Memorex 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

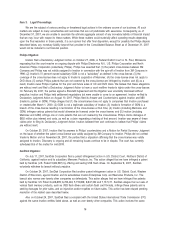

patents and the same products as described above and SanDisk is seeking an order from the ITC blocking the defendants’

importation of these products into the United States. On January 9, 2008, Imation filed its response to the complaint.

Because some of our suppliers are already licensed by SanDisk and we are indemnified by our suppliers against

claims for patent infringement, at this time we do not believe these actions will have a material adverse impact on our

financial statements.

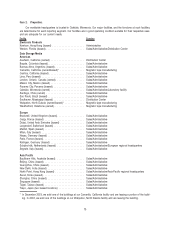

Item 4. Submission of Matters to a Vote of Security Holders.

None.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

(a) — (b)

As of February 22, 2008, there were 37,769,588 shares of our common stock, $0.01 par value (common stock),

outstanding held by approximately 24,850 shareholders of record. Our common stock is listed on the New York and

Chicago Stock Exchanges under the symbol of IMN. The Board of Directors declared a dividend of $0.14 per share of

common stock in February 2007 and dividends of $0.16 per share of common stock in May, August and November 2007,

as well as a dividend of $0.12 per share of common stock in February 2006 and dividends of $0.14 per share of common

stock in May, August and November 2006. We paid a total of $23.2 million and $18.8 million in dividends to shareholders

in 2007 and 2006, respectively.

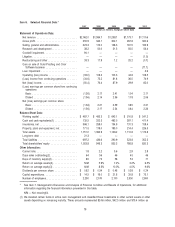

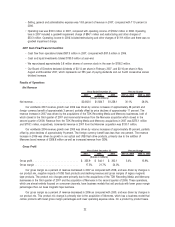

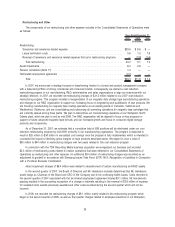

The following table sets forth, for the periods indicated, the high and low sales prices of common stock as reported

on the New York Stock Exchange.

High Low High Low

2007 Sales Prices 2006 Sales Prices

First quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $49.20 $38.96 $50.93 $41.97

Second quarter . . . . . . . . . . . . . . . . . . . . . . . . . . . $41.95 $35.69 $48.24 $37.11

Third quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $37.89 $23.71 $44.34 $37.60

Fourth quarter. . . . . . . . . . . . . . . . . . . . . . . . . . . . $27.95 $18.96 $47.99 $39.60

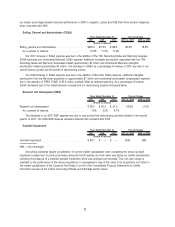

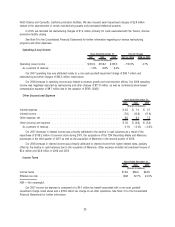

(c) Issuer Purchases of Equity Securities

Period

(a)

Total Number of

Shares

Purchased

(b)

Average

Price Paid

per Share

(c)

Total Number of

Shares Purchased as

Part of Publicly

Announced Plans or

Programs

(d)

Maximum Number

of Shares that May

Yet Be Purchased

Under the Plans or

Programs

October 1, 2007 — October 31, 2007 . . . . . . . . . . 518,900 $24.55 518,900 1,942,099

November 1, 2007 — November 30, 2007 . . . . . . . 420,093 $20.14 419,700 1,522,399

December 1, 2007 — December 31, 2007 . . . . . . . 338,800 $21.98 338,800 1,183,599

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,277,793 $22.42 1,277,400 1,183,599

(a) The purchases in this column include shares repurchased as part of our publicly announced program and in addition

include 393 shares that were surrendered to Imation by participants in our stock-based compensation plans (the Plans)

to satisfy the tax obligations related to the vesting of restricted stock awards.

(b) The average price paid in this column includes shares repurchased as part of our publicly announced program and

shares that were surrendered to Imation by participants in the Plans to satisfy the tax obligations related to the vesting

of restricted stock awards.

17