Neiman Marcus 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

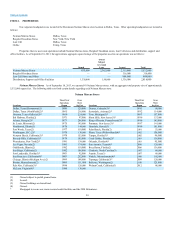

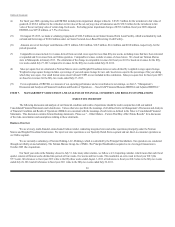

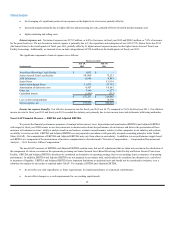

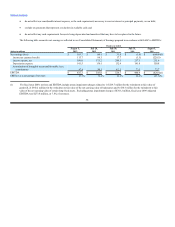

(3) For an explanation of EBITDA as a measure of our operating performance and a reconciliation to net earnings, see Item 7, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measure-EBITDA and Adjusted EBITDA.”

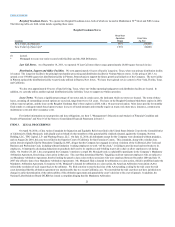

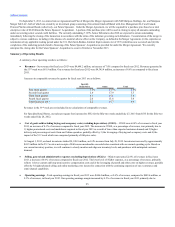

Factors Affecting Our Results

Revenues. We generate our revenues from the sale of high-end merchandise through our Specialty Retail Stores and our Online operation.

Components of our revenues include:

· Sales of merchandise—Revenues are recognized at the later of the point-of-sale or the delivery of goods to the customer. Revenues are reduced

when customers return goods previously purchased. We maintain reserves for anticipated sales returns primarily based on our historical trends.

Revenues exclude sales taxes collected from our customers.

· Delivery and processing—We generate revenues from delivery and processing charges related to merchandise delivered to our customers.

Our revenues can be affected by the following factors:

· general economic conditions;

· changes in the level of consumer spending generally and, specifically, on luxury goods;

· our ability to acquire goods meeting customers’ tastes and preferences;

· changes in the level of full-price sales;

· changes in the level of promotional events conducted;

· changes in the level of delivery and processing revenues collected from our customers;

· our ability to successfully implement our expansion and growth strategies; and

· the rate of growth in internet revenues.

In addition, our revenues are seasonal, as discussed below under “—Seasonality.”

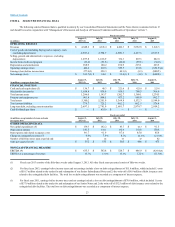

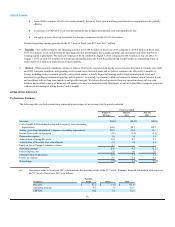

Cost of goods sold including buying and occupancy costs (excluding depreciation). COGS consists of the following components:

· Inventory costs—We utilize the retail inventory method of accounting. Under the retail inventory method, the valuation of inventories at cost

and the resulting gross margins are determined by applying a calculated cost-to-retail ratio, for various groupings of similar items, to the retail

value of our inventories. The cost of the inventory reflected on the Consolidated Balance Sheets is decreased by charges to cost of goods sold at

average cost and the retail value of the inventory is lowered through the use of markdowns. Earnings are negatively impacted when merchandise

is marked down. With the introduction of new fashions in the first and third fiscal quarters of each fiscal year and our emphasis on full-price

selling in these quarters, a lower level of markdowns and higher margins are characteristic of these quarters.

· Buying costs—Buying costs consist primarily of salaries and expenses incurred by our merchandising and buying operations.

· Occupancy costs—Occupancy costs consist primarily of rent, property taxes and operating costs of our retail, distribution and support

facilities. A significant portion of our buying and occupancy costs are fixed in nature and are not dependent on the revenues we generate.

· Delivery and processing costs—Delivery and processing costs consist primarily of delivery charges we pay to third party carriers and other

costs related to the fulfillment of customer orders not delivered at the point-of-sale.

28