Supercuts 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

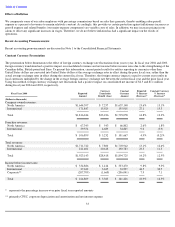

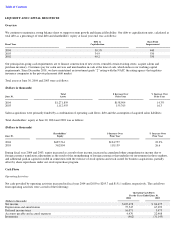

Effects of Inflation

We compensate some of our salon employees with percentage commissions based on sales they generate, thereby enabling salon payroll

expense as a percent of revenues to remain relatively constant. Accordingly, this provides us certain protection against inflationary increases as

payroll expense and related benefits (our major expense components) are variable costs of sales. In addition, we may increase pricing in our

salons to offset any significant increases in wages. Therefore, we do not believe inflation has had a significant impact on the results of

operations.

Recent Accounting Pronouncements

Recent accounting pronouncements are discussed in Note 1 to the Consolidated Financial Statements.

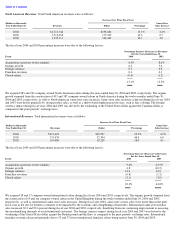

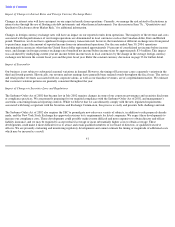

Constant Currency Presentation

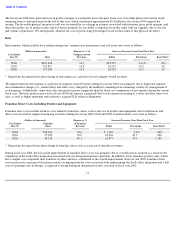

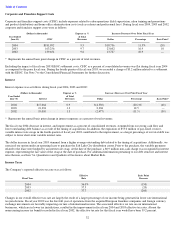

The presentation below demonstrates the effect of foreign currency exchange rate fluctuations from year to year. In fiscal year 2004 and 2003,

foreign currency translation had a positive impact on consolidated revenues and net income before income taxes due to the strengthening of the

Canadian dollar, British pound and Euro. To present this information, current period results for entities reporting in currencies other than

United States dollars are converted into United States dollars at the average exchange rates in effect during the prior fiscal year, rather than the

actual average exchange rates in effect during the current fiscal year. Therefore, the foreign currency impact is equal to current year results in

local currencies multiplied by the change in the average foreign currency exchange rate between the current fiscal year and the prior fiscal year.

Using this method, foreign currency exchange rate fluctuations had a positive impact on consolidated net income of $2.5 and $1.1 million

during fiscal year 2004 and 2003, respectively.

33

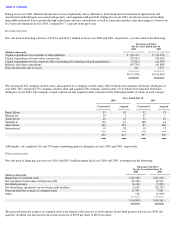

Currency

Constant

Reported

Constant Currency

Fiscal Year 2004

Reported

Translation

Currency

% Increase

% Increase

(Dollars in thousands)

Amount

Benefit (Loss)

Amount

(Decrease)*

(Decrease)*

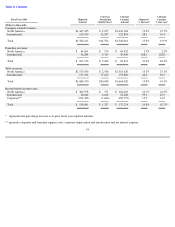

Company

-

owned revenues:

North America

$

1,644,397

$

7,257

$

1,637,140

13.6

%

13.1

%

International

171,847

15,929

155,918

27.1

15.3

Total

$

1,816,244

$

23,186

$

1,793,058

14.8

%

13.3

%

Franchise revenues:

North America

$

67,345

$

543

$

66,802

2.6

%

1.8

%

International

39,554

4,689

34,865

9.0

(3.9

)

Total

$

106,899

$

5,232

$

101,667

4.9

%

(0.2)

%

Total revenues:

North America

$

1,711,742

$

7,800

$

1,703,942

13.1

%

12.6

%

International

211,401

20,618

190,783

23.3

11.3

Total

$

1,923,143

$

28,418

$

1,894,725

14.2

%

12.5

%

Income before income taxes:

North America

$

334,886

$

1,416

$

333,470

9.8

%

9.3

%

International

37,632

3,635

33,997

44.5

30.5

Corporate**

(207,709

)

(1,668

)

(206,041

)

7.9

7.1

Total

$

164,809

$

3,383

$

161,426

18.9

%

16.5

%

*

represents the percentage increase over prior fiscal year reported amounts

**

primarily CFSC, corporate depreciation and amortization and net interest expense