Neiman Marcus 2012 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

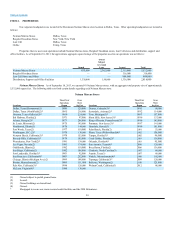

Seasonality

Our business, like that of most retailers, is affected by seasonal fluctuations in customer demand, product offerings and working capital

expenditures. For additional information on seasonality, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations

—Executive Overview—Seasonality.”

Intellectual Property

We own certain tradenames and service marks, including the “Neiman Marcus” and “Bergdorf Goodman” marks, that are important to our overall

business strategy. These marks are valuable assets that consumers associate with luxury goods.

Regulation

The credit card operations that are conducted under our arrangements with Capital One are subject to numerous federal and state laws that impose

disclosure and other requirements upon the origination, servicing and enforcement of credit accounts and limitations on the maximum amount of finance

charges that may be charged by a credit provider. In addition to our proprietary credit cards, credit to our customers is also provided primarily through third

parties. Any regulation or change in the regulation of credit arrangements that would materially limit the availability of credit to our customer base could

adversely affect our results of operations or financial condition.

Our practices, as well as those of our competitors, are subject to review in the ordinary course of business by the Federal Trade Commission and are

subject to numerous federal and state laws. Additionally, we are subject to certain customs, anti-corruption laws, truth-in-advertising and other laws,

including consumer protection regulations that regulate retailers generally and/or govern the importation, promotion and sale of merchandise. We undertake to

monitor changes in these laws and believe that we are in material compliance with all applicable state and federal regulations with respect to such practices.

ITEM 1A. RISK FACTORS

Risks Related to Our Business and Industry

Economic conditions may impact demand for our merchandise.

Deterioration in domestic and global economic conditions leading to reductions in consumer spending have had a significant adverse impact on our

business in the past. A number of factors affect the level of consumer spending on merchandise that we offer, including, among other things:

· general economic and industry conditions, including consumer confidence in future economic conditions;

· the performance of the financial, equity and credit markets;

· the level of consumer spending, debt and savings; and

· current and expected tax rates and policies.

The merchandise we sell consists of luxury retail goods. The purchase of these goods by customers is discretionary, and therefore highly dependent

upon the level of consumer spending, particularly among affluent customers. During an actual or perceived economic downturn, fewer customers may shop

with us and those who do shop may limit the amounts of their purchases. While economic conditions have improved since the severe downturn we experienced

in calendar years 2008 and 2009, domestic and global economic conditions remain volatile. The recurrence of adverse economic conditions could have an

adverse effect on our results of operations and continued growth.

If we significantly overestimate our future sales or fail to identify fashion trends and consumer shopping preferences correctly, our profitability

may be adversely affected.

Our success depends in large part on our ability to identify fashion trends and consumer shopping preferences as well as to anticipate, gauge, and

react to rapidly changing consumer demands in a timely manner. We make decisions regarding the purchase of our merchandise well in advance of the season

in which it will be sold. For example, women’s

12