Memorex 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

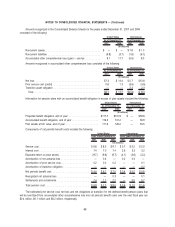

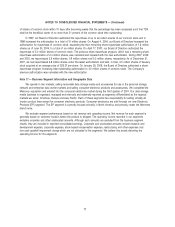

2007 2006 2005

As of December 31,

(In millions)

Long-Lived Assets

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $167.0 $174.6 $190.9

International. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.5 3.4 4.1

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $171.5 $178.0 $195.0

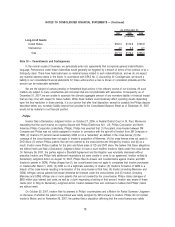

Note 18 — Commitments and Contingencies

In the normal course of business, we periodically enter into agreements that incorporate general indemnification

language. Performance under these indemnities would generally be triggered by a breach of terms of the contract or by a

third-party claim. There have historically been no material losses related to such indemnifications, and we do not expect

any material adverse claims in the future. In accordance with SFAS No. 5, Accounting for Contingencies, we record a

liability in our consolidated financial statements for these actions when a loss is known or considered probable and the

amount can be reasonably estimated.

We are the subject of various pending or threatened legal actions in the ordinary course of our business. All such

matters are subject to many uncertainties and outcomes that are not predictable with assurance. Consequently, as of

December 31, 2007, we are unable to ascertain the ultimate aggregate amount of any monetary liability or financial impact

that we may incur with respect to these matters. While these matters could materially affect operating results depending

upon the final resolution in future periods, it is our opinion that after final disposition, except for possibly the Philips dispute

described below, any monetary liability beyond that provided in the Consolidated Balance Sheet as of December 31, 2007

would not be material to our financial position.

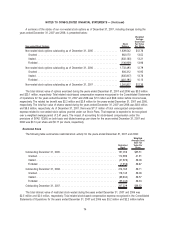

Philips

Imation filed a Declaratory Judgment Action on October 27, 2006, in Federal District Court in St. Paul, Minnesota

requesting that the court resolve an ongoing dispute with Philips Electronics N.V., U.S. Philips Corporation and North

American Philips Corporation (collectively, Philips). Philips has asserted that (1) the patent cross-license between 3M

Company and Philips was not validly assigned to Imation in connection with the spin-off of Imation from 3M Company in

1996; (2) Imation’s 51 percent owned subsidiary GDM is not a “subsidiary” as defined in the cross-license; (3) the

coverage of the cross-license does not apply to Imation’s acquisition of Memorex; (4) the cross-license does not apply to

DVD discs; (5) certain Philips patents that are not covered by the cross-license are infringed by Imation; and (6) as a

result, Imation owes Philips royalties for the prior and future sales of CD and DVD discs. We believe that these allegations

are without merit and filed a Declaratory Judgment Action to have a court reaffirm Imation’s rights under the cross-license.

On February 26, 2007, the parties signed a Standstill Agreement and the litigation was voluntarily dismissed without

prejudice. Imation and Philips held settlement negotiations but were unable to come to an agreement. Imation re-filed its

Declaratory Judgment Action on August 10, 2007. Philips filed its Answer and Counterclaims against Imation and MBI

(Imation’s partner in GDM). Philips alleges that (1) the cross-license does not apply to companies that Imation purchased

or created after March 1, 2000; (2) GDM is not a legitimate subsidiary of Imation; (3) Imation’s formation of GDM is a

breach of the cross-license resulting in termination of the cross-license at that time; (4) Imation (including Memorex and

GDM) infringes various patents that would otherwise be licensed under the cross-license; and (5) Imation (including

Memorex and GDM) infringe one or more patents that are not covered by the cross-license. Philips claims damages of

$655 million plus interest and costs, as well as a claim requesting a trebling of that amount. Imation was aware of these

claims prior to filing its Declaratory Judgment Action. Imation believed then and continues to believe that Philips’ claims

are without merit.

On October 30, 2007, Imation filed its answers to Philips’ counterclaims and a Motion for Partial Summary Judgment

on the issue of whether the patent cross-license was validly assigned by 3M Company to Imation. Philips did not contest

Imation’s Motion and on November 26, 2007, the parties filed a stipulation affirming that the cross-license was validly

79

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)