Supercuts 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

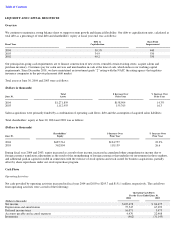

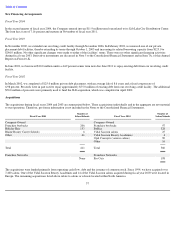

LIQUIDITY AND CAPITAL RESOURCES

Overview

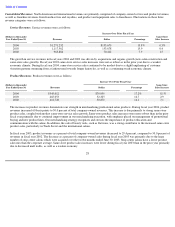

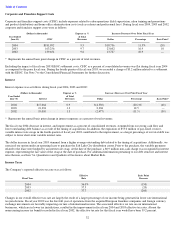

We continue to maintain a strong balance sheet to support system growth and financial flexibility. Our debt to capitalization ratio, calculated as

total debt as a percentage of total debt and shareholders’ equity at fiscal year end, was as follows:

Our principal on-going cash requirements are to finance construction of new stores, remodel certain existing stores, acquire salons and

purchase inventory. Customers pay for salon services and merchandise in cash at the time of sale, which reduces our working capital

requirements. Since December 2001, we have maintained an investment grade “2” rating with the NAIC, the rating agency that regulates

insurance companies in the private placement debt market.

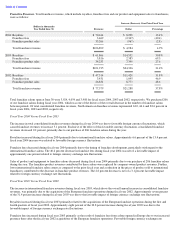

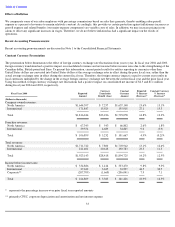

Total assets at June 30, 2004 and 2003 were as follows:

(Dollars in thousands)

Salon acquisitions were primarily funded by a combination of operating cash flows, debt and the assumption of acquired salon liabilities.

Total shareholders’ equity at June 30, 2004 and 2003 was as follows:

(Dollars in thousands)

During fiscal year 2004 and 2003, equity increased as a result of net income, increased accumulated other comprehensive income due to

foreign currency translation adjustments as the result of the strengthening of foreign currencies that underlie our investments in those markets,

and additional paid-in capital recorded in connection with the exercise of stock options and stock issued for business acquisitions, partially

offset by share repurchases under our stock repurchase program.

Cash Flows

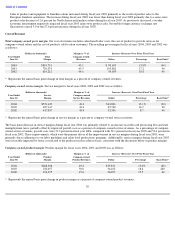

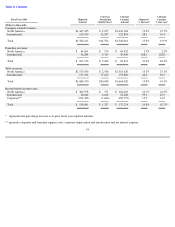

Operating Activities

Net cash provided by operating activities increased in fiscal year 2004 and 2003 to $205.7 and $151.1 million, respectively. The cash flows

from operating activities were a result of the following:

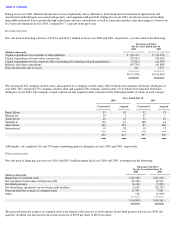

Debt to

Basis Point

Fiscal Year

Capitalization

Improvement

2004

30.5

%

440

2003

34.9

530

2002

40.2

330

Total

$ Increase Over

% Increase Over

June 30,

Assets

Prior Year

Prior Year

2004

$

1,271,859

$

158,904

14.3

%

2003

1,112,955

155,765

16.3

Shareholders

’

$

Increase Over

% Increase Over

June 30,

Equity

Prior Year

Prior Year

2004

$

687,561

$

124,757

22.2

%

2003

562,804

118,139

26.6

Operating Cash Flows

For the Years Ended June 30,

(Dollars in thousands)

2004

2003

Net income

$

105,478

$

86,675

Depreciation and amortization

75,547

67,399

Deferred income taxes

16,071

3,475

Accounts payable and accrued expenses

4,470

22,468

Inventories

(462

)

(31,145

)