Neiman Marcus 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

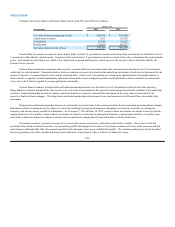

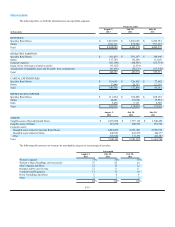

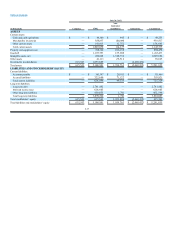

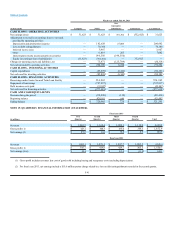

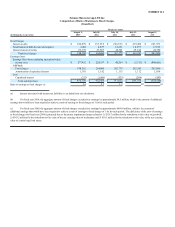

Fiscal year ended August 3, 2013

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 3,875,580 $772,669 $ — $ 4,648,249

Cost of goods sold including buying and occupancy

costs (excluding depreciation) — 2,500,640 494,723 —2,995,363

Selling, general and administrative expenses (excluding

depreciation) —921,850 135,946 —1,057,796

Income from credit card program — (48,635) (4,738) — (53,373)

Depreciation expense —127,606 13,909 —141,515

Amortization of intangible assets and favorable lease

commitments —35,092 12,344 —47,436

Equity in loss of foreign e-commerce retailer — — 13,125 —13,125

Operating earnings —339,027 107,360 —446,387

Interest expense, net —168,952 3—168,955

Intercompany royalty charges (income) — 130,459 (130,459) — —

Equity in (earnings) loss of subsidiaries (163,699) (237,816) — 401,515 —

Earnings (loss) before income taxes 163,699 277,432 237,816 (401,515) 277,432

Income tax expense —113,733 — — 113,733

Net earnings (loss) $163,699 $163,699 $237,816 $ (401,515) $ 163,699

Total other comprehensive earnings (loss), net of tax 41,263 41,263 — (41,263) 41,263

Total comprehensive earnings (loss) $204,962 $204,962 $237,816 $(442,778)$204,962

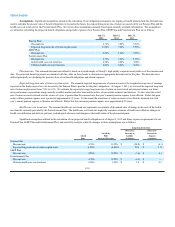

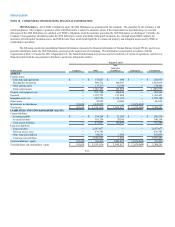

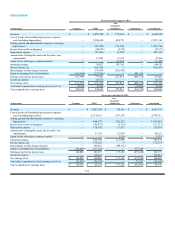

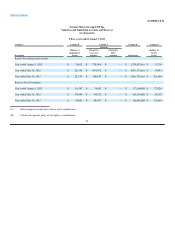

Fiscal year ended July 28, 2012

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

Revenues $ — $ 3,607,190 $738,184 $ — $ 4,345,374

Cost of goods sold including buying and occupancy

costs (excluding depreciation) —2,319,516 475,197 —2,794,713

Selling, general and administrative expenses (excluding

depreciation) —890,677 126,225 —1,016,902

Income from credit card program —(46,957)(4,614) — (51,571)

Depreciation expense —116,142 13,977 —130,119

Amortization of intangible assets and favorable lease

commitments —37,224 12,899 — 50,123

Equity in loss of foreign e-commerce retailer — — 1,514 —1,514

Operating earnings —290,588 112,986 —403,574

Interest expense, net —175,232 5 — 175,237

Intercompany royalty charges (income) —204,181 (204,181) — —

Equity in (earnings) loss of subsidiaries (140,086) (317,162) — 457,248 —

Earnings (loss) before income taxes 140,086 228,337 317,162 (457,248)228,337

Income tax expense —88,251 — — 88,251

Net earnings (loss) $140,086 $140,086 $317,162 $(457,248) $ 140,086

Total other comprehensive (loss) earnings, net of tax (75,747) (75,747) — 75,747 (75,747)

Total comprehensive earnings (loss) $ 64,339 $ 64,339 $ 317,162 $(381,501)$ 64,339

F-38