Supercuts 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

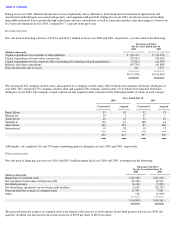

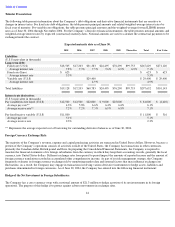

During fiscal year 2004, deferred income taxes increased primarily due to differences in the book and tax treatment of depreciation and

amortization methodologies associated with property and equipment and goodwill. During fiscal year 2003, inventories increased resulting

from additional needs due to growth through acquisitions and new construction, as well as same-store product sales increasing at a slower rate

of 2.9 percent during fiscal year 2003, compared to 7.1 percent in the prior year.

Investing Activities

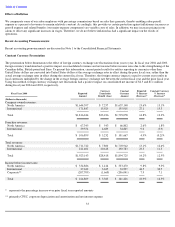

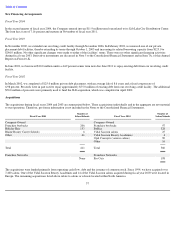

Net cash used in investing activities of $173.4 and $143.1 million in fiscal year 2004 and 2003, respectively, was the result of the following:

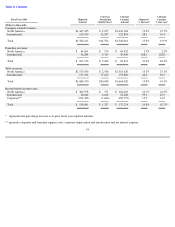

We constructed 452 company-owned salons and acquired 411 company-owned salons (206 of which were franchise buybacks) during fiscal

year 2004. We constructed 397 company

-owned salons and acquired 560 company-owned salons (97 of which were franchise buybacks)

during fiscal year 2003. The company-owned constructed and acquired salons consisted of the following number of salons in each concept:

Additionally, we completed 169 and 179 major remodeling projects during fiscal years 2004 and 2003, respectively.

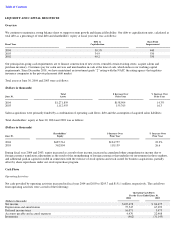

Financing Activities

Net cash used in financing activities was $16.8 and $36.3 million during fiscal year 2004 and 2003, resulting from the following:

The proceeds from the issuance of common stock were related to the exercise of stock options. In the third quarter of fiscal year 2004, the

quarterly dividend was increased from its historical rate of $0.03 per share to $0.04 per share.

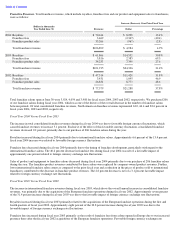

Investing Cash Flows

For the Years Ended June 30,

(Dollars in thousands)

2004

2003

Capital expenditures for remodels or other additions

$

(36,192

)

$

(32,339

)

Capital expenditures for new salon construction

(28,542

)

(28,418

)

Capital expenditures for the corporate office (including all technology

-

related expenditures)

(9,342

)

(16,703

)

Business and salon acquisitions

(99,734

)

(66,880

)

Proceeds from the sale of assets

432

1,273

$

(173,378

)

$

(143,067

)

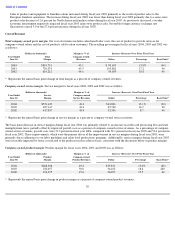

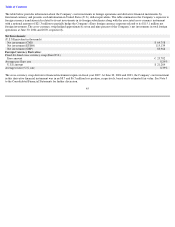

Years Ended June 30,

2004

2003

Constructed

Acquired

Constructed

Acquired

Regis Salons

33

10

53

73

MasterCuts

34

3

47

—

Trade Secret

26

14

34

10

SmartStyle

174

61

168

14

Strip Center

166

295

85

446

International

19

28

10

17

452

411

397

560

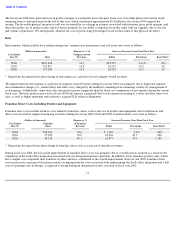

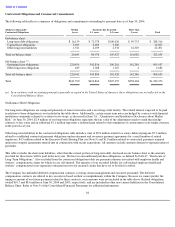

Financing Cash Flows

For the Years Ended June 30,

(Dollars in thousands)

2004

2003

Repurchase of common stock

$

(22,548

)

$

(21,694

)

Net (payments) borrowings of long

-

term debt

(12,224

)

18,529

Dividend payments

(6,166

)

(5,202

)

Net borrowings (payments) on revolving credit facilities

6,625

(32,225

)

Proceeds from the issuance of common stock

17,347

7,051

Other

118

(2,720

)

$

(16,848

)

$

(36,261

)