Supercuts 2004 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

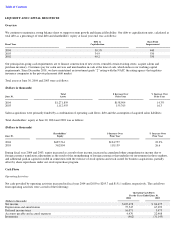

New Financing Arrangements

Fiscal Year 2004

In the second quarter of fiscal year 2004, the Company entered into an $11.9 million term loan related to its Salt Lake City Distribution Center.

The loan has a rate of 7.16 percent and matures in November of fiscal year 2011.

Fiscal Year 2003

In November 2002, we extended our revolving credit facility through November 2006. In February 2003, we renewed one of our private

placement debt facilities, thereby extending its terms through October 1, 2005 and increasing its related borrowing capacity from $125.0 to

$246.0 million. No other significant changes were made to either of the facilities’ terms. There were no other significant financing activities

during fiscal year 2003. Derivative instruments are discussed in Note 5 to the Consolidated Financial Statements and in Item 7A. of this Annual

Report on Form 10-K.

In June 2003, we borrowed $30.0 million under a 4.69 percent senior term note due June 2013 to repay existing debt from our revolving credit

facility.

Fiscal Year 2002

In March 2002, we completed a $125.0 million private debt placement, with an average life of 8.6 years and a fixed coupon rate of

6.98 percent. Proceeds were in part used to repay approximately $75.0 million of existing debt from our revolving credit facility. The additional

$50.0 million of proceeds were primarily used to fund the JLD acquisition, which was completed in April 2002.

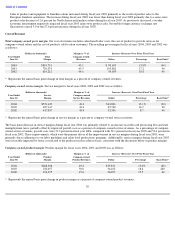

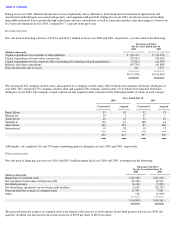

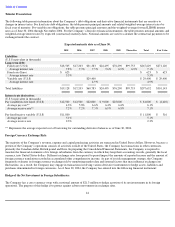

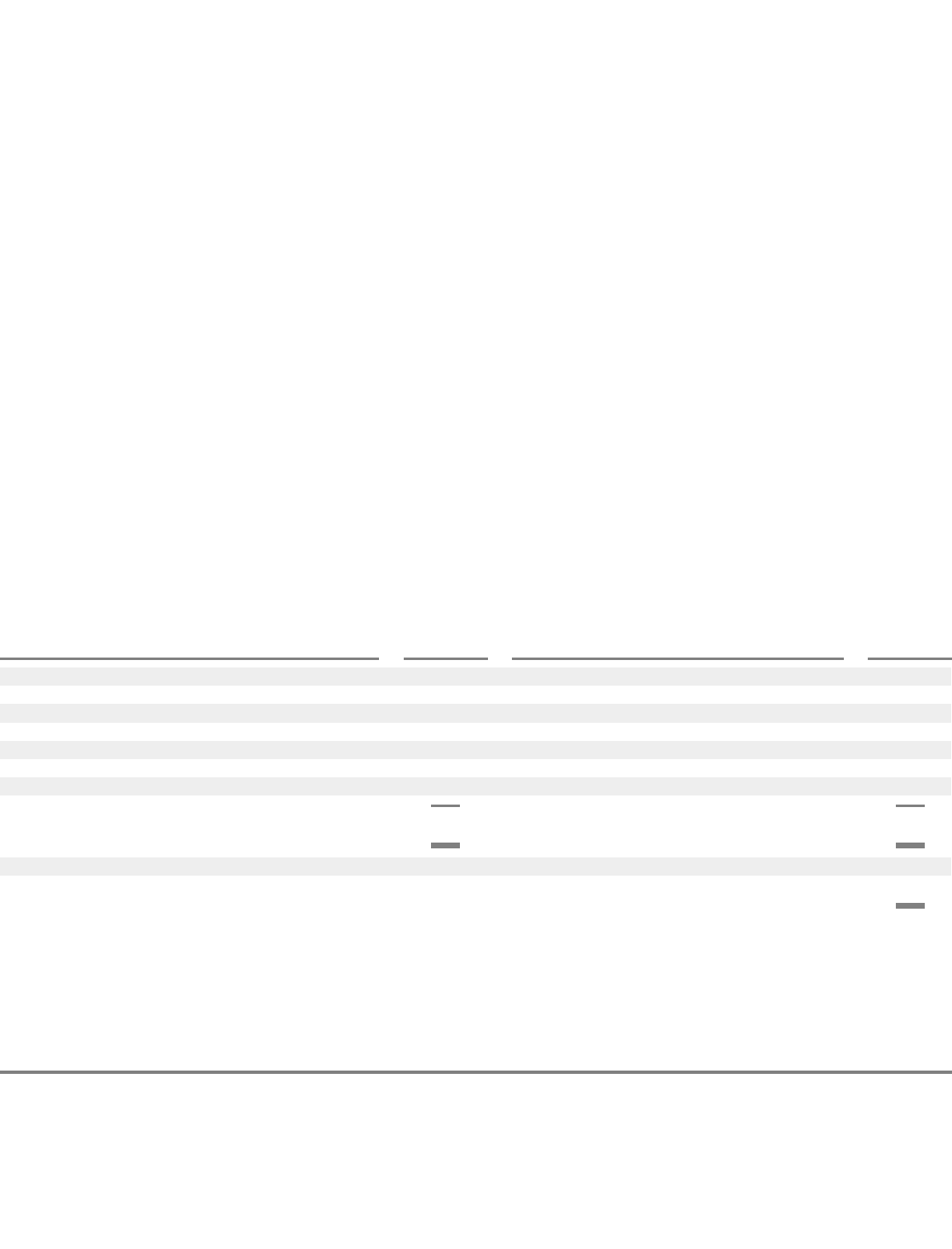

Acquisitions

The acquisitions during fiscal years 2004 and 2003 are summarized below. These acquisitions individually and in the aggregate are not material

to our operations. Therefore, pro forma information is not included in the Notes to the Consolidated Financial Statements.

The acquisitions were funded primarily from operating cash flow, debt and the issuance of common stock. Since 1994, we have acquired over

7,400 salons. One of the Vidal Sassoon Beauty Academies and 14 of the Vidal Sassoon salons acquired during fiscal year 2003 were located in

Europe. The remaining acquisitions listed above relate to salons or schools located within North America.

37

Number of

Number of

Fiscal Year 2004

Salons/Schools

Fiscal Year 2003

Salons/Schools

Company

-

Owned

Company

-

Owned

Franchise buybacks

206

Franchise buybacks

97

Holiday Hair

153

BoRics

328

Blaine Beauty Career Schools

6

Vidal Sassoon salons

25

Other

46

Vidal Sassoon Beauty Academies

4

Opal Concepts (various salons)

90

Other

16

Total

411

Total

560

Franchise Networks

Franchise Networks

None

Pro Cuts

198