Term Incentive Plan (2004 Plan). The 2004 Plan is currently

pending shareholder approval at the annual shareholders’ meeting to be held on October 28, 2004. The 2004 Plan provides for the granting of

stock options, stock appreciation rights (SARs) and restricted stock, as well as cash-based performance grants, to officers of the Company. The

2004 Plan will expire on May 26, 2014. A maximum of 2,500,000 shares of the Company’s common stock are available for issuance pursuant

to grants and awards made under the 2004 Plan. Stock options, SARs and restricted stock under the 2004 Plan generally vest pro rata over five

years and have a maximum term of ten years. The cash

-based performance grants will be tied to the achievement of certain performance goals

during a specified performance period, not less than one fiscal year in length.

In June 2004, 72,500 shares of restricted stock and 110,750 SARs were awarded under the 2004 Plan, pending shareholder approval. No stock

options were granted under the 2004 Plan. No compensation expense was recognized or will be recognized in the Consolidated Statement of

Operations related to these awards until the 2004 Plan is approved by the Company’s shareholders. See Note 1 to the Consolidated Financial

Statements for discussion of the Company’s measure of compensation cost for its incentive stock plans, as well as an estimate of future

compensation expense related to these awards.

Other:

The Company has agreed to pay the Chief Executive Officer, commencing upon his retirement, an amount equal to 60 percent of his salary,

adjusted for inflation, for the remainder of his life. Additionally, the Company has a survivor benefit plan for the Chief Executive Officer’s

spouse, payable upon his death, at a rate of one half of his deferred compensation benefit, adjusted for inflation, for the remaining life of his

spouse. In addition, the Company has other unfunded deferred compensation contracts covering key executives based on their accomplishments

within the Company. The key executives’ benefits are based on years of service and the employee’s compensation prior to departure. The

Company utilizes a June 30 measurement date for these deferred compensation contracts and a discount rate based on the Aa Bond index rate

(6.25 percent at June 30, 2004). Compensation associated with these agreements is charged to expense as services are provided. Associated

costs included in corporate and franchise support costs on the Consolidated Statement of Operations totaled $2.1, $2.3 and $1.2 million for

fiscal years 2004, 2003 and 2002, respectively. Related obligations totaled $10.7 and $8.6 million at June 30, 2004 and 2003, respectively, and

are included in other non-current liabilities in the Consolidated Balance Sheet. The Company intends to fund its future obligations under this

plan through company-owned life insurance policies on the participants. Cash values of these policies totaled $9.4 and $8.4 million at June 30,

2004 and 2003, respectively, and are included in other assets in the Consolidated Balance Sheet.

The Company also has entered into an agreement with the Vice Chairman of the Board of Directors (the Vice Chairman), providing that the

Vice Chairman will continue to service the Company until at least May 2007. The Company has agreed to pay the Vice Chairman an annual

amount of $0.6 million, adjusted for inflation, for the remainder of his life. The Vice Chairman has agreed that during the period in which

payments are made, as provided in the agreement, he will not engage in any business competitive with the business conducted by the Company.

Additionally, the Company has a survivor benefit plan for the Vice Chairman’s spouse, payable upon his death, at a rate of one half of his

deferred compensation benefit, adjusted for inflation, for the remaining life of his spouse. Estimated associated costs included in corporate and

franchise support costs on the Consolidated Statement of Operations totaled $0.3, $2.3 and $0.4 million for fiscal years 2004, 2003 and 2002,

respectively. All service costs will be fully recognized by May 2007. Related obligations totaled $4.0 and $3.7 million at June 30, 2004 and

2003, respectively, and are included in other non-current liabilities in the Consolidated Balance Sheet. The Company intends to fund all future

obligations under this agreement through company-owned life insurance policies on the Vice Chairman. Cash values of these policies totaled

$2.3 and $2.1 million at June 30, 2004 and 2003, respectively, and are included in other assets in the Consolidated Balance Sheet. The policy

death benefits exceed the obligations under this agreement.

71