Memorex 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

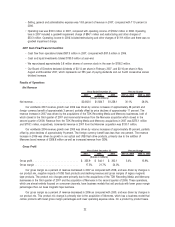

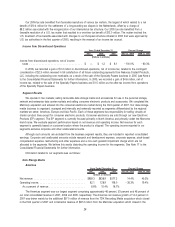

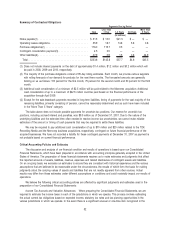

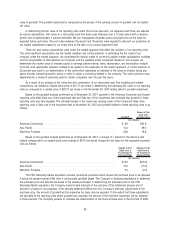

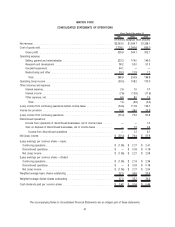

Summary of Contractual Obligations

Total

Less Than

1 Year 1-3 Years 3-5 Years

More Than

5 Years

Payments Due by Period

(In millions)

Notes payable(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 31.3 $ 10.0 $21.3 $ — $ —

Operating leases obligations . . . . . . . . . . . . . . . . . . . . . . . . . 35.9 16.7 14.8 3.8 0.6

Purchase obligations(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116.0 115.7 0.3 — —

Contingent consideration payment(3) . . . . . . . . . . . . . . . . . . . 2.5 2.5 — — —

Other liabilities(4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47.9 0.9 1.3 0.8 44.9

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $233.6 $145.8 $37.7 $4.6 $45.5

(1) Does not include interest payments on the debt of approximately $1.4 million, $1.2 million and $0.2 million which will

be paid in 2008, 2009 and 2010, respectively.

(2) The majority of the purchase obligations consist of 90-day rolling estimates. Each month, we provide various suppliers

with rolling forecasts of our demand for products for the next three months. The forecasted amounts are generally

binding on us as follows: 100 percent for the first month, 75 percent for the second month and 50 percent for the third

month.

(3) Additional cash consideration of a minimum of $2.5 million will be paid related to the Memorex acquisition. Additional

cash consideration of up to a maximum of $42.5 million could be paid based on the financial performance of the

acquisition through April 2009.

(4) Except for the sale-leaseback payments recorded in long-term liabilities, timing of payments for the vast majority of the

remaining liabilities, primarily consisting of pension, cannot be reasonably determined and as such have been included

in the “More Than 5 Years” category.

The table above does not include possible payments for uncertain tax positions. Our reserve for uncertain tax

positions, including accrued interest and penalties, was $9.5 million as of December 31, 2007. Due to the nature of the

underlying liabilities and the extended time often needed to resolve income tax uncertainties, we cannot make reliable

estimates of the amount or timing of cash payments that may be required to settle these liabilities.

We may be required to pay additional cash consideration of up to $70 million and $20 million related to the TDK

Recording Media and the Memcorp business acquisitions, respectively, contingent on future financial performance of the

acquired businesses. We have not recorded a liability for these contingent payments at December 31, 2007 as payment is

not probable based on current financial performance.

Critical Accounting Policies and Estimates

The discussion and analysis of our financial condition and results of operations is based upon our Consolidated

Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the United

States of America. The preparation of these financial statements requires us to make estimates and judgments that affect

the reported amounts of assets, liabilities, revenue, expenses and related disclosures of contingent assets and liabilities.

On an on-going basis, we evaluate our estimates to ensure they are consistent with historical experience and the various

assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual

results may differ from these estimates under different assumptions or conditions and could materially impact our results of

operations.

We believe the following critical accounting policies are affected by significant judgments and estimates used in the

preparation of our Consolidated Financial Statements:

Income Tax Accruals and Valuation Allowances. When preparing the Consolidated Financial Statements, we are

required to estimate the income taxes in each of the jurisdictions in which we operate. This process involves estimating

the actual current tax obligations based on expected income, statutory tax rates and tax planning opportunities in the

various jurisdictions in which we operate. In the event there is a significant unusual or one-time item recognized in the

32