Neiman Marcus 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

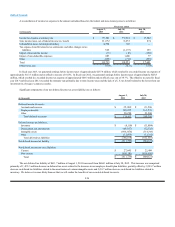

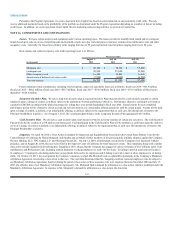

NOTE 11. DISTRIBUTIONS TO STOCKHOLDERS

On March 28, 2012, the Board of Directors of NMG declared a cash dividend (the 2012 Dividend) of $435 per share of its outstanding common

stock resulting in total distributions to our stockholders and certain option holders (including related expenses) of $449.3 million. The 2012 Dividend was

paid on March 30, 2012 to stockholders of record at the close of business on March 28, 2012.

NOTE 12. STOCK-BASED COMPENSATION

The Company has approved equity-based management arrangements, which authorize equity awards to be granted to certain management employees

for up to 115,792 shares of the common stock of the Company. Options generally vest over four to five years and expire six to eight years from the date of

grant.

The exercise prices of certain of our options escalate at a 10% compound rate per year (Accreting Options) until the earliest to occur of (i) exercise,

(ii) a defined anniversary of the date of grant (four to five years) or (iii) the occurrence of a change of control. However, in the event the Principal Stockholders

cause the sale of shares of the Company to an unaffiliated entity, the exercise price will cease to accrete at the time of the sale with respect to a pro rata portion

of the Accreting Options. The exercise price with respect to all other options (Fixed Price Options) is fixed at the grant date.

Stock Option Modifications. In connection with the payment of the 2012 Dividend in the third quarter of fiscal year 2012, the Company adjusted

the exercise price of 45,812 unvested options outstanding on the payment date by the per share amount of the 2012 Dividend of $435 per share. Holders of

47,055 vested options received a cash payment in respect of their vested options equal to 50% of the per share amount of the 2012 Dividend ($217.50 per

share) and a decrease in the exercise price of their vested options for the remaining 50% of the per share amount of the 2012 Dividend. There was no expense

to the Company as a result of the stock option modification triggered by the payment of the 2012 Dividend as the post-modification fair values of both vested

and unvested options outstanding were less than the pre-modification fair values.

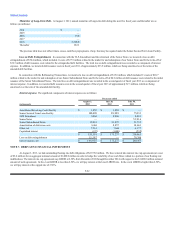

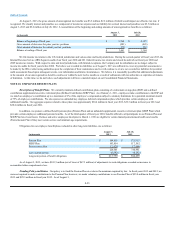

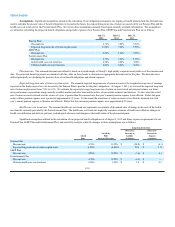

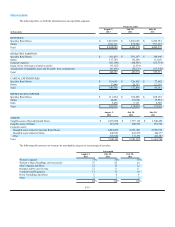

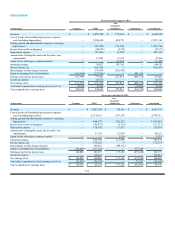

Outstanding Stock Options. A summary of the stock option activity for fiscal year 2013 is as follows:

Fiscal year ended August 3, 2013

Weighted Weighted Average

Average Remaining

Exercise Contractual Life

Shares Price (years)

Outstanding at beginning of fiscal year 96,180 $ 1,214

Granted 12,400 1,987

Exercised (4,288) 1,064

Forfeited (1,272) 1,363

Expired (894)1,228

Outstanding at end of fiscal year 102,126 $1,344 4.6

Options exercisable at end of fiscal year 64,173 $1,200 4.2

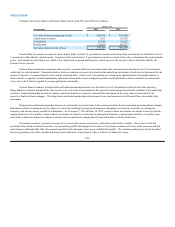

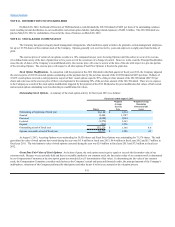

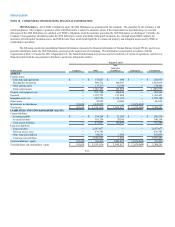

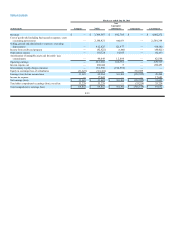

At August 3, 2013, Accreting Options were outstanding for 30,550 shares and Fixed Price Options were outstanding for 71,576 shares. The total

grant date fair value of stock options that vested during the year was $13.8 million in fiscal year 2013, $6.4 million in fiscal year 2012 and $5.7 million in

fiscal year 2011. The total intrinsic value of stock options exercised during the year was $3.6 million in fiscal year 2013 and $7.5 million in fiscal year

2012.

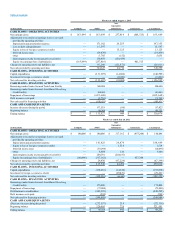

Grant Date Fair Value of Stock Options. At the date of grant, the stock option exercise price equals or exceeds the fair market value of our

common stock. Because we are privately held and there is no public market for our common stock, the fair market value of our common stock is determined

by our Compensation Committee at the time option grants are awarded (Level 3 determination of fair value). In determining the fair value of our common

stock, the Compensation Committee considers such factors as the Company’s actual and projected financial results, the principal amount of the Company’s

indebtedness, valuations of the Company performed by third parties and other factors it believes are material to the valuation process.

F-31