Neiman Marcus 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

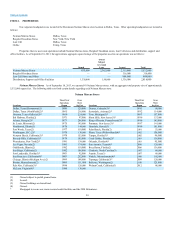

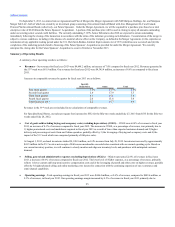

Bergdorf Goodman Stores. We operate two Bergdorf Goodman stores, both of which are located in Manhattan at 58 Street and Fifth Avenue.

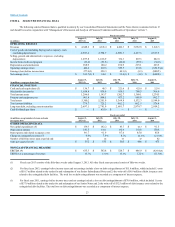

The following table sets forth certain details regarding these stores:

Bergdorf Goodman Stores

Locations

Fiscal Year

Operations

Began

Gross Store

Sq. Feet

New York City (Main)(1) 1901 250,000

New York City (Men’s)(1)* 1991 66,000

(1) Leased.

* Mortgaged to secure our senior secured credit facilities and the 2028 Debentures.

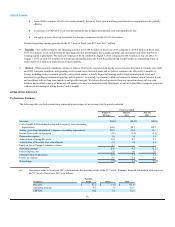

Last Call Stores. As of September 18, 2013, we operated 36 Last Call stores that average approximately 26,000 square feet each in size.

Distribution, Support and Office Facilities. We own approximately 41 acres of land in Longview, Texas, where our primary distribution facility

is located. The Longview facility is the principal merchandise processing and distribution facility for Neiman Marcus stores. In the spring of 2013, we

opened a new 198,000 square feet distribution facility in Pittston, Pennsylvania to support the future growth and initiatives of the Company. The new facility

in Pittston replaced the distribution facility we previously utilized in Dayton, New Jersey. We lease four regional service centers in New York, Florida, Texas

and California.

We also own approximately 50 acres of land in Irving, Texas, where our Online operating headquarters and distribution facility are located. In

addition, we currently utilize another regional distribution facility in Dallas, Texas to support our Online operation.

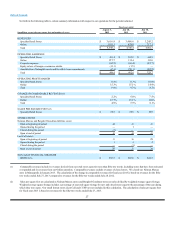

Lease Terms. We lease a significant percentage of our stores and, in certain cases, the land upon which our stores are located. The terms of these

leases, assuming all outstanding renewal options are exercised, range from two to 121 years. The lease on the Bergdorf Goodman Main Store expires in 2050,

with no renewal options, and the lease on the Bergdorf Goodman Men’s Store expires in 2020, with a 10-year renewal option. Most leases provide for monthly

fixed rentals or contingent rentals based upon revenues in excess of stated amounts and normally require us to pay real estate taxes, insurance, common area

maintenance costs and other occupancy costs.

For further information on our properties and lease obligations, see Item 7, “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and Note 16 of the Notes to Consolidated Financial Statements in Item 15.

ITEM 3. LEGAL PROCEEDINGS

On April 30, 2010, a Class Action Complaint for Injunction and Equitable Relief was filed in the United States District Court for the Central District

of California by Sheila Monjazeb, individually and on behalf of other members of the general public similarly situated, against the Company, Newton

Holding, LLC, TPG Capital, L.P. and Warburg Pincus, LLC. On July 12, 2010, all defendants except for the Company were dismissed without prejudice,

and on August 20, 2010, this case was refiled in the Superior Court of California for San Francisco County. This complaint, along with a similar class

action lawsuit originally filed by Bernadette Tanguilig in 2007, alleges that the Company has engaged in various violations of the California Labor Code and

Business and Professions Code, including without limitation 1) asking employees to work “off the clock,” 2) failing to provide meal and rest breaks to its

employees, 3) improperly calculating deductions on paychecks delivered to its employees and 4) failing to provide a chair or allow employees to sit during

shifts. On October 24, 2011, the court granted the Company’s motion to compel Ms. Monjazeb and a co-plaintiff to participate in the Company’s Mandatory

Arbitration Agreement, foreclosing a class action in that case. The court then determined that Ms. Tanguilig could not represent employees who are subject to

our Mandatory Arbitration Agreement, thereby limiting the putative class action to those associates who were employed between December 2004 and July 15,

2007 (the effective date of our Mandatory Arbitration Agreement). Ms. Monjazeb filed a demand for arbitration as a class action, which is prohibited under the

Mandatory Arbitration Agreement. In response to Ms. Monjazeb’s demand for arbitration as a class action, the American Arbitration Association (AAA)

referred the resolution of such request back to the arbitrator. We filed a motion to stay the decision of the AAA pending a ruling by the trial court; the trial

court determined that the arbitration agreement was unenforceable due to a recent California case. We asserted that the trial court does not have jurisdiction to

change its earlier determination of the enforceability of the arbitration agreement and appealed the court’s decision to the court of appeals. In addition, the

National Labor Relations Board (NLRB) has issued a complaint alleging that the Mandatory Arbitration

21

th