Supercuts 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

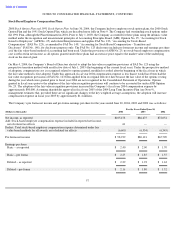

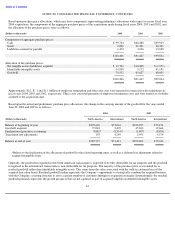

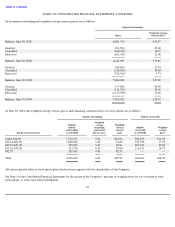

As a result of the fair value hedging activities discussed in Note 5, an adjustment of approximately $3.5 and $8.5 million were made to

increase the carrying value of the Company’s long-term fixed rate debt at June 30, 2004 and 2003, respectively. Therefore, at June 30, 2004

and 2003, approximately 30 and 34 percent of the Company’s fixed rate debt has been marked to market, respectively. Considering the

mark-to-market adjustment and current market interest rates, the carrying values of the Company’s debt instruments, based upon discounted

cash flow analyses using the Company’s current incremental borrowing rate, approximate their fair values at June 30, 2004 and 2003.

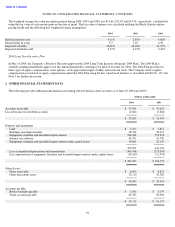

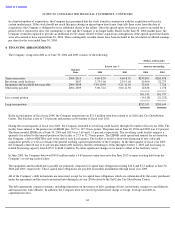

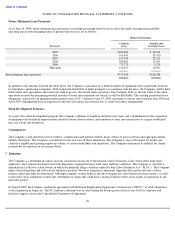

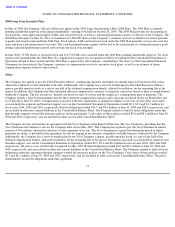

Aggregate maturities of long-term debt, including associated fair value hedge obligations of $3.5 million and capital lease obligations of

$12.8 million at June 30, 2004, are as follows:

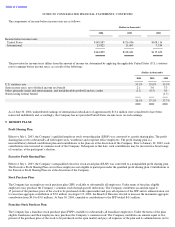

The primary market risk exposure of the Company relates to changes in interest rates in connection with its debt, some of which bears

interest at floating rates based on LIBOR plus an applicable borrowing margin. Additionally, the Company is exposed to foreign currency

translation risk related to its net investments in its foreign subsidiaries. The Company has established policies and procedures that govern the

management of these exposures. By policy, the Company does not enter into such contracts for the purpose of speculation.

The Company has established an interest rate management policy that attempts to minimize its overall cost of debt, while taking into

consideration the earnings implications associated with the volatility of short-term interest rates. As part of this policy, the Company has

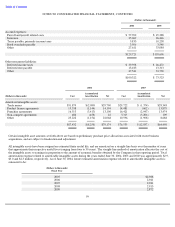

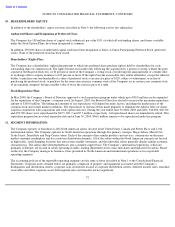

elected to maintain a combination of floating and fixed rate debt. As of June 30, 2004 and 2003, the Company had the following outstanding

debt balances:

Considering the Company’

s policy of maintaining variable rate debt instruments, a one percent change in interest rates (including the impact

of existing interest rate swap contracts) may impact the Company’s interest expense by approximately $1.0 million. In this regards, the

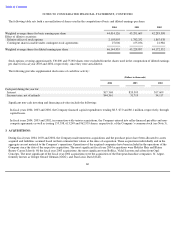

Company has entered into the following financial instruments:

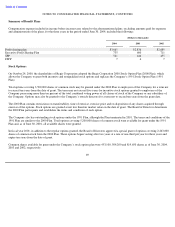

Cash Flow Hedges

The Company had interest rate swap contracts that pay fixed rates of interest and receive variable rates of interest (based on the three-month

LIBOR rate) on notional amounts of indebtedness of $11.8 million at June 30, 2004 and 2003. These cash flow hedges are recorded at fair

value within other noncurrent liabilities in the Consolidated Balance Sheet, with a corresponding offset in other comprehensive income

within shareholders’ equity.

Additionally, when interest payments are made on the underlying hedged items, a pre-tax adjustment to interest expense based on the net

settlement amounts on the swaps is recorded in the Consolidated Statement of Operations, as amounts are transferred out of accumulated

other comprehensive income to earnings at each interest payment date.

63

Fiscal year

(Dollars in thousands)

2005

$

19,128

2006

17,471

2007

61,396

2008

24,495

2009

78,900

Thereafter

99,753

$

301,143

5.

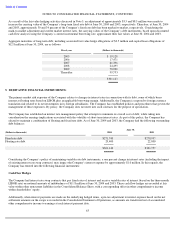

DERIVATIVE FINANCIAL INSTRUMENTS:

June 30,

(Dollars in thousands)

2004

2003

Fixed rate debt

$

271,743

$

278,957

Floating rate debt

29,400

22,800

$

301,143

$

301,757