Supercuts 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

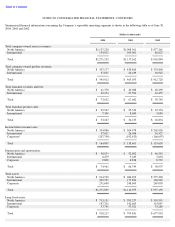

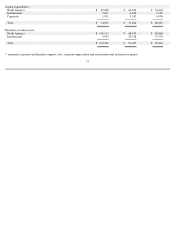

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS, CONTINUED

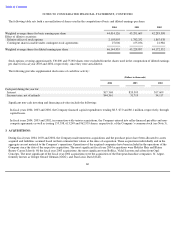

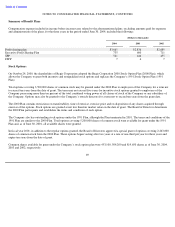

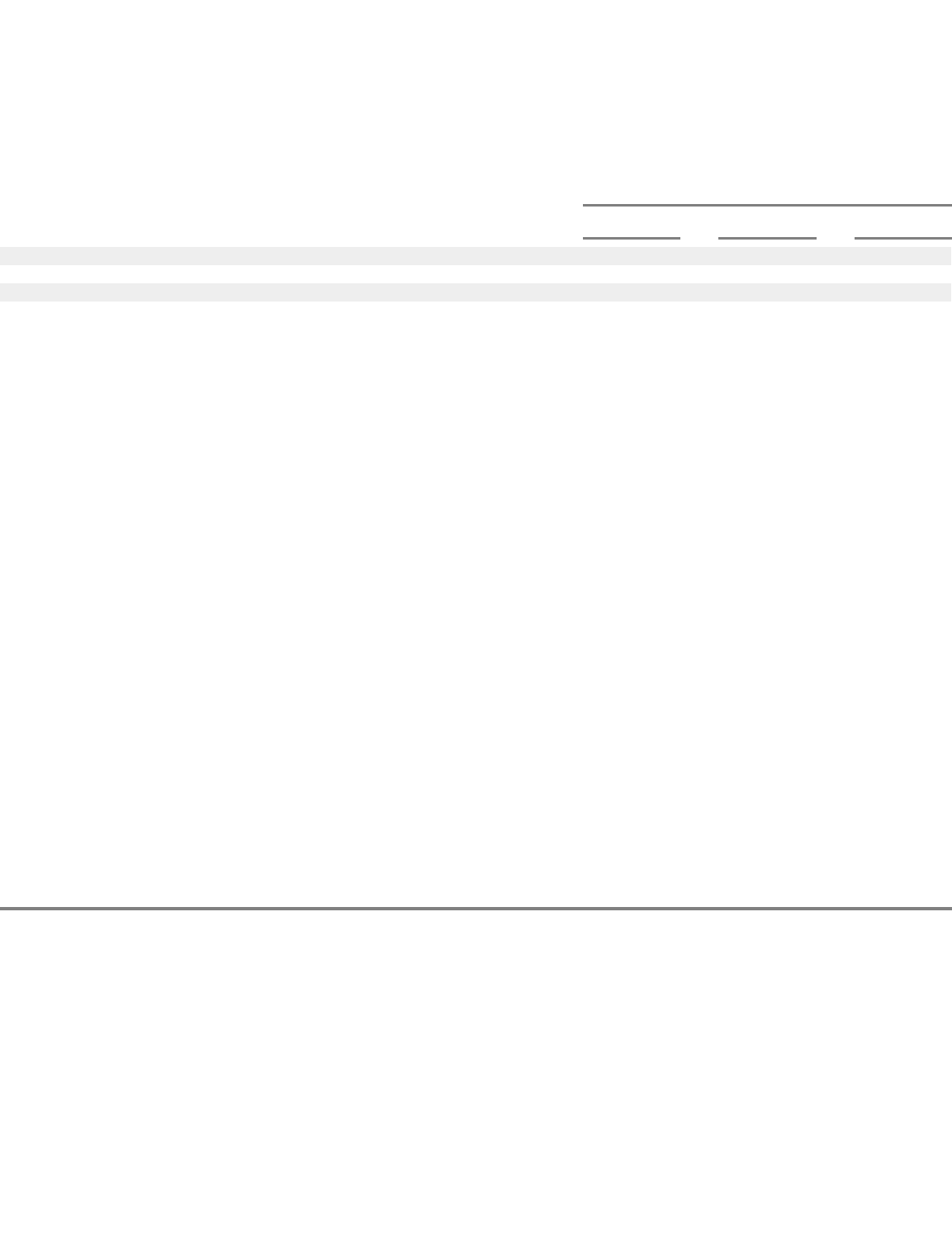

Summary of Benefit Plans

Compensation expense included in income before income taxes related to the aforementioned plans, excluding amounts paid for expenses

and administration of the plans, for the three years in the period ended June 30, 2004, included the following:

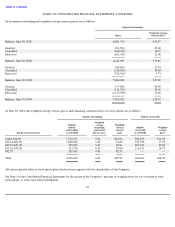

Stock Options:

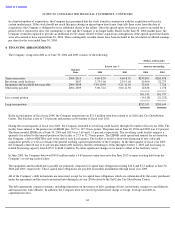

On October 24, 2000, the shareholders of Regis Corporation adopted the Regis Corporation 2000 Stock Option Plan (2000 Plan), which

allows the Company to grant both incentive and nonqualified stock options and replaces the Company’s 1991 Stock Option Plan (1991

Plan).

Total options covering 3,500,000 shares of common stock may be granted under the 2000 Plan to employees of the Company for a term not

to exceed ten years from the date of grant. The term may not exceed five years for incentive stock options granted to employees of the

Company possessing more than ten percent of the total combined voting power of all classes of stock of the Company or any subsidiary of

the Company. Options may also be granted to the Company’s outside directors for a term not to exceed ten years from the grant date.

The 2000 Plan contains restrictions on transferability, time of exercise, exercise price and on disposition of any shares acquired through

exercise of the options. Stock options are granted at not less than fair market value on the date of grant. The Board of Directors determines

the 2000 Plan participants and establishes the terms and conditions of each option.

The Company also has outstanding stock options under the 1991 Plan, although the Plan terminated in 2001. The terms and conditions of the

1991 Plan are similar to the 2000 Plan. Total options covering 5,200,000 shares of common stock were available for grant under the 1991

Plan and, as of June 30, 2001, all available shares were granted.

In fiscal year 2001, in addition to the regular options granted, the Board of Directors approved a special grant of options covering 2,263,000

shares of common stock from the 2000 Plan. These options began vesting after two years at a rate of one-third per year for three years and

expire ten years from the date of grant.

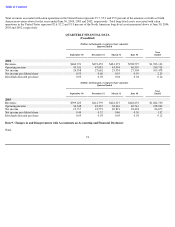

Common shares available for grant under the Company’s stock option plan were 453,100, 504,200 and 819,650 shares as of June 30, 2004,

2003 and 2002, respectively.

69

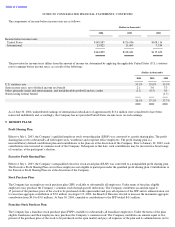

(Dollars in thousands)

2004

2003

2002

Profit sharing plan

$

3,665

$

2,836

$

2,689

Executive Profit Sharing Plan

735

600

711

SPP

521

446

455

FSPP

7

6

7