Neiman Marcus 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

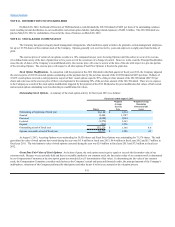

Arbitration Association (AAA) referred the resolution of such request back to the arbitrator. We filed a motion to stay the decision of the AAA pending a ruling

by the trial court; the trial court determined that the arbitration agreement was unenforceable due to a recent California case. We asserted that the trial court

does not have jurisdiction to change its earlier determination of the enforceability of the arbitration agreement and appealed the court’s decision to the court of

appeals. In addition, the National Labor Relations Board (NLRB) has issued a complaint alleging that the Mandatory Arbitration Agreement’s class action

prohibition violates employees’ rights to engage in concerted activity, which is being submitted to the administrative law judge in late September for

determination, unless the NLRB in Washington, D.C., dismisses the matter entirely based upon our previous settlement of the issues surrounding the 2007

Arbitration Agreement with the NLRB. We will continue to vigorously defend our interests in these matters. Currently, we cannot reasonably estimate the

amount of loss, if any, arising from these matters. We will continue to evaluate these matters based on subsequent events, new information and future

circumstances.

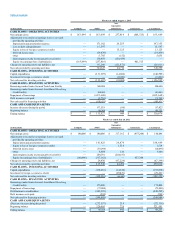

We are currently involved in various other legal actions and proceedings that arose in the ordinary course of business. With respect to the matter

described above as well as all other current outstanding litigation involving the Company, we believe that any liability arising as a result of such litigation will

not have a material adverse effect on our financial position, results of operations or cash flows.

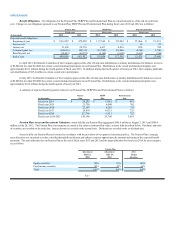

Other. We had no outstanding irrevocable letters of credit relating to purchase commitments and insurance and other liabilities at August 3, 2013.

We had approximately $5.1 million in surety bonds at August 3, 2013 relating primarily to merchandise imports and state sales tax and utility requirements.

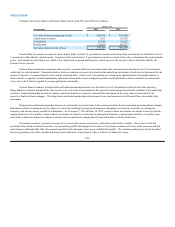

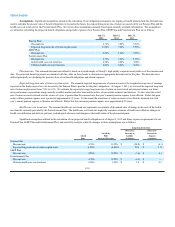

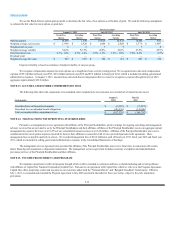

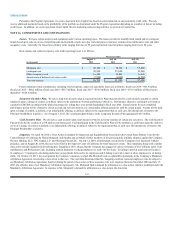

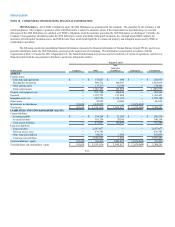

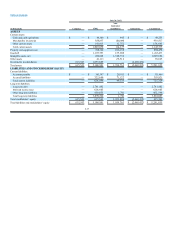

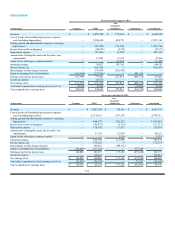

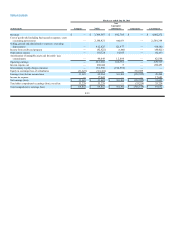

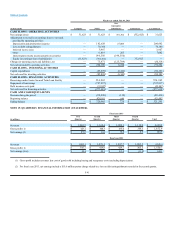

NOTE 17. SEGMENT REPORTING

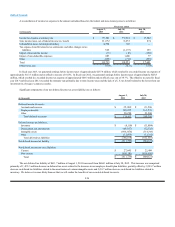

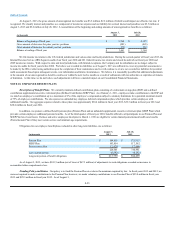

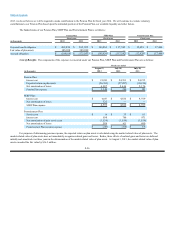

We have identified two reportable segments: Specialty Retail Stores and Online. The Specialty Retail Stores segment aggregates the activities of our

Neiman Marcus and Bergdorf Goodman retail stores, including Last Call stores. The Online segment conducts online and supplemental print catalog

operations under the Neiman Marcus, Bergdorf Goodman, Last Call and Horchow brand names. Both the Specialty Retail Stores and Online segments derive

their revenues from the sales of high-end fashion apparel, accessories, cosmetics and fragrances from leading designers, precious and fashion jewelry and

decorative home accessories.

Operating earnings for the segments include 1) revenues, 2) cost of sales, 3) direct selling, general and administrative expenses, 4) other direct

operating expenses, 5) income from credit card program and 6) depreciation expense for the respective segment. Items not allocated to our operating segments

include those items not considered by management in measuring the assets and profitability of our segments. These amounts include 1) corporate expenses

including, but not limited to, treasury, investor relations, legal and finance support services and general corporate management, 2) charges related to the

application of purchase accounting adjustments made in connection with the Acquisition including amortization of intangible assets and favorable lease

commitments and other non-cash items and 3) interest expense. These items, while often related to the operations of a segment, are not considered by segment

operating management, corporate operating management and the chief operating decision maker in assessing segment operating performance. The accounting

policies of the operating segments are the same as those described in the summary of significant accounting policies (except with respect to purchase accounting

adjustments not allocated to the operating segments).

F-34