Supercuts 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

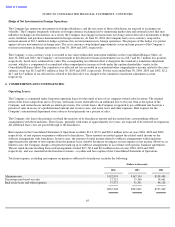

Stock-Based Employee Compensation Plans:

2000 Stock Option Plan and 1991 Stock Option Plan At June 30, 2004, the Company had two employee stock option plans, the 2000 Stock

Option Plan and the 1991 Stock Option Plan, which are described more fully in Note 9. The Company had outstanding stock options under

the 1991 Plan, although the Plan terminated in 2001. Prior to July 1, 2003, the Company accounted for these plans using the intrinsic value

method under the recognition and measurement principles of Accounting Principles Board (APB) Opinion No. 25, “Accounting for Stock

Issued to Employees” (APB No. 25) and related Interpretations and applies FAS No. 123, “Accounting for Stock-Based

Compensation” (FAS No. 123), as amended by FAS No. 148, “Accounting for Stock-Based Compensation – Transition and

Disclosure” (

FAS No. 148), for disclosure purposes only. The FAS No. 123 disclosures include pro forma net income and earnings per share

as if the fair value-based method of accounting had been used. Under the provisions of APB No. 25, no stock-

based employee compensation

cost is reflected in net income, as all options granted under those plans had an exercise price equal to the market value of the underlying

stock on the date of grant.

On May 4, 2004, the Company’s Board of Directors elected to adopt the fair value recognition provisions of FAS No. 123 using the

prospective transition method with an effective date of July 1, 2003 (the beginning of the current fiscal year). Under the prospective method

of adoption, compensation cost is recognized related to options granted, modified or settled after the beginning of the fiscal year in which

the fair value method is first adopted. Under this approach, fiscal year 2004 compensation expense is less than it would have been had the

fair value recognition provisions of FAS No. 123 been applied from its original effective date because the fair value of the options vesting

during the year which were granted prior to fiscal year 2004 are not recognized in the Consolidated Statement of Operations. Options

granted in fiscal years prior to the adoption of the fair value recognition provisions will continue to be accounted for under APB Opinion

No. 25. The adoption of the fair value recognition provisions increased the Company’s fiscal year 2004 compensation expense by

approximately $98,000. Assuming shareholder approval in fiscal year 2005 of the 2004 Long Term Incentive Plan (see Note 9),

management estimates that, provided there are no significant changes to the key weighted average assumptions, the adoption will increase

compensation expense in fiscal year 2005 by approximately $1.4 million.

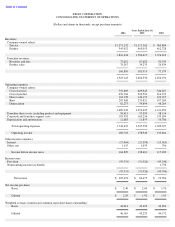

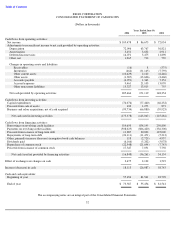

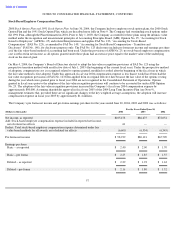

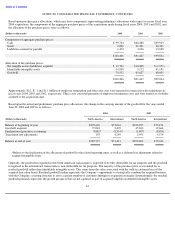

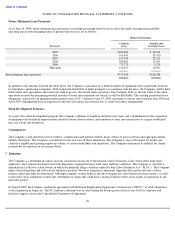

The Company’s pro forma net income and pro forma earnings per share for the years ended June 30, 2004, 2003 and 2002 was as follows:

57

For the Years Ended June 30,

(Dollars in thousands)

2004

2003

2002

Net income, as reported

$

105,478

$

86,675

$

72,054

Add: Stock-based employee compensation expense included in reported net income,

net of related tax effects

61

—

—

Deduct: Total stock-based employee compensation expense determined under fair

value based methods for all awards, net of related tax effects

(6,600

)

(6,554

)

(6,345

)

Pro forma net income

$

98,939

$

80,121

$

65,709

Earnings per share:

Basic

–

as reported

$

2.40

$

2.00

$

1.70

Basic

–

pro forma

$

2.25

$

1.85

$

1.55

Diluted

–

as reported

$

2.29

$

1.92

$

1.63

Diluted

–

pro forma

$

2.16

$

1.80

$

1.52