Neiman Marcus 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

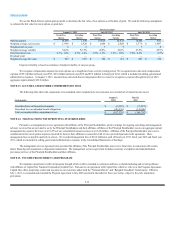

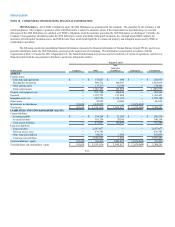

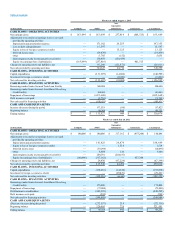

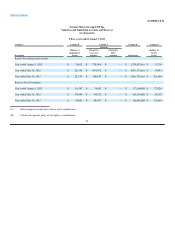

Fiscal year ended July 30, 2011

(in thousands) Company NMG

Non-

Guarantor

Subsidiaries Eliminations Consolidated

CASH FLOWS - OPERATING ACTIVITIES

Net earnings (loss) $ 31,623 $ 31,623 $ 301,302 $ (332,925) $ 31,623

Adjustments to reconcile net earnings (loss) to net cash

provided by operating activities:

Depreciation and amortization expense —182,638 27,004 —209,642

Loss on debt extinguishment —70,388 — — 70,388

Deferred income taxes —3,967 — — 3,967

Other —6,819 263 — 7,082

Intercompany royalty income payable (receivable) —194,556 (194,556) — —

Equity in (earnings) loss of subsidiaries (31,623)(301,302) — 332,925 —

Changes in operating assets and liabilities, net —75,471 (125,789) — (50,318)

Net cash provided by operating activities —264,160 8,224 — 272,384

CASH FLOWS - INVESTING ACTIVITIES

Capital expenditures —(85,839)(8,342) — (94,181)

Net cash used for investing activities —(85,839)(8,342) — (94,181)

CASH FLOWS - FINANCING ACTIVITIES

Borrowings under Senior Secured Term Loan Facility —554,265 — — 554,265

Repayment of borrowings —(797,937) — — (797,937)

Debt issuance costs paid —(33,947) — — (33,947)

Net cash used for financing activities —(277,619) — — (277,619)

CASH AND CASH EQUIVALENTS

Decrease during the period —(99,298)(118) — (99,416)

Beginning balance —420,163 844 —421,007

Ending balance $ — $ 320,865 $726 $ — $ 321,591

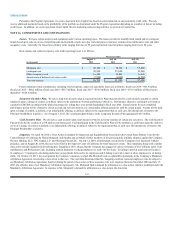

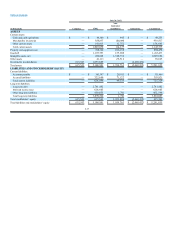

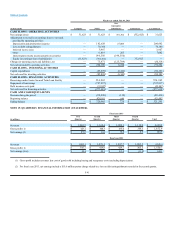

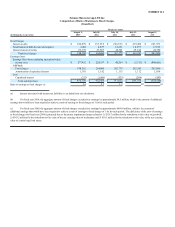

NOTE 19. QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

Fiscal year 2013

(in millions)

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter Total

Revenues $1,068.5 $ 1,362.4 $ 1,098.3 $ 1,119.0 $ 4,648.2

Gross profit (1) $423.1 $440.7 $435.0 $354.1 $1,652.9

Net earnings (2) $49.6 $40.4 $70.8 $2.9 $ 163.7

Fiscal year 2012

Revenues $1,003.1 $1,279.1 $1,057.7 $1,005.5 $4,345.4

Gross profit (1) $395.7 $ 419.8 $ 429.7 $ 305.5 $ 1,550.7

Net earnings (loss) $48.4 $40.1 $62.6 $(11.0)$140.1

(1) Gross profit includes revenues less cost of goods sold including buying and occupancy costs (excluding depreciation).

(2) For fiscal year 2013, net earnings include a $15.6 million pretax charge related to a loss on debt extinguishment recorded in the second quarter.

F-41