Supercuts 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

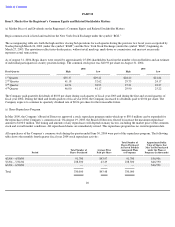

Item 5. Market for the Registrant’s Common Equity and Related Stockholder Matters

(a) Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

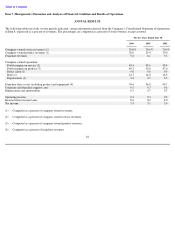

Regis common stock is listed and traded on the New York Stock Exchange under the symbol “RGS.”

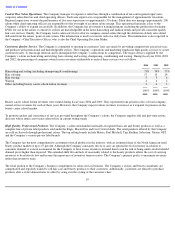

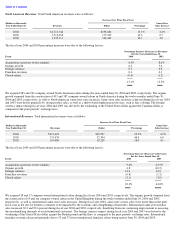

The accompanying table sets forth the high and low closing bid quotations for each quarter during the previous two fiscal years as reported by

Nasdaq through March 26, 2003 (under the symbol

“RGIS”) and the New York Stock Exchange (under the symbol “RGS”) beginning on

March 27, 2003. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not necessarily

represent actual transactions.

As of August 31, 2004, Regis shares were owned by approximately 25,000 shareholders based on the number of record holders and an estimate

of individual participants in security position listings. The common stock price was $40.93 per share on August 31, 2004.

The Company paid quarterly dividends of $0.03 per share during each quarter of fiscal year 2003 and during the first and second quarters of

fiscal year 2004. During the third and fourth quarters of fiscal year 2004, the Company increased its dividends paid to $0.04 per share. The

Company expects to continue its quarterly dividend rate of $0.04 per share for the foreseeable future.

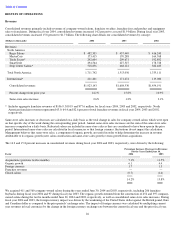

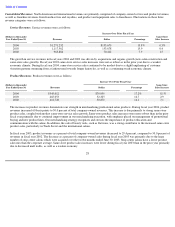

(c) Share Repurchase Program

In May 2000, the Company’s Board of Directors approved a stock repurchase program under which up to $50.0 million can be expended for

the repurchase of the Company’s common stock. On August 19, 2003, the Board of Directors elected to increase the maximum repurchase

amount to $100.0 million. The timing and amounts of any repurchases will depend on many factors, including the market price of the common

stock and overall market conditions. All repurchased shares are immediately retired. This repurchase program has no stated expiration date.

All repurchases of the Company’s common stock during the quarter ended June 30, 2004 were part of this repurchase program. The following

table shows the monthly fourth quarter fiscal year 2004 stock repurchase activity:

20

2004

2003

Fiscal Quarter

High

Low

High

Low

1

st

Quarter

$

35.37

$

29.22

$

28.20

$

21.84

2

nd

Quarter

41.18

32.62

29.75

24.17

3

rd

Quarter

44.54

38.93

27.21

22.27

4

th

Quarter

46.00

41.17

29.90

25.22

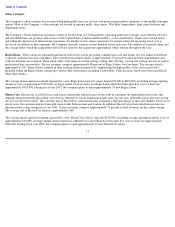

Total Number of

Approximate Dollar

Shares Purchased

Value of Shares that

As Part of Publicly

May Yet Be Purchased

Total Number of

Average Price

Announced Plans

under the Plans or

Period

Shares Purchased

Paid per Share

or Programs

Programs (in thousands)

4/1/04

–

4/30/04

91,700

$

43.97

91,700

$

56,906

5/1/04

–

5/31/04

238,300

43.29

238,300

$

46,590

6/1/04

–

6/30/04

—

—

—

$

46,590

Total

330,000

$

43.48

330,000