Supercuts 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

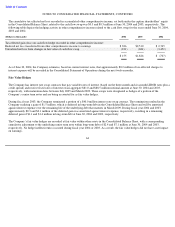

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

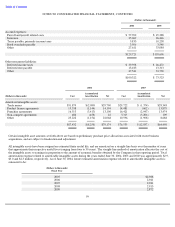

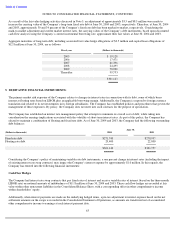

Certain intangible asset amounts set forth above are based on preliminary purchase price allocations associated with recent business

acquisitions, and are subject to finalization and adjustment.

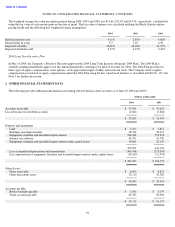

All intangible assets have been assigned an estimated finite useful life, and are amortized on a straight-line basis over the number of years

that approximate their respective useful lives (ranging from four to 30 years). The straight-line method of amortization allocates the cost of

the intangible assets to earnings in proportion to the amount of economic benefits obtained by the Company in that reporting period. Total

amortization expense related to amortizable intangible assets during the years ended June 30, 2004, 2003 and 2002 was approximately $2.9,

$3.0 and $2.3 million, respectively. As of June 30, 2004, future estimated amortization expense related to amortizable intangible assets is

estimated to be:

59

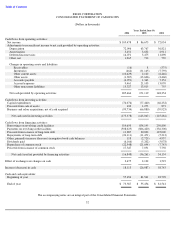

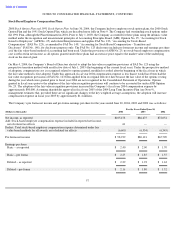

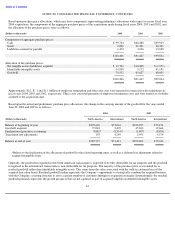

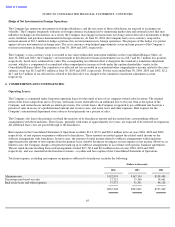

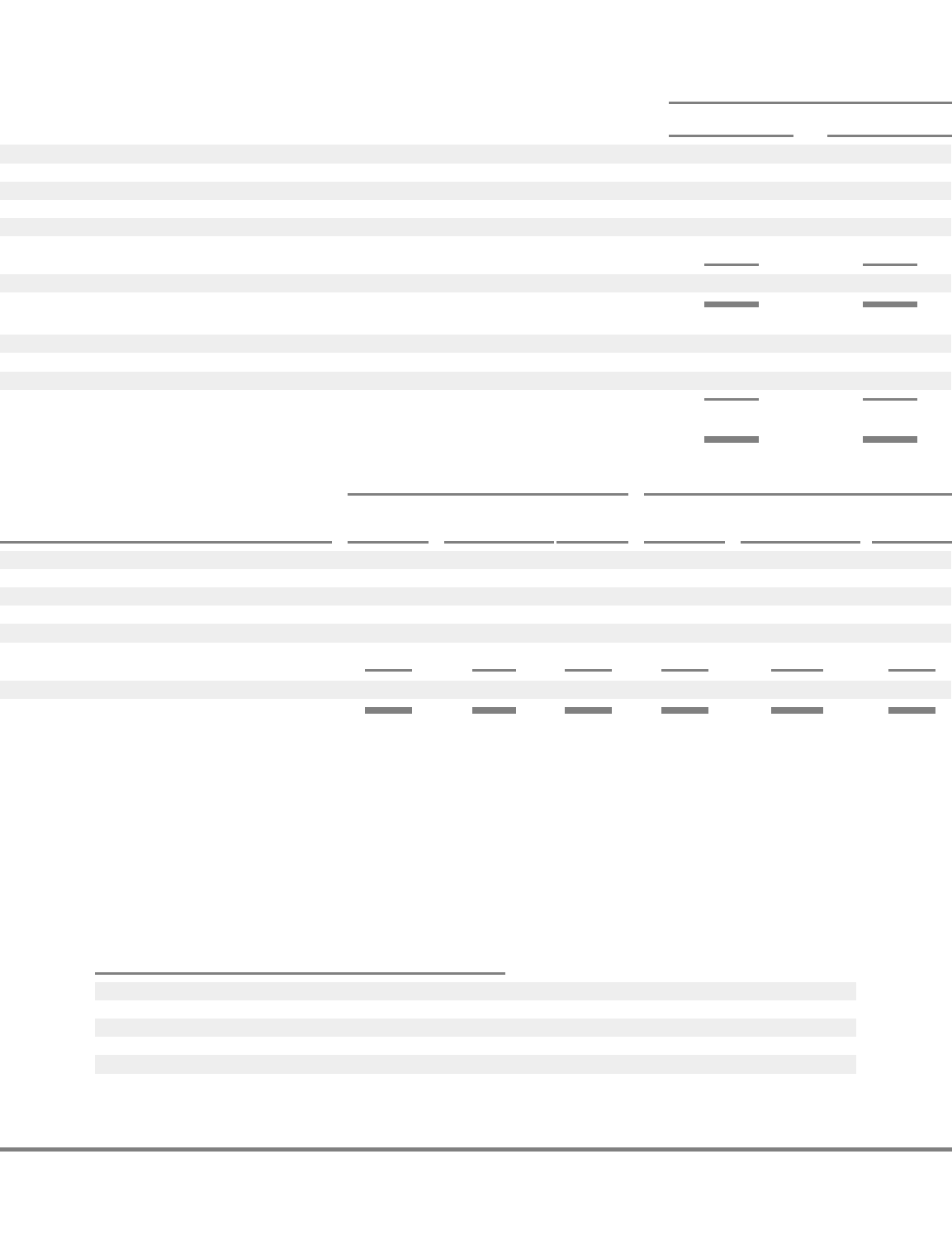

(Dollars in thousands)

2004

2003

Accrued expenses:

Payroll and payroll related costs

$

57,702

$

45,388

Insurance

35,069

26,446

Taxes payable, primarily income taxes

5,833

10,238

Book overdrafts payable

3,506

3,540

Other

27,611

33,084

$

129,721

$

118,696

Other noncurrent liabilities:

Deferred income taxes

$

39,598

$

26,472

Deferred rent payable

13,183

13,313

Other

47,541

33,738

$

100,322

$

73,523

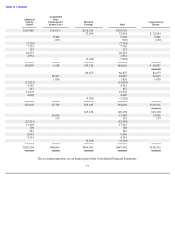

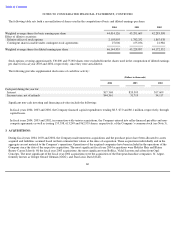

2004

2003

Accumulated

Accumulated

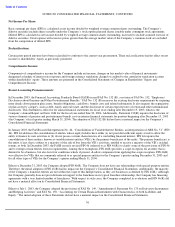

(Dollars in thousands)

Cost

Amortization

Net

Cost

Amortization

Net

Amortized intangible assets:

Trade names

$

31,879

$

(2,089

)

$

29,790

$

29,722

$

(1,374

)

$

28,348

Product license agreements

15,338

(1,144

)

14,194

14,481

(602

)

13,879

Franchise agreements

16,513

(3,413

)

13,100

16,421

(2,947

)

13,474

Non

-

compete agreements

480

(458

)

22

5,315

(5,206

)

109

Other

23,222

(1,154

)

22,068

10,596

(1,908

)

8,688

$

87,432

$

(8,258

)

$

79,174

$

76,535

$

(12,037

)

$

64,498

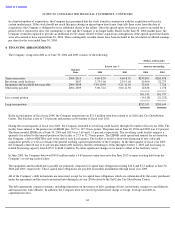

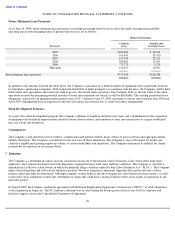

(Dollars in thousands)

Fiscal Year

2005

$

2,988

2006

2,941

2007

2,941

2008

2,913

2009

2,872