Supercuts 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

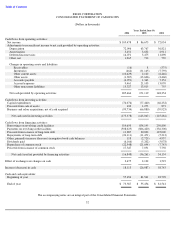

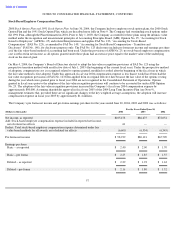

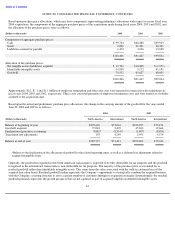

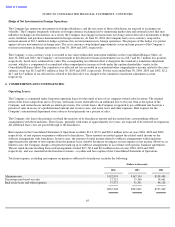

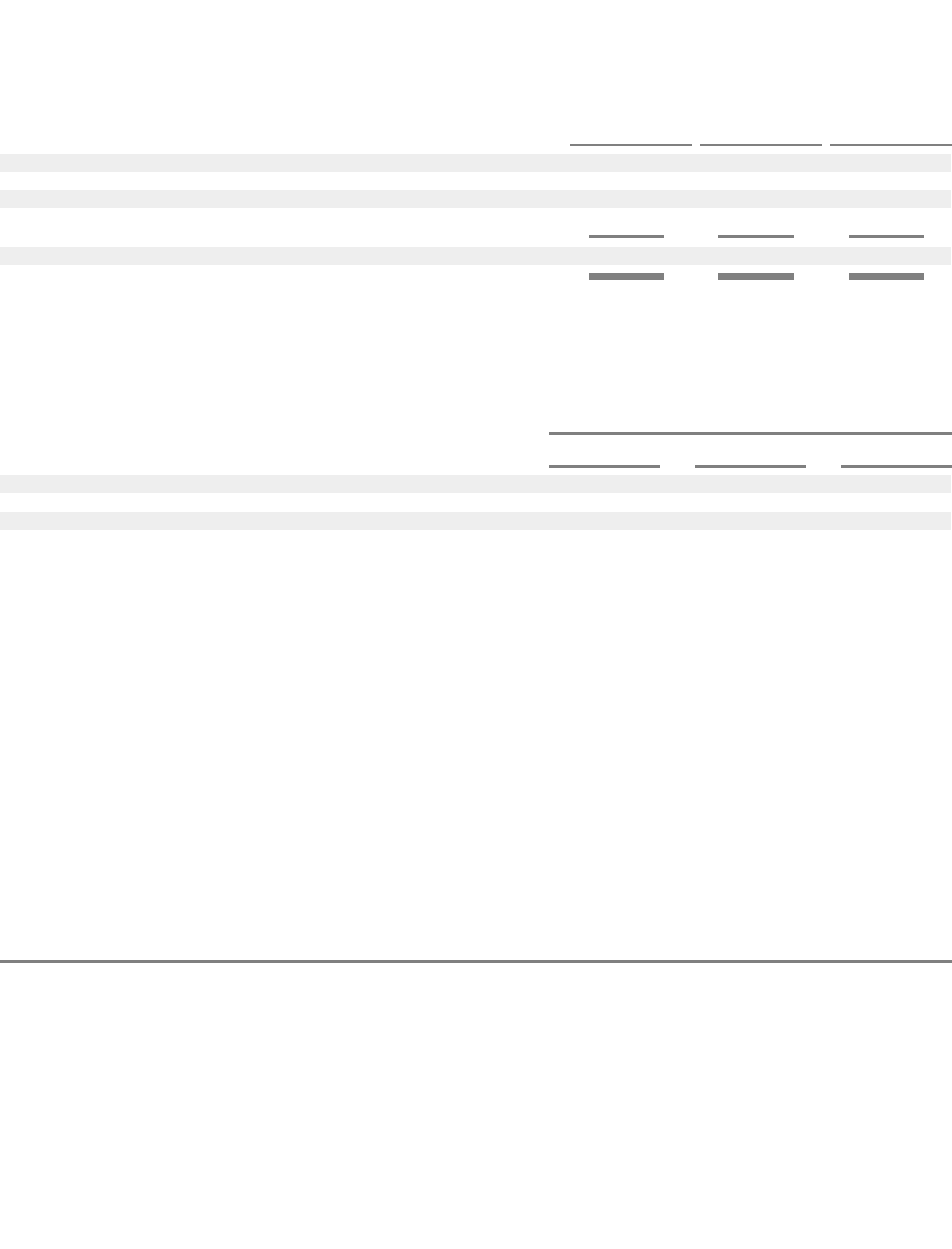

The following table sets forth a reconciliation of shares used in the computation of basic and diluted earnings per share:

Stock options covering approximately 330,000 and 55,000 shares were excluded from the shares used in the computation of diluted earnings

per share for fiscal year 2003 and 2002, respectively, since they were anti-dilutive.

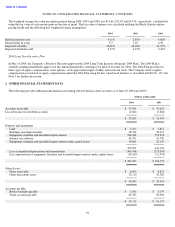

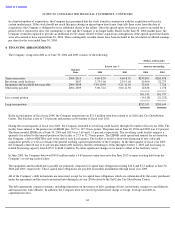

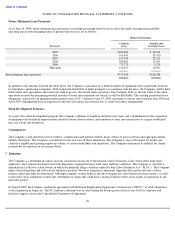

The following provides supplemental disclosures of cash flow activity:

Significant non-cash investing and financing activities include the following:

In fiscal years 2004, 2003 and 2002, the Company financed capital expenditures totaling $8.5, $7.0 and $0.1 million, respectively, through

capital leases.

In fiscal years 2004, 2003 and 2002, in connection with various acquisitions, the Company entered into seller-financed payables and non-

compete agreements as well as issuing 155,338, 613,249 and 962,933 shares, respectively, of the Company’s common stock (see Note 3).

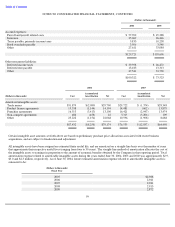

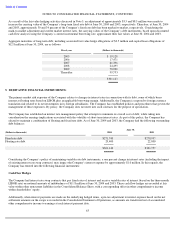

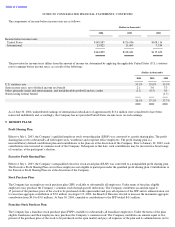

During fiscal years 2004, 2003 and 2002, the Company made numerous acquisitions and the purchase prices have been allocated to assets

acquired and liabilities assumed based on their estimated fair values at the dates of acquisition. These acquisitions individually and in the

aggregate are not material to the Company’s operations. Operations of the acquired companies have been included in the operations of the

Company since the date of the respective acquisition. The most significant fiscal year 2004 acquisitions were Holiday Hair and Blaine

Beauty Career Schools. Of the fiscal year 2003 acquisitions, the most significant were BoRics, Vidal Sassoon and salons from Opal

Concepts. The most significant of the fiscal year 2002 acquisitions were the acquisition of the European franchise companies, St. Algue,

formerly known as Groupe Gerard Glemain (GGG), and Jean Louis David (JLD).

60

2004

2003

2002

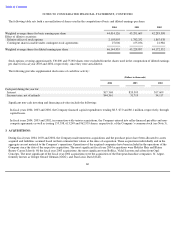

Weighted average shares for basic earnings per share

44,014,126

43,291,609

42,283,308

Effect of dilutive securities:

Dilutive effect of stock options

2,103,803

1,782,252

1,867,038

Contingent shares issuable under contingent stock agreements

27,006

155,036

21,986

Weighted average shares for diluted earnings per share

46,144,935

45,228,897

44,172,332

(Dollars in thousands)

2004

2003

2002

Cash paid during the year for:

Interest

$

17,368

$

20,303

$

17,609

Income taxes, net of refunds

$

44,361

31,719

34,117

3.

ACQUISITIONS: