Neiman Marcus 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

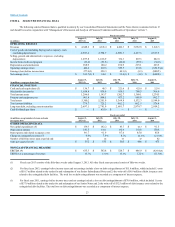

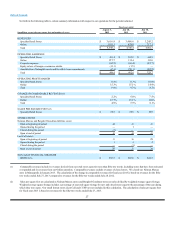

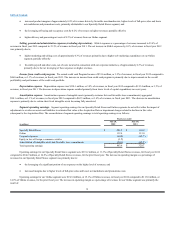

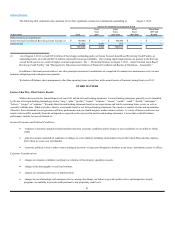

Fiscal year ended

August 3, July 28,

(in thousands) 2013 2012

Asset-Based Revolving Credit Facility $ 1,453 $ 1,052

Senior Secured Term Loan Facility 108,489 98,989

2028 Debentures 9,004 8,906

Senior Subordinated Notes 19,031 51,873

Amortization of debt issue costs 8,404 8,457

Other, net 7,214 7,040

Capitalized interest (237)(1,080)

$153,358 $175,237

Loss on debt extinguishment 15,597 —

Interest expense, net $168,955 $175,237

Income tax expense. Our effective income tax rate for fiscal year 2013 was 41.0% compared to 38.7% for fiscal year 2012. Our effective income

tax rates exceeded the federal statutory rate primarily due to:

· state income taxes; and

· the lack of a U.S. tax benefit related to the losses from our investment in a foreign e-commerce retailer in fiscal year 2013.

We file income tax returns in the U.S. federal jurisdiction and various state and local jurisdictions. During the second quarter of fiscal year 2013, the

Internal Revenue Service (IRS) began its audit of our fiscal year 2010 and 2011 income tax returns and closed its audit of our fiscal year 2008 and 2009

income tax returns. With respect to state and local jurisdictions, with limited exceptions, the Company and its subsidiaries are no longer subject to income tax

audits for fiscal years before 2008. We believe our recorded tax liabilities as of August 3, 2013 are sufficient to cover any potential assessments to be made by

the IRS or other taxing authorities upon the completion of their examinations and we will continue to review our recorded tax liabilities for potential audit

assessments based upon subsequent events, new information and future circumstances. We believe it is reasonably possible that additional adjustments in the

amounts of our unrecognized tax benefits could occur within the next twelve months as a result of settlements with tax authorities or expiration of statutes of

limitation. At this time, we do not believe such adjustments will have a material impact on our Consolidated Financial Statements.

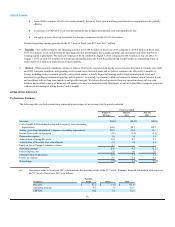

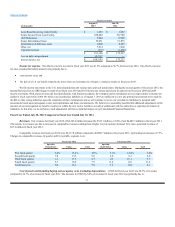

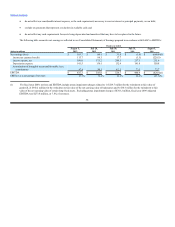

Fiscal Year Ended July 28, 2012 Compared to Fiscal Year Ended July 30, 2011

Revenues. Our revenues for fiscal year 2012 of $4,345.4 million increased by $343.1 million, or 8.6%, from $4,002.3 million in fiscal year 2011.

The increase in revenues was due to increases in comparable revenues resulting from a higher level of customer demand. New stores generated revenues of

$27.6 million in fiscal year 2012.

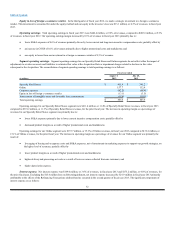

Comparable revenues for fiscal year 2012 were $4,317.8 million compared to $4,000.7 million in fiscal year 2011, representing an increase of 7.9%.

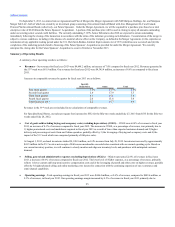

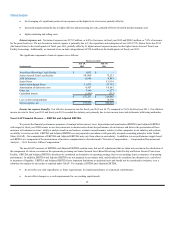

Changes in comparable revenues, by quarter and by reportable segment, were:

Fiscal year 2012 Fiscal year 2011

Specialty Specialty

Retail Stores Online Total Retail Stores Online Total

First fiscal quarter 6.4%15.2%8.0%5.1%12.8%6.4%

Second fiscal quarter 7.8 13.5 9.0 6.0 6.3 6.0

Third fiscal quarter 4.3 17.5 6.7 8.3 16.1 9.7

Fourth fiscal quarter 5.3 18.8 7.9 11.0 11.0 11.0

Total fiscal year 6.0 16.1 7.9 7.5 11.0 8.1

Cost of goods sold including buying and occupancy costs (excluding depreciation). COGS for fiscal year 2012 was 64.3% of revenues

compared to 64.7% of revenues for fiscal year 2011. The decrease in COGS by 0.4% of revenues for fiscal year 2012 was primarily due to:

33