Neiman Marcus 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

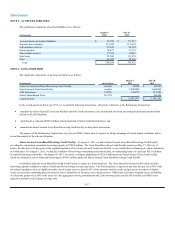

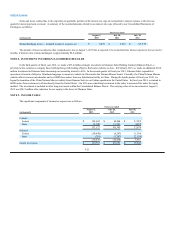

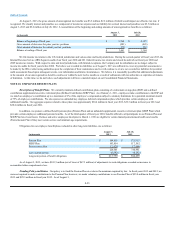

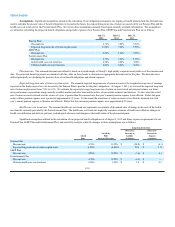

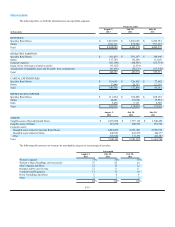

Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the end of each fiscal

year. Changes in our obligations pursuant to our Pension Plan, SERP Plan and Postretirement Plan during fiscal years 2013 and 2012 are as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2013 2012 2013 2012 2013 2012

Projected benefit obligations:

Beginning of year $565,852 $475,052 $117,562 $99,942 $17,466 $15,651

Service cost — — — — 34 35

Interest cost 21,243 24,761 4,037 4,816 650 780

Actuarial (gain) loss (64,616)108,311 (13,565)16,646 (4,308)1,746

Benefits paid, net (32,623)(42,272)(4,180)(3,842)(1,413)(746)

End of year $489,856 $565,852 $103,854 $117,562 $12,429 $17,466

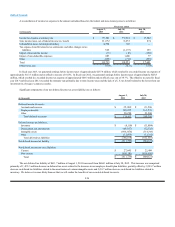

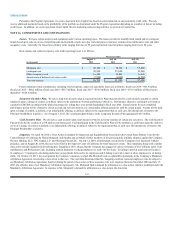

In April 2012, the Benefits Committee of the Company approved the offer of lump sum distributions or annuity distributions (for balances in excess

of $5,000 but less than $14,000) for certain vested terminated participants in our Pension Plan. Distributions to the vested terminated participants were

approximately $10.1 million during the fourth quarter of fiscal year 2012. In addition, during the fourth quarter of fiscal year 2012, the Company paid lump

sum distributions of $15.4 million to certain vested active participants.

In July 2013, the Benefits Committee of the Company approved the offer of lump sum distributions or annuity distributions (for balances in excess

of $5,000 but less than $30,000) for certain vested terminated participants in our Pension Plan. Distributions to the vested terminated participants were

approximately $14.2 million during the fourth quarter of fiscal year 2013.

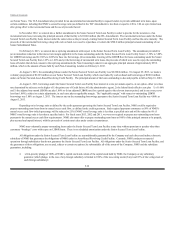

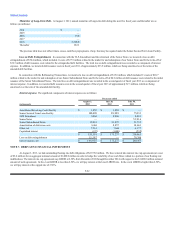

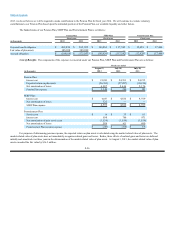

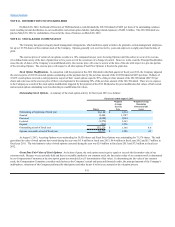

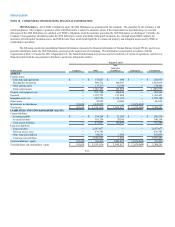

A summary of expected benefit payments related to our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Pension SERP Postretirement

(in thousands) Plan Plan Plan

Fiscal year 2014 $20,285 $5,861 $681

Fiscal year 2015 21,750 6,048 702

Fiscal year 2016 23,167 6,203 732

Fiscal year 2017 24,493 6,635 725

Fiscal year 2018 25,796 6,931 722

Fiscal years 2019-2023 145,106 35,760 3,616

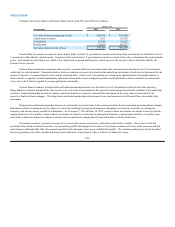

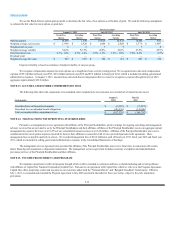

Pension Plan Assets and Investment Valuations. Assets held by our Pension Plan aggregated $385.8 million at August 3, 2013 and $389.9

million at July 28, 2012. The Pension Plan’s investments are stated at fair value or estimated fair value, as more fully described below. Purchases and sales

of securities are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date.

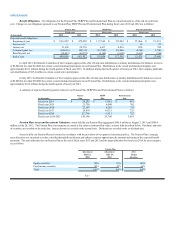

Assets held by our Pension Plan are invested in accordance with the provisions of our approved investment policy. The Pension Plan’s strategic

asset allocation was structured to reduce volatility through diversification and enhance return to approximate the amounts and timing of the expected benefit

payments. The asset allocation for our Pension Plan at the end of fiscal years 2013 and 2012 and the target allocation for fiscal year 2014, by asset category,

are as follows:

Pension Plan

Allocation at Allocation at 2014

July 31, July 31, Target

2013 2012 Allocation

Equity securities 50%53%60%

Fixed income securities 50%47%40%

Total 100%100%100%

F-27