Neiman Marcus 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

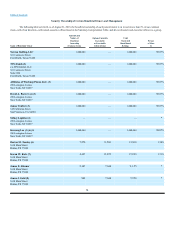

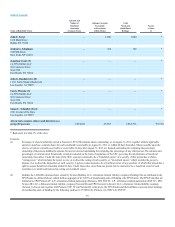

(iii) 6.9204% by Newton III and (iv) 6.9204% by Newton Co-Invest.

The general partner of each of Partners and FOF IV and managing member of Newton Co-Invest is TPG GenPar IV, L.P., a Delaware limited

partnership, whose general partner is TPG GenPar IV Advisors, LLC, a Delaware limited liability company, whose sole member is TPG Holdings

I, L.P., a Delaware limited partnership, whose general partner is TPG Holdings I-A, LLC, a Delaware limited liability company, whose sole

member is TPG Group Holdings (SBS), L.P., a Delaware limited partnership, whose general partner is TPG Group Holdings (SBS)

Advisors, Inc., a Delaware corporation (Group Advisors). The managing member of Newton III is TPG GenPar III, L.P., a Delaware limited

partnership, whose general partner is TPG Advisors III, Inc., a Delaware corporation (Advisors III).

Pursuant to the Holding limited liability company operating agreement, the TPG Funds (collectively) and WP VIII and WP IX (collectively) each

have the separate right to designate four directors to the Board of Directors of Holding, or assign the right to designate one of their four director

designees, to another direct or indirect member of Holding. Messrs. Coulter, Coslet and Ms. Wheeler are the initial directors appointed by the TPG

Funds, and Mr. Danhakl is a director assignee of Leonard Green & Partners, L.P. (LGP), as such designation right has been assigned by the TPG

Funds.

Because of these relationships, Group Advisors and Advisors III may be deemed to be the beneficial owners of the common shares directly held by

Holding. Messrs. Bonderman and Coulter are officers and sole stockholders of Group Advisors and Advisors III and may therefore be deemed to

be the beneficial owners of the common shares directly held by the TPG Funds, WP VIII and WP IX. Messrs. Bonderman and Coulter disclaim

beneficial ownership of the common shares directly held by Holding except to the extent of their pecuniary interest therein.

The mailing address for each of Group Advisors, Advisors III and Messrs. Bonderman and Coulter is c/o TPG Global, LLC, 301 Commerce

Street, Suite 3300, Fort Worth, TX 76102.

(3) Includes the 1,000,000 shares owned by Holding over which Warburg Pincus Private Equity VIII, L.P., a Delaware limited partnership (WP VIII),

together with two affiliated partnerships, and Warburg Pincus Private Equity IX, L.P., a Delaware limited partnership (WP IX and, collectively,

the WP Funds) may be deemed, as a result of their ownership of 43.2526% of membership units of Holding and certain provisions under the

Holding operating agreement, to have shared voting or dispositive power. Warburg Pincus IX LLC, a New York limited liability company (WP IX

LLC), an indirect subsidiary of Warburg Pincus & Co., a New York general partnership (WP), is the general partner of WP IX. Warburg Pincus

Partners LLC, a New York limited liability company (WP Partners) is the sole member of WP IX LLC and the general partner of WP VIII. WP is

the managing member of WP Partners. Warburg Pincus LLC, a New York limited liability company (WP LLC), is the manager of WP VIII and

WP IX. Charles R. Kaye and Joseph P. Landy are each Managing General Partners of WP and Managing Members and Co-Presidents of WP LLC

and may be deemed to control the Warburg Pincus entities. Messrs. Kaye and Landy disclaim beneficial ownership of all shares of common stock

owned by the Warburg Pincus entities.

(4) Pursuant to the Holding operating agreement, the TPG Funds (collectively), WP VIII and WP IX (collectively) have the separate right to designate

four directors to the Board of Directors of Holding, or assign the right to designate one of their four director designees, to another direct or indirect

member of Holding. Messrs. Barr, Lapidus and Lee are the initial directors appointed by the Warburg Pincus entities, and Ms. Schnabel is the

director assignee of DLJ Merchant Banking Partners, Credit Suisse, as such designation right has been assigned by the Warburg Pincus entities.

(5) Messrs. Barr and Lee, as partners of WP and managing directors and members of WP LLC, may be deemed to beneficially own all of the shares

of common stock beneficially owned by the Warburg Pincus entities. Messrs. Barr and Lee disclaim beneficial ownership of all shares of common

stock held by the Warburg Pincus entities.

(6) Includes 5,625 shares held for the benefit of a family trust of which Mr. Tansky disclaims beneficial ownership.

(7) Includes 4,027 shares held for the benefit of a family trust of which Ms. Katz disclaims beneficial ownership.

(8) Includes 902 shares held for the benefit of an investment trust of which Mr. Gold disclaims beneficial

80