Neiman Marcus 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

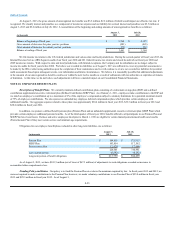

The Asset-Based Revolving Credit Facility provides that NMG has the right at any time to request up to $300.0 million of additional revolving

facility commitments and/or incremental term loans, provided that the aggregate amount of loan commitments under the Asset-Based Revolving Credit Facility

may not exceed $1,000.0 million. However, the lenders are under no obligation to provide any such additional commitments or loans, and any increase in

commitments or incremental term loans will be subject to customary conditions precedent. If NMG were to request any such additional commitments and the

existing lenders or new lenders were to agree to provide such commitments, the size of the Asset-Based Revolving Credit Facility could be increased to up to

$1,000.0 million, but NMG’s ability to borrow would still be limited by the amount of the borrowing base. The cash proceeds of any incremental term loans

may be used for working capital and general corporate purposes.

At August 3, 2013, borrowings under the Asset-Based Revolving Credit Facility bore interest at a rate per annum equal to, at NMG’s option, either

(a) a base rate determined by reference to the highest of 1) a defined prime rate, 2) the federal funds effective rate plus of 1.00% or 3) a one-month LIBOR

rate plus 1.00% or (b) a LIBOR rate, subject to certain adjustments, in each case plus an applicable margin. The applicable margin is up to 1.25% with

respect to base rate borrowings and up to 2.25% with respect to LIBOR borrowings. The applicable margin is subject to adjustment based on the historical

excess availability under the Asset-Based Revolving Credit Facility. The interest rate on the outstanding borrowings pursuant to the Asset-Based Revolving

Credit Facility was 2.00% at August 3, 2013. In addition, NMG is required to pay a commitment fee in respect of unused commitments of (a) 0.375% per

annum during any applicable period in which the average revolving loan utilization is 40% or more or (b) 0.50% per annum during any applicable period in

which the average revolving loan utilization is less than 40%. NMG must also pay customary letter of credit fees and agency fees.

If at any time the aggregate amount of outstanding revolving loans, unreimbursed letter of credit drawings and undrawn letters of credit under the

Asset-Based Revolving Credit Facility exceeds the lesser of (a) the commitment amount and (b) the borrowing base (including as a result of reductions to the

borrowing base that would result from certain non-ordinary course sales of inventory with a value in excess of $25.0 million, if applicable), NMG will be

required to repay outstanding loans or cash collateralize letters of credit in an aggregate amount equal to such excess, with no reduction of the commitment

amount. In addition, at any time when incremental term loans are outstanding, if the aggregate amount outstanding under the Asset-Based Revolving Credit

Facility exceeds the reported value of inventory owned by the borrowers and guarantors, NMG will be required to eliminate such excess within a limited period

of time. If the amount available under the Asset-Based Revolving Credit Facility is less than the greater of a) 12.5% of the lesser of (1) the aggregate revolving

commitments and (2) the borrowing base and b) $60.0 million, NMG will be required to repay outstanding loans and, if an event of default has occurred,

cash collateralize letters of credit. NMG would then be required to deposit daily in a collection account maintained with the agent under the Asset-Based

Revolving Credit Facility.

NMG may voluntarily reduce the unutilized portion of the commitment amount and repay outstanding loans at any time without premium or penalty

other than customary “breakage” costs with respect to LIBOR loans. There is no scheduled amortization under the Asset-Based Revolving Credit Facility; the

principal amount of the revolving loans outstanding thereunder will be due and payable in full on May 17, 2016, unless extended, or if earlier, the maturity

date of the Senior Secured Term Loan Facility (subject to certain exceptions).

All obligations under the Asset-Based Revolving Credit Facility are guaranteed by the Company and certain of NMG’s existing and future domestic

subsidiaries (principally, Bergdorf Goodman, Inc., through which NMG conducts the operations of its Bergdorf Goodman stores, and NM Nevada Trust,

which holds legal title to certain real property and intangible assets used by NMG in conducting its operations). Currently, NMG conducts no material

operations through subsidiaries that do not guarantee the Asset-Based Revolving Credit Facility. All obligations under NMG’s Asset-Based Revolving Credit

Facility, and the guarantees of those obligations, are secured, subject to certain significant exceptions, by substantially all of the assets of the Company, NMG

and the subsidiaries that have guaranteed the Asset-Based Revolving Credit Facility (subsidiary guarantors), including:

· a first-priority security interest in personal property consisting of inventory and related accounts, cash, deposit accounts, all payments received by

NMG or the subsidiary guarantors from credit card clearinghouses and processors or otherwise in respect of all credit card charges for sales of

inventory by NMG and the subsidiary guarantors, certain related assets and proceeds of the foregoing;

· a second-priority pledge of 100% of NMG’s capital stock and certain of the capital stock held by NMG, the Company or any subsidiary guarantor

(which pledge, in the case of any foreign subsidiary is limited to 100% of the non-voting stock (if any) and 65% of the voting stock of such foreign

subsidiary); and

F-18

12