Neiman Marcus 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

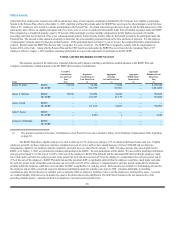

DIRECTOR COMPENSATION

None of our directors, except Mr. Tansky, receive compensation for their service as a member of our Board of Directors. They are reimbursed for

any expenses incurred as a result of their service. Pursuant to the terms and conditions of his Director Services Agreement, described below, Mr. Tansky will

serve as non-executive Chairman of the Board of Directors for a term beginning on October 6, 2010 through December 31, 2013. As an employee director,

Ms. Katz receives no compensation for her service as a member of our Board of Directors.

In connection with the Acquisition, affiliates of the Principal Stockholders receive an annual management fee equal to the lesser of 1) 0.25% of

consolidated annual revenue, and 2) $10 million for consulting and management advisory services they provide to us. See Item 13, “Certain Relationships

and Related Transactions, and Director Independence—Management Services Agreement” on page 83.

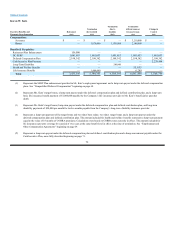

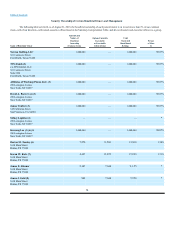

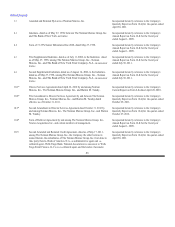

Mr. Tansky, as the only paid member of our Board of Directors, received $37,500 for each meeting attended. For the year ended August 3, 2013,

director compensation was as follows:

2013 Director Compensation

Name

Fees

Earned

or Paid in

Cash ($)

Stock

Awards ($)

Option

Awards ($)

Non-Equity

Incentive Plan

Compensation

($)

Nonqualified

Deferred

Compensation

Earnings ($)

All Other

Compensation

($) Total ($)

Burton M. Tansky 150,000 — — — — — 150,000

Director Services Agreement with Mr. Tansky

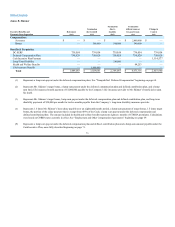

Following Mr. Tansky’s retirement as President and Chief Executive Officer on October 5, 2010, the Company entered into a director services

agreement wherein he agreed to act as non-executive Chairman of the Board of Directors for an initial term beginning October 6, 2010 through December 31,

2011 (the Director Services Agreement). In fiscal year 2012, the Director Services Agreement with Mr. Tansky was amended to extend the term to

December 31, 2012 and in fiscal year 2013 the Director Services Agreement was again amended to extend the term to December 31, 2013. He is compensated

in this new role at the rate of $37,500 for each meeting of the Board of Directors up to four meetings in any twelve-month period. The Director Services

Agreement will expire at the end of the term unless extended by agreement of both parties. In addition, Mr. Tansky will be provided with office space and

appropriate staff assistance at Bergdorf Goodman in New York and reimbursement for travel and other expenses incurred in the fulfillment of his

responsibilities as non-executive Chairman of the Board of Directors. The agreement provides that Mr. Tansky shall be subject to removal pursuant to the

standards and requirements of the Company’s By-Laws and applicable law. Also, the Director Services Agreement continues certain provisions of

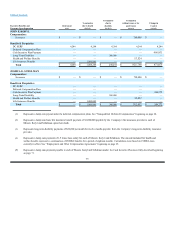

Mr. Tansky’s employment agreement that expired on the date of his retirement. He will be entitled to a tax gross-up whereby if, in the event of a change of

control following the existence of a public market for the Company’s stock, he incurs any excise tax by reason of his receipt of any payment that constitutes

an excess parachute payment as defined in Section 280G of the Code, he will receive a gross-up payment in an amount that would place him in the same after-

tax position that he would have been in if no excise tax had applied. However, under certain conditions, rather than receive a gross-up payment, the payments

payable to him will be reduced so that no excise tax is imposed. He also continues to be entitled to indemnification on the same terms as indemnification is

made available to our senior executives. The Director Services Agreement also continues Mr. Tansky’s obligations regarding non-competition and non-

solicitation of employees, confidential information and non-disparagement of the Company and its business. He is generally prohibited, for a period of three

years from his retirement, from becoming a director, officer, employee or consultant for any competing business that owns or operates a luxury specialty retail

store located in the geographic areas of our operations. He is also required to disclose and assign to us any trademarks or inventions developed by him which

relate to our business. The Director Services Agreement also continues Mr. Tansky’s obligation to furnish his assistance in any litigation in which we or any

of our affiliates is a party subject to receiving reasonable out-of-pocket expenses incurred in rendering such assistance.

In addition to the foregoing, Mr. Tansky’s Director Services Agreement provides that, upon the occurrence of the earlier of a change of control or an

initial public offering, he will be entitled to a cash bonus equal to $3,080,911, which represents his portion of the cash incentive pool pursuant to the Cash

Incentive Plan (more fully described beginning on page 71).

76