Neiman Marcus 2012 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

our Senior Notes. The TLF Amendment also provided for an uncommitted incremental facility to request lenders to provide additional term loans, upon

certain conditions, including that NMG’s secured leverage ratio (as defined in the TLF Amendment) is less than or equal to 4.50 to 1.00 on a pro forma basis

after giving effect to the incremental loans and the use of proceeds thereof.

In November 2012, we entered into a further amendment to the Senior Secured Term Loan Facility in order to provide for the incurrence of an

incremental term loan, increasing the principal amount of that facility to $2,560.0 million (the ITL Amendment). The incremental term loan under the Senior

Secured Term Loan Facility bears interest under the same terms as the previously existing Senior Secured Term Loan Facility and has the same maturity. The

proceeds of the incremental borrowing, along with cash on hand, were used to repurchase or redeem the $500.0 million principal amount outstanding of our

Senior Subordinated Notes.

On February 8, 2013, we entered into a repricing amendment with respect to the Senior Secured Term Loan Facility. The amendment provided for

(a) an immediate reduction in the interest rate margin applicable to the loans outstanding under the Senior Secured Term Loan Facility from 1) 3.50% to 3.00%

for LIBOR borrowings and 2) 2.50% to 2.00% for base rate borrowings, (b) an immediate lowering of the LIBOR floor for loans outstanding under the Senior

Secured Term Loan Facility from 1.25% to 1.00% and (c) the borrowing of incremental term loans, the proceeds of which were used to repay the outstanding

loans of lenders that did not consent to the repricing amendment (the Non-Consenting Lenders) in an aggregate principal amount of approximately $99.6

million, which is the amount of loans held by such Non-Consenting Lenders on February 8, 2013.

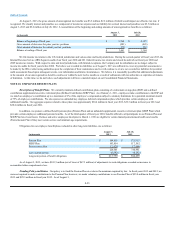

At August 3, 2013, the outstanding balance under the Senior Secured Term Loan Facility was $2,560.0 million. On August 29, 2013, we made a

voluntary prepayment of $126.9 million on our Senior Secured Term Loan Facility, which was funded by cash on hand and borrowings of $100.0 million

under our Senior Secured Asset-Based Revolving Credit Facility. The principal amount of the loans outstanding is due and payable in full on May 16, 2018.

At August 3, 2013, borrowings under the Senior Secured Term Loan Facility bore interest at a rate per annum equal to, at our option, either (a) a base

rate determined by reference to the higher of 1) the prime rate of Credit Suisse AG (the administrative agent), 2) the federal funds effective rate plus of 1.00%

and 3) the adjusted one-month LIBOR rate plus 1.00% or (b) an adjusted LIBOR rate (for a period equal to the relevant interest period, and in any event, never

less than 1.00%), subject to certain adjustments, in each case plus an applicable margin. The “applicable margin” with respect to outstanding LIBOR

borrowings was 3.00% at August 3, 2013. The interest rate on the outstanding borrowings pursuant to the Senior Secured Term Loan Facility was 4.00% at

August 3, 2013.

Depending on its leverage ratio as defined by the credit agreement governing the Senior Secured Term Loan Facility, NMG could be required to

prepay outstanding term loans from its annual excess cash flow, as defined in the credit agreement. Such required payments commence at 50% of NMG’s

annual excess cash flow (which percentage will be reduced to 25% if NMG’s total leverage ratio is less than a specified ratio and will be reduced to 0% if

NMG’s total leverage ratio is less than a specified ratio). For fiscal years 2013, 2012 and 2011, we were not required to prepay any outstanding term loans

pursuant to the annual excess cash flow requirements. NMG also must offer to prepay outstanding term loans at 100% of the principal amount to be prepaid,

plus accrued and unpaid interest, with the proceeds of certain asset sales under certain circumstances.

NMG may voluntarily prepay outstanding loans under the Senior Secured Term Loan Facility at any time without premium or penalty other than

customary “breakage” costs with respect to LIBOR loans. There is no scheduled amortization under the Senior Secured Term Loan Facility.

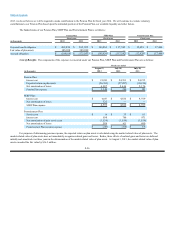

All obligations under the Senior Secured Term Loan Facility are unconditionally guaranteed by the Company and each direct and indirect domestic

subsidiary of NMG that guarantees the obligations of NMG under its Asset-Based Revolving Credit Facility. Currently, NMG conducts no material

operations through subsidiaries that do not guarantee the Senior Secured Term Loan Facility. All obligations under the Senior Secured Term Loan Facility, and

the guarantees of those obligations, are secured, subject to certain exceptions, by substantially all of the assets of the Company, NMG and the subsidiary

guarantors, including:

· a first-priority pledge of 100% of NMG’s capital stock and certain of the capital stock held by NMG, the Company or any subsidiary

guarantor (which pledge, in the case of any foreign subsidiary is limited to 100% of the non-voting stock (if any) and 65% of the voting stock of

such foreign subsidiary);

F-20

12