Supercuts 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

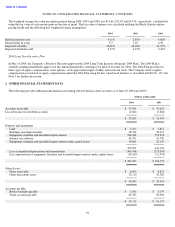

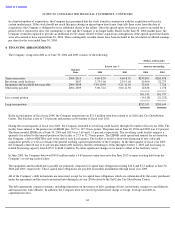

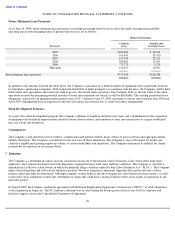

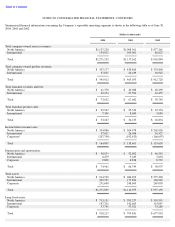

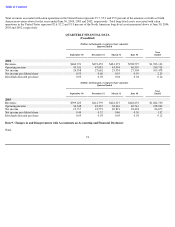

The provision for income taxes consists of:

In fiscal year 2002, the Company implemented certain tax strategies resulting in approximately $1.8 million of economic benefit, which has

been recognized as a nonrecurring income tax benefit in the third quarter, thus reducing fiscal year 2002 income tax expense. The majority

of the nonrecurring benefit was realized through the amendment of previous tax filings.

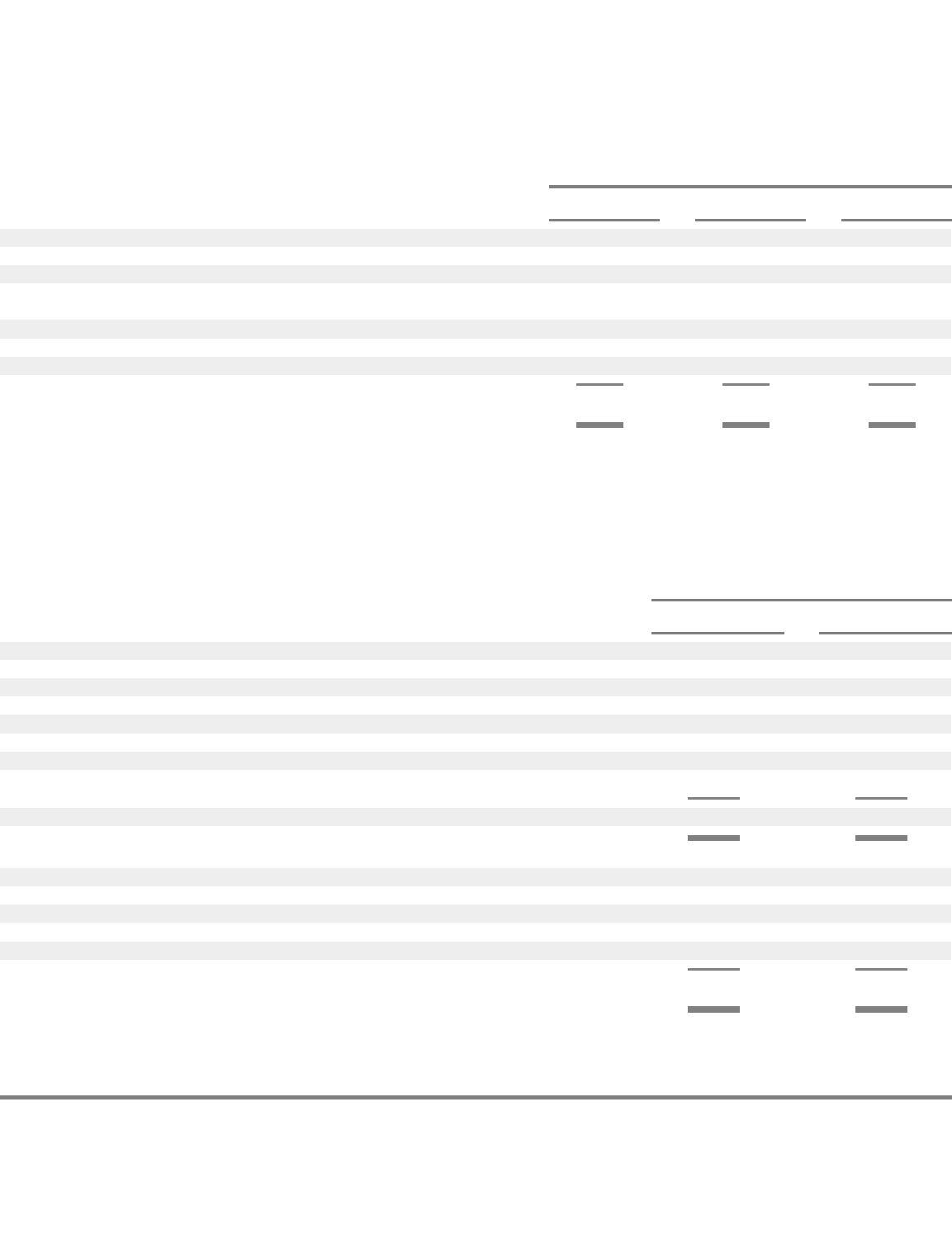

The components of the net deferred tax asset (liability) are as follows:

67

8.

INCOME TAXES:

(Dollars in thousands)

2004

2003

2002

Current:

United States

$

39,722

$

46,462

$

27,815

International

3,538

2,086

2,891

Nonrecurring federal benefit

(1,750

)

Deferred:

United States

15,159

2,090

14,640

International

912

1,288

$

59,331

$

51,926

$

43,596

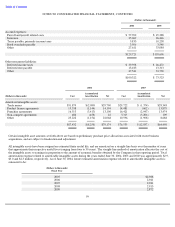

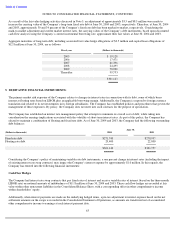

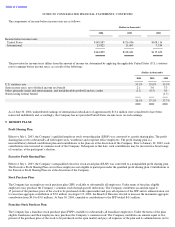

(Dollars in thousands)

2004

2003

Net current deferred tax asset:

Insurance

$

5,752

$

8,415

Payroll and payroll related costs

4,902

3,014

Nonrecurring items

382

455

Reserve for impaired assets

2,351

1,485

Accrued litigation

—

1,321

Deferred franchise fees

767

702

Other, net

1,131

3,077

$

15,285

$

18,469

Net noncurrent deferred tax liability:

Depreciation and amortization

$

(56,786

)

$

(39,881

)

Deferred rent

3,910

3,576

Payroll and payroll related costs

10,168

7,088

Derivatives

3,367

2,860

Other, net

(257

)

(115

)

$

(39,598

)

$

(26,472

)