Supercuts 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

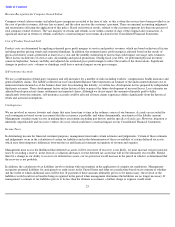

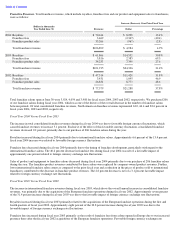

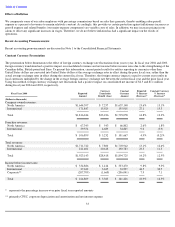

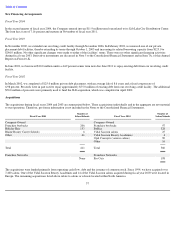

Corporate and Franchise Support Costs

Corporate and franchise support costs (CFSC) include expenses related to salon operations (field supervision, salon training and promotions

and product distribution) and home office administration costs (such as salaries and professional fees). During fiscal year 2004, 2003 and 2002,

corporate and franchise support costs were as follows:

Excluding the impact of fiscal year 2003 EEOC settlement costs, CFSC as a percent of consolidated revenues was flat during fiscal year 2004

as compared to the prior fiscal year. During the fourth quarter of fiscal year 2003, we recorded a charge of $3.2 million related to a settlement

with the EEOC. See Note 7 to the Consolidated Financial Statements for further discussion.

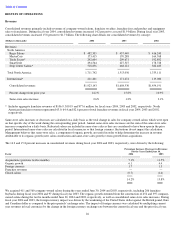

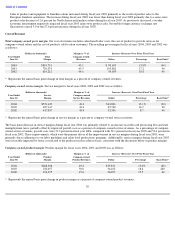

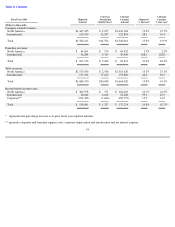

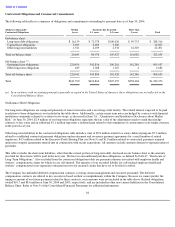

Interest

Interest expense was as follows during fiscal year 2004, 2003 and 2002:

The fiscal year 2004 decrease in interest, and improvement as a percent of consolidated revenues, stemmed from our strong cash flow and

lower outstanding debt balance as a result of the timing of acquisitions. In addition, the expiration of $55.0 million of pay-fixed, receive-

variable interest rate swaps in the fourth quarter of fiscal year 2003 contributed to the improvement, as a larger percentage of our total debt was

subject to lower short-term variable interest rates.

The dollar increase in fiscal year 2003 stemmed from a higher average outstanding debt related to the timing of acquisitions. Additionally, we

exercised our option under an operating lease to purchase the Salt Lake City distribution center. Prior to the purchase, the variable payments

related to the lease were hedged by an interest rate swap. At the date of the purchase, a $0.9 million non-cash charge was recognized in interest

expense, representing the fair value of the swap at the date of purchase. For additional information pertaining to our debt structure and interest

rates thereon, see Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

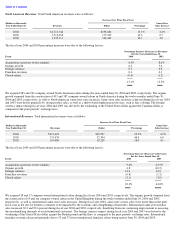

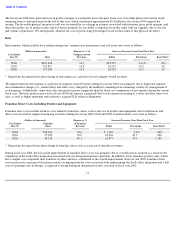

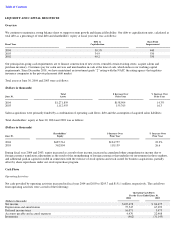

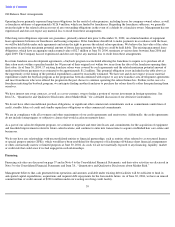

Income Taxes

The Company’s reported effective tax rate was as follows:

Changes in our overall effective tax rate are largely the result of a larger percentage of our income being generated in lower rate international

tax jurisdictions. Fiscal year 2003 was the first full year of operations from the acquired European franchise companies and foreign currency

exchange movements are favorably impacting our mix of international income. The associated effective tax rate on our international

businesses, which are in lower tax jurisdictions, resulted in the improvement in fiscal year 2004 and 2003 effective tax rates. Absent the

nonrecurring income tax benefit recorded in fiscal year 2002, the effective tax rate for that fiscal year would have been 39.2 percent.

32

(Dollars in thousands)

Expense as %

Increase (Decrease) Over Prior Fiscal Year

Year Ended

of Total

June 30,

CFSC

Revenues

Dollar

Percentage

Basis Point*

2004

$

181,992

9.5

$

18,736

11.5

%

(20

)

2003

163,256

9.7

23,602

16.9

10

2002

139,654

9.6

13,727

10.9

—

*

Represents the annual basis point change in CFSC as a percent of total revenues.

(Dollars in thousands)

Expense as %

Increase (Decrease) Over Prior Fiscal Year

Year Ended

of Total

June 30,

Interest

Revenues

Dollar

Percentage

Basis Point*

2004

$

17,064

0.9

$

(4,330

)

(20.2

)%

(40

)

2003

21,394

1.3

2,384

12.5

—

2002

19,010

1.3

(2,477

)

(11.5

)

(30

)

*

Represents the annual basis point change in interest expenses as a percent of total revenues.

Effective

Basis Point

Fiscal Year

Rate

Decrease

2004

36.0

%

(150

)

2003

37.5

(20

)

2002

37.7

(260

)