Neiman Marcus 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

employment agreement), or 3) her employment terminates upon expiration of the term following the provision by us of a notice of non-renewal, and, in any

such case, on the date of such termination she has not yet reached age 65, her SERP Plan benefit shall not be reduced according to the terms of the SERP Plan

solely by reason of her failure to reach age 65 as of the termination date. During the employment term following December 31, 2010, she will accrue benefits

under DC SERP provided that the amounts credited to her account as of the last day of her employment term shall not be less than the present value of the

additional benefits she would have accrued under the SERP Plan had it remained in effect.

If we terminate Ms. Katz’s employment without “cause” or if she resigns for “good reason” or following her receipt of a notice of non-renewal from us

relating to the employment term, she will receive 1) an amount of annual incentive pay equal to a prorated portion of her target bonus amount for the year in

which the employment termination date occurs, and 2) a lump sum equal to (A) 18 times the monthly COBRA premium applicable to Ms. Katz plus (B) two

times the sum of her base salary and target bonus, at the level in effect as of the employment termination date; provided, however, that Ms. Katz shall be

required to repay this payment if she violates certain restrictive covenants in her agreement or if she is found to have engaged in certain acts of wrongdoing, all

as further described in the agreement. Ms. Katz is also entitled to continuation of certain benefits for a two-year period following a termination of her

employment for any reason as set forth more fully in her employment agreement.

If Ms. Katz’s employment terminates before the end of the term due to her death or “disability” we will pay her or her estate, as applicable, 1) any

unpaid salary through the date of termination and any bonus payable for the preceding fiscal year that has otherwise not already been paid, 2) any accrued but

unused vacation days, 3) any reimbursement for business travel and other expenses to which she is entitled, and 4) an amount of annual incentive pay equal

to a prorated portion of her target bonus amount for the year in which the employment termination date occurs.

Ms. Katz’s agreement also contains obligations on her part regarding non-competition and non-solicitation of employees following the termination of

her employment for any reason, confidential information and non-disparagement of us and our business. The non-competition agreement generally prohibits

Ms. Katz during employment and for a period of two years after termination from becoming a director, officer, employee or consultant for any competing

business that owns or operates a luxury specialty retail store located in the geographic areas of our operations. The agreement also requires that she disclose

and assign to us any trademarks or inventions developed by her which relate to her employment by us or to our business.

Effective December 31, 2010, Ms. Katz’s employment agreement was amended with respect to reimbursement for hotel or other lodging expenses

while on business trips to New York. Under the amendment, Ms. Katz will receive a lump sum cash payment during each year of the employment term in the

amount of $15,000 in lieu of any reimbursement of hotel or other lodging expenses incurred in connection with business trips to New York, plus an amount

necessary to gross-up such payment for income tax purposes. The amendment also provides for reimbursement of liability for any New York state and city

taxes, on an after-tax basis.

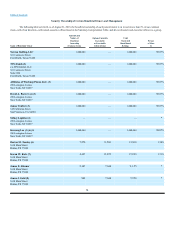

Employment Agreements with Mr. Skinner and Mr. Gold

On July 22, 2010, we entered into new employment agreements with James E. Skinner, Executive Vice President, Chief Operating Officer, and Chief

Financial Officer, and James J. Gold, President and Chief Executive Officer, Specialty Retail, the terms of which became effective on October 6, 2010. Each

of the employment agreements is for a four-year term with automatic extensions of one year unless either party provides three months’ written notice of non-

renewal. The agreement with Mr. Skinner provides that he will act as Executive Vice President, Chief Operating Officer and Chief Financial Officer for a

beginning annual base salary of $700,000 and participation in an annual incentive program with a target bonus opportunity of 75% of annual base salary and

a maximum bonus of 150% of annual base salary. In addition, as part of the agreement, effective September 30, 2010, he received a nonqualified stock option

grant under the Management Equity Incentive Plan with respect to 2,200 shares of our common stock with an exercise price equal to the fair market value of

the common stock at the time of grant. The stock option will expire no later than the seventh anniversary of the grant date.

The agreement with Mr. Gold provides that he will act as President and Chief Executive Officer, Specialty Retail for a beginning annual base salary

of $750,000 and participation in an annual incentive program with a target bonus opportunity of 75% of annual base salary and a maximum bonus of 150%

of annual base salary. In addition, as part of the agreement, effective September 30, 2010, he received a nonqualified stock option grant under the Management

Equity Incentive Plan with respect to 2,200 shares of our common stock with an exercise price equal to the fair market value of the common stock on the date

of grant. The stock option will expire no later than the seventh anniversary of the grant date.

The employment agreements may be terminated by either party. In certain termination circumstances, Mr. Skinner and Mr. Gold each will receive,

subject to their execution of a waiver and release agreement, severance pay consisting of no

70