Memorex 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

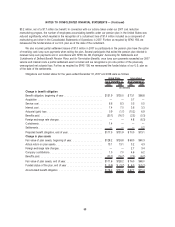

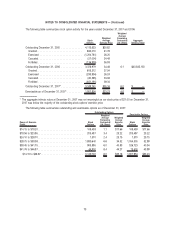

The valuation allowance was provided to account for uncertainties regarding the recoverability of certain foreign net

operating loss carryforwards and state tax credit carryforwards. The valuation allowance was $16.5 million, $9.4 million

and $8.5 million as of December 31, 2007, 2006 and 2005, respectively. The increase in 2007 is primarily due to the

acquisition of a foreign subsidiary. The increase in 2006 relates to new requirements primarily relating to tax law changes

in the Netherlands. Of the aggregate net operating loss carryforwards totaling $90.3 million, $51.2 million will expire at

various dates up to 2023 and $39.1 million may be carried forward indefinitely. State tax credit carryforwards of $8.2 million

will expire between 2008 and 2021.

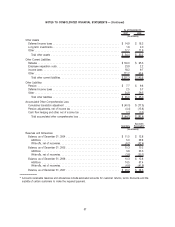

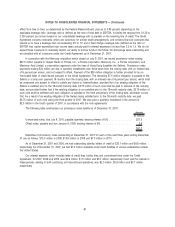

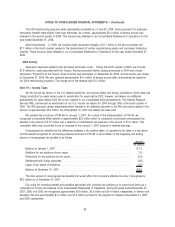

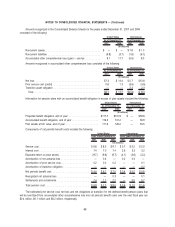

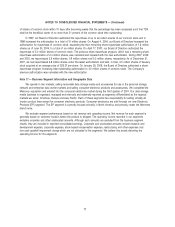

The income tax provision from continuing operations differs from the amount computed by applying the statutory

U.S. income tax rate (35 percent) because of the following items:

2007 2006 2005

Years Ended December 31,

(In millions)

Tax at statutory U.S. tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(12.1) $ 39.1 $ 37.3

State income taxes, net of federal benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.2 3.1 4.0

Net effect of international operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.8 1.4 (1.2)

Reversal of valuation allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.5) (0.7) (4.3)

International audit settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (10.4) (12.0)

Tax on foreign earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 8.2 —

Goodwill impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.9 — —

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.5) (4.1) 1.1

Income tax provision. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 15.8 $ 36.6 $ 24.9

Our 2007 income tax provision was reduced by $4.0 million as a result of the non-cash goodwill impairment charge

that occurred in the fourth quarter of 2007.

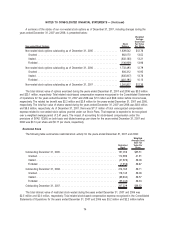

Significant tax loss carryforwards had been generated in the Netherlands for the years 1998 through 2000. The filing

of the related tax returns resulted in a “nil” assessment from the Dutch tax authorities on carryforwards representing a

possible tax benefit of up to approximately $14.0 million. This matter was favorably resolved in 2006 and resulted in a net

benefit to the tax rate of $10.4 million. Further, in conjunction with the reorganization of our international tax structure, a

charge of $8.2 million was recorded in 2006 on foreign earnings no longer considered permanently invested. Our 2005 tax

rate benefited from a favorable resolution of a U.S. tax matter that resulted in a one-time tax benefit of $12.0 million.

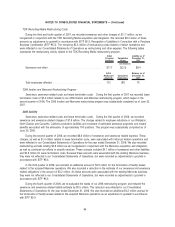

In 2007, 2006 and 2005 cash paid for income taxes, relating to both continuing and discontinued operations, was

$9.6 million, $22.0 million and $5.2 million, respectively.

As of December 31, 2007, approximately $101.7 million of earnings attributable to international subsidiaries were

considered to be permanently invested. No provision has been made for taxes that might be payable if these earnings

were remitted to the United States.

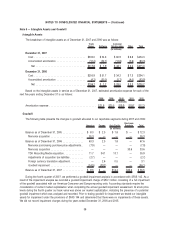

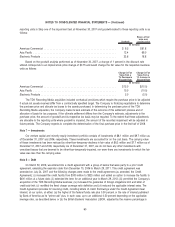

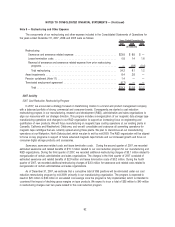

Note 11 — Retirement Plans

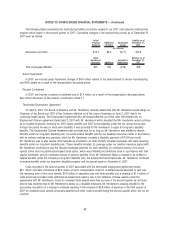

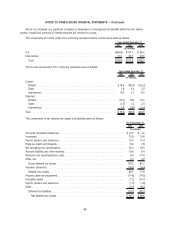

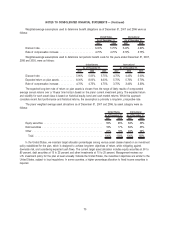

We have various non-contributory defined benefit pension plans covering substantially all U.S. employees and certain

employees outside the United States. Total pension expense was $7.3 million, $8.3 million and $11.1 million in 2007, 2006

and 2005, respectively. The measurement date of our pension plans is December 31. We expect to contribute

approximately $5 million to $6 million to our pension plans in 2008. It is our general practice, at a minimum, to fund

amounts sufficient to meet the requirements set forth in applicable benefits laws and local tax laws. From time to time, we

contribute additional amounts, as we deem appropriate.

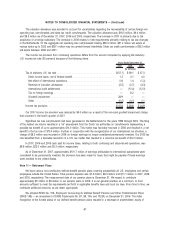

We adopted SFAS No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans

(SFAS 158) — an amendment of FASB Statements No. 87, 88, 106, and 132(R) on December 31, 2006. The initial

recognition of the funded status of our defined benefit pension plans resulted in a decrease in shareholders’ equity of

67

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)