Supercuts 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

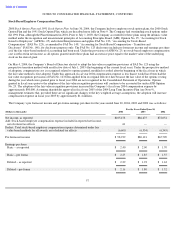

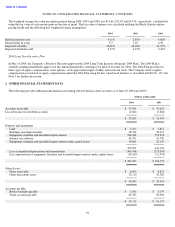

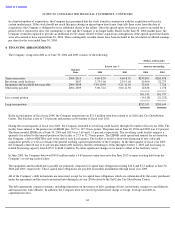

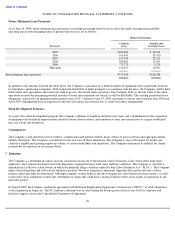

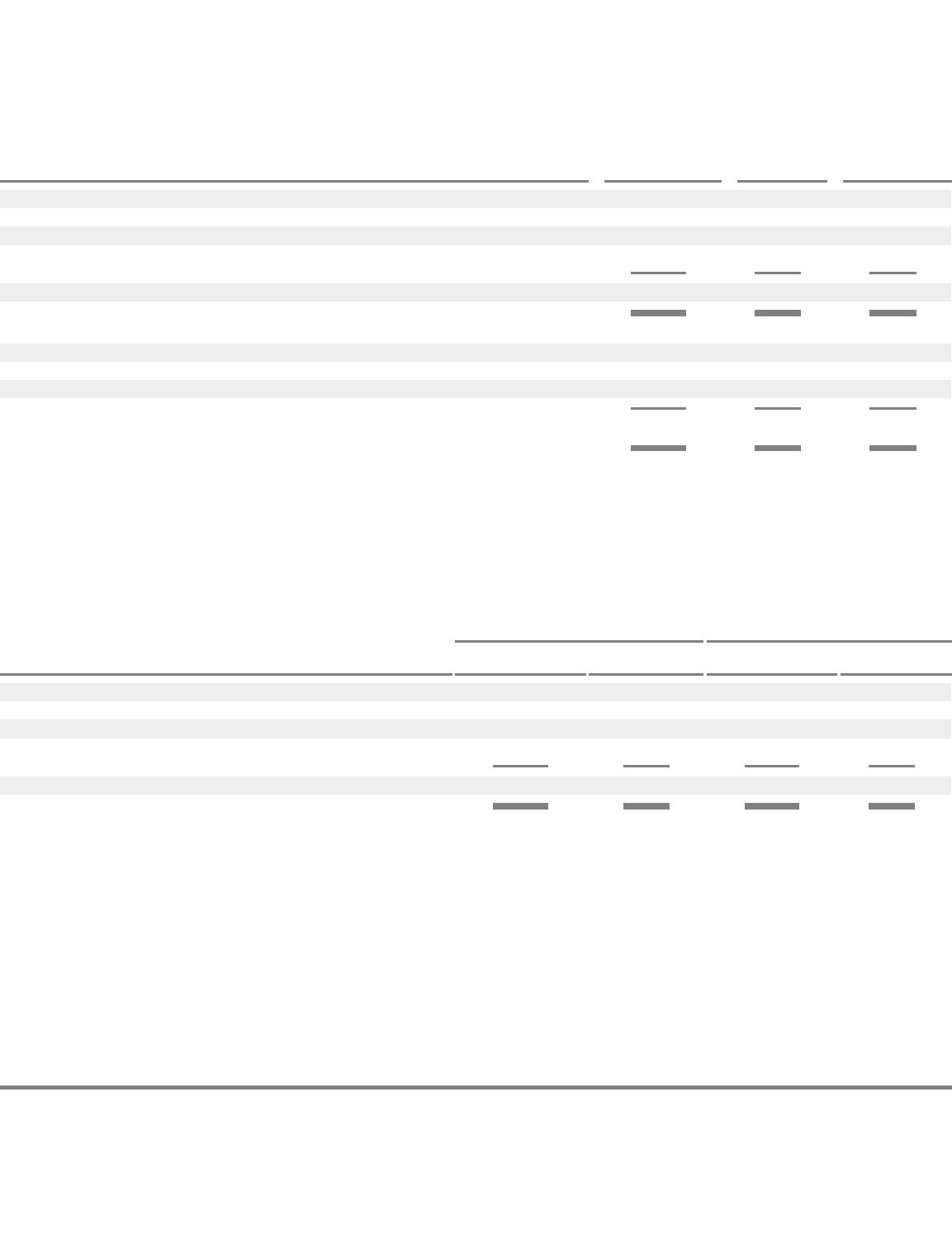

Based upon purchase price allocations, which may have components representing preliminary allocations with respect to recent fiscal year

2004 acquisitions, the components of the aggregate purchase prices of the acquisitions made during fiscal years 2004, 2003 and 2002, and

the allocation of the purchase prices, were as follows:

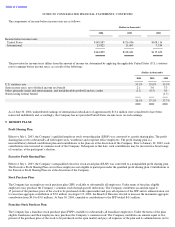

Approximately $0.1, $1.1 and $1.1 million of employee termination and other exit costs were incurred in connection with acquisitions in

fiscal years 2004, 2003 and 2002, respectively. These costs consisted primarily of employee termination costs and were treated as a liability

assumed at the acquisition date.

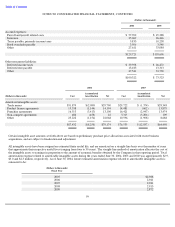

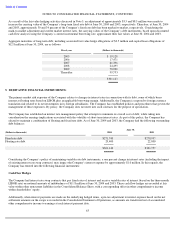

Based upon the actual and preliminary purchase price allocations, the change in the carrying amount of the goodwill for the years ended

June 30, 2004 and 2003 is as follows:

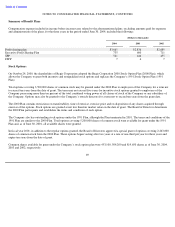

Generally, the goodwill recognized in the North American transactions is expected to be fully deductible for tax purposes and the goodwill

recognized in the international transactions is non-deductible for tax purposes. The majority of the purchase price is accounted for as

residual goodwill rather than identifiable intangible assets. This stems from the value associated with the walk-in customer base of the

acquired hair salon brand. Residual goodwill further represents the Company’s opportunity to strategically combine the acquired business

with the Company’s existing structure to serve a greater number of customers through its expansion strategies. Internationally, the residual

goodwill primarily represents the growth prospects that are not captured as part of acquired tangible or identified intangible assets.

61

(Dollars in thousands)

2004

2003

2002

Components of aggregate purchase prices:

Cash

$

99,734

$

66,880

$

59,925

Stock

9,000

21,501

26,301

Liabilities assumed or payable

1,472

3,246

13,608

$

110,206

$

91,627

$

99,834

Allocation of the purchase prices:

Net tangible assets (liabilities) acquired

$

15,704

$

16,828

$

(1,952

)

Identifiable intangible assets

14,990

9,172

41,181

Goodwill

79,512

65,627

60,605

$

110,206

$

91,627

$

99,834

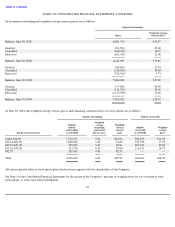

2004

2003

(Dollars in thousands)

North America

International

North America

International

Balance at beginning of year

$

299,602

$

73,016

$

252,055

$

52,474

Goodwill acquired

77,042

2,470

45,963

19,664

Finalization of purchase accounting

8,882

*

(8,314

)*

(1,407

)

(8,496

)

Translation rate adjustments

193

4,249

2,991

9,374

Balance at end of year

$

385,719

$

71,421

$

299,602

$

73,016

*Relates to the finalization of the allocation of goodwill to the related reporting units, as well as a deferred tax adjustment related to

acquired intangible assets.