Neiman Marcus 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

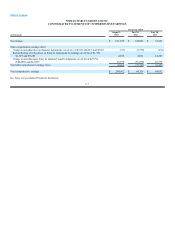

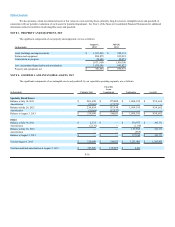

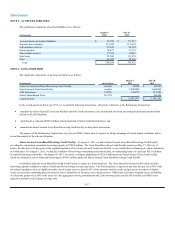

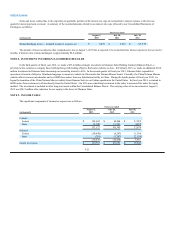

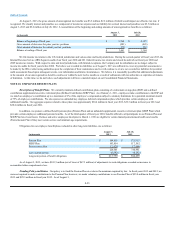

NOTE 5. ACCRUED LIABILITIES

The significant components of accrued liabilities are as follows:

(in thousands)

August 3,

2013

July 28,

2012

Accrued salaries and related liabilities $74,395 $79,517

Amounts due customers 113,412 115,691

Self-insurance reserves 37,626 36,187

Interest payable 18,677 31,119

Sales returns reserves 37,370 34,015

Sales taxes 25,306 18,976

Other 83,382 78,316

Total $390,168 $ 393,821

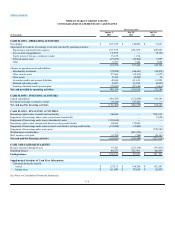

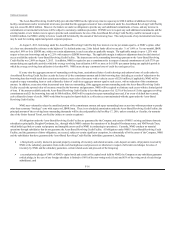

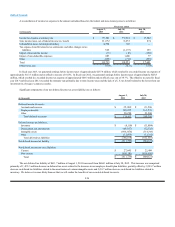

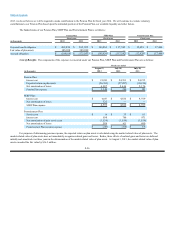

NOTE 6. LONG-TERM DEBT

The significant components of our long-term debt are as follows:

(in thousands) Interest Rate

August 3,

2013

July 28,

2012

Senior Secured Asset-Based Revolving Credit Facility variable $15,000 $100,000

Senior Secured Term Loan Facility variable 2,560,000 2,060,000

2028 Debentures 7.125% 122,077 121,882

Senior Subordinated Notes 10.375% —500,000

Long-term debt $2,697,077 $2,781,882

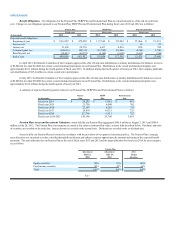

In the second quarter of fiscal year 2013, we executed the following transactions, collectively referred to as the Refinancing Transactions:

· amended our Senior Secured Term Loan Facility to provide for the incurrence of an incremental term loan, increasing the principal amount of that

facility to $2,560.0 million;

· repurchased or redeemed $500.0 million principal amount of Senior Subordinated Notes; and

· amended the Senior Secured Asset-Based Revolving Credit Facility to allow these transactions.

The purpose of the Refinancing Transactions was to lower NMG’s future interest expense by taking advantage of current market conditions and to

extend the maturity of the relevant obligation.

Senior Secured Asset-Based Revolving Credit Facility. At August 3, 2013, we had a Senior Secured Asset-Based Revolving Credit Facility

providing for a maximum committed borrowing capacity of $700.0 million. The Asset-Based Revolving Credit Facility matures on May 17, 2016 (or, if

earlier, the date that is 45 days prior to the scheduled maturity of our Senior Secured Term Loan Facility, or any indebtedness refinancing it, unless refinanced

as of that date). On August 3, 2013, we had $15.0 million of borrowings outstanding under this facility, no outstanding letters of credit and $615.0 million

of unused borrowing availability. On August 29, 2013, we made a voluntary prepayment of $126.9 million on our Senior Secured Term Loan Facility,

which was funded by cash on hand and borrowings of $100.0 million under our Senior Secured Asset-Based Revolving Credit Facility.

Availability under the Asset-Based Revolving Credit Facility is subject to a borrowing base. The Asset-Based Revolving Credit Facility includes

borrowing capacity available for letters of credit and for borrowings on same-day notice. The borrowing base is equal to at any time the sum of (a) 90% of the

net orderly liquidation value of eligible inventory, net of certain reserves, plus (b) 85% of the amounts owed by credit card processors in respect of eligible

credit card accounts constituting proceeds from the sale or disposition of inventory, less certain reserves. NMG must at all times maintain excess availability

of at least the greater of (a) 10% of the lesser of 1) the aggregate revolving commitments and 2) the borrowing base and (b) $50.0 million, but NMG is not

required to maintain a fixed charge coverage ratio.

F-17