Neiman Marcus 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

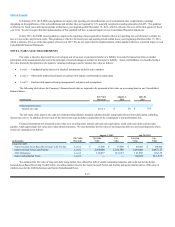

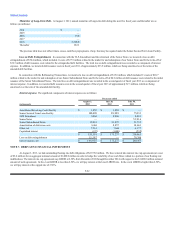

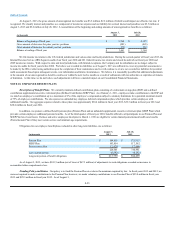

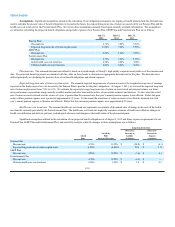

Maturities of Long-Term Debt. At August 3, 2013, annual maturities of long-term debt during the next five fiscal years and thereafter are as

follows (in millions):

2014 $ —

2015 —

2016 15.0

2017 —

2018 2,560.0

Thereafter 122.1

The previous table does not reflect future excess cash flow prepayments, if any, that may be required under the Senior Secured Term Loan Facility.

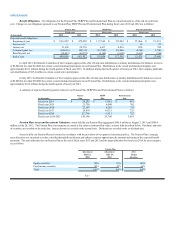

Loss on Debt Extinguishment. In connection with the TLF Amendment and the retirement of the Senior Notes, we incurred a loss on debt

extinguishment of $70.4 million, which included 1) costs of $37.9 million related to the tender for and redemption of our Senior Notes and 2) the write-off of

$32.5 million of debt issuance costs related to the extinguished debt facilities. The total loss on debt extinguishment was recorded as a component of interest

expense. In addition, we incurred debt issuance costs in fiscal year 2011 of approximately $33.9 million, which are being amortized over the terms of the

amended debt facilities.

In connection with the Refinancing Transactions, we incurred a loss on debt extinguishment of $15.6 million, which included 1) costs of $10.7

million related to the tender for and redemption of our Senior Subordinated Notes and 2) the write-off of $4.9 million of debt issuance costs related to the initial

issuance of the Senior Subordinated Notes. The total loss on debt extinguishment was recorded in the second quarter of fiscal year 2013 as a component of

interest expense. In addition, we incurred debt issuance costs in the second quarter of fiscal year 2013 of approximately $7.3 million, which are being

amortized over the term of the amended debt facility.

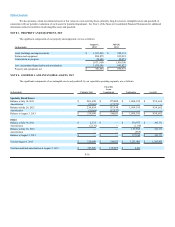

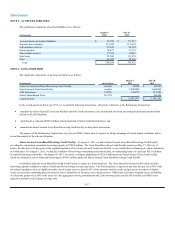

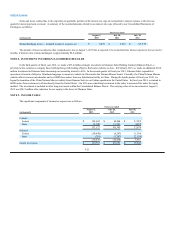

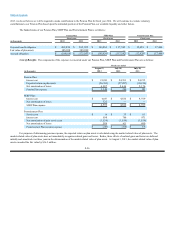

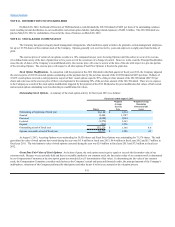

Interest expense. The significant components of interest expense are as follows:

Fiscal year ended

(in thousands)

August 3,

2013

July 28,

2012

July 30,

2011

Asset-Based Revolving Credit Facility $ 1,453 $ 1,052 $ —

Senior Secured Term Loan Facility 108,489 98,989 75,233

2028 Debentures 9,004 8,906 8,881

Senior Notes — — 53,916

Senior Subordinated Notes 19,031 51,873 51,732

Amortization of debt issue costs 8,404 8,457 14,661

Other, net 7,214 7,040 6,177

Capitalized interest (237)(1,080) (535)

$153,358 $175,237 $210,065

Loss on debt extinguishment 15,597 —70,388

Interest expense, net $168,955 $175,237 $280,453

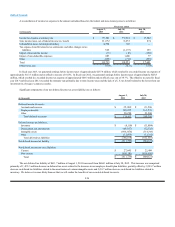

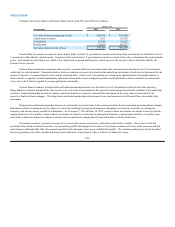

NOTE 7. DERIVATIVE FINANCIAL INSTRUMENTS

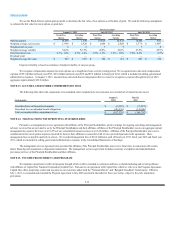

At August 3, 2013, we had outstanding floating rate debt obligations of $2,575.0 million. We have entered into interest rate cap agreements (at a cost

of $5.8 million) for an aggregate notional amount of $1,000.0 million in order to hedge the variability of our cash flows related to a portion of our floating rate

indebtedness. The interest rate cap agreements cap LIBOR at 2.50% from December 2012 through December 2014 with respect to the $1,000.0 million notional

amount of such agreements. In the event LIBOR is less than 2.50%, we will pay interest at the lower LIBOR rate. In the event LIBOR is higher than 2.50%,

we will pay interest at the capped rate of 2.50%.

F-22