Supercuts 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

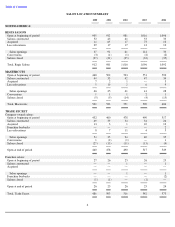

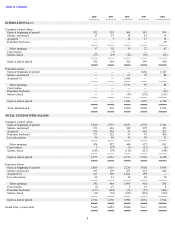

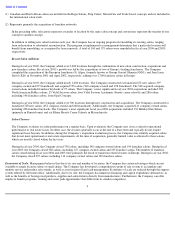

In the preceding table, relocations represent a transfer of location by the same salon concept and conversions represent the transfer of one

concept to another concept.

In addition to adding new salon locations each year, the Company has an ongoing program of remodeling its existing salons, ranging

from redecoration to substantial reconstruction. This program is implemented as management determines that a particular location will

benefit from remodeling, or as required by lease renewals. A total of 169 and 179 salons were remodeled in fiscal year 2004 and 2003,

respectively.

Recent Salon Additions

During fiscal year 2002, the Company added over 2,000 locations through the combination of new salon construction, acquisitions and

new franchise salons. Fiscal year 2002’s growth was led by the acquisitions of two of Europe’s leading franchisors. The Company

completed the acquisition of the European franchisors St. Algue, formerly known as Groupe Gerard Glemain (GGG), and Jean Louis

David (JLD) in November 2001 and April 2002, respectively, adding over 1,700 franchise salons in Europe.

During fiscal year 2003, the Company added nearly 1,000 locations. The Company constructed or franchised 672 new salons (397

company-owned and 275 franchised) and acquired 758 salons (560 company-owned and 198 franchised). The 560 acquired company-

owned salons included franchise buybacks of 97 salons. The Company’s most significant fiscal year 2003 acquisitions included 328

North American BoRics salons, 25 Vidal Sassoon salons, four Vidal Sassoon Academies (beauty career schools) and 286 salons,

including 196 franchise salons, from Opal Concepts.

During fiscal year 2004, the Company added over 500 locations through new construction and acquisitions. The Company constructed or

franchised 720 new salons (452 company-owned and 268 franchised). Additionally, the Company acquired 411 company-owned salons,

including 206 franchise buybacks. The Company’s most significant fiscal year 2004 acquisitions included 153 Holiday Hair Salons

(primarily in Pennsylvania) and six Blaine Beauty Career Schools in Massachusetts.

Salon Closures

The Company evaluates its salon performance on a regular basis. Upon evaluation, the Company may close a salon for operational

performance or real estate issues. In either case, the closures generally occur at the end of a lease term and typically do not require

significant lease buyouts. In addition, during the Company’s acquisition evaluation process, the Company may identify acquired salons

that do not meet operational or real estate requirements. At the time of acquisition, generally limited value is allocated to these salons,

which are usually closed within the first year.

During fiscal year 2004, the Company closed 338 salons, including 148 company-owned salons and 190 franchise salons. During fiscal

year 2003, the Company closed 360 salons; including 127 company-owned salons and 233 franchise salons. The number of franchise

salons closed during fiscal year 2004 and 2003 were primarily the result of transition related closures in Europe. During fiscal year 2002,

the Company closed 297 salons; including 114 company-owned salons and 183 franchise salons.

Economies of Scale.

Management believes that due to its size and number of locations, the Company has certain advantages which are not

available to single location salons or small chains. The Company has developed a comprehensive point of sale system to accumulate and

monitor service and product sales trends, as well as assist in payroll and cash management. Economies of scale are realized through the support

system offered by the home office. Additionally, due to its size, the Company has numerous financing and capital expenditure alternatives, as

well as the benefits of buying retail products, supplies and salon fixtures directly from manufacturers. Furthermore, the Company can offer

employee benefit programs, training and career path opportunities that differ from its smaller competitors.

9

(1)

Canadian and Puerto Rican salons are included in the Regis Salons, Strip Center, MasterCuts and Trade Secret concepts and not included in

the international salon totals.

(2)

Represents primarily the acquisition of franchise networks.