Memorex 2007 Annual Report Download - page 63

Download and view the complete annual report

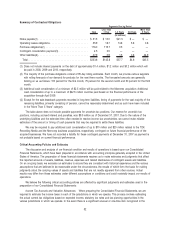

Please find page 63 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Intangible Assets. Under certain situations, interim impairment tests may be required if events occur or

circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount.

Other intangible assets are subject to impairment if events or circumstances indicate a possible inability to realize the

carrying amount.

Intangible assets are amortized using methods that approximate the benefit provided by utilization of the assets. In

determining the useful life of a trade name, we consider the following: (1) the overall strength of the trade name in the

market in terms of market awareness and market share, (2) the length of time that the trade name has been in existence,

(3) the period of time over which the trade name is expected to remain in use and (4) the strength of the trade name and

its perseverance through changes in the data storage industry. In determining the useful lives of other intangible assets, we

consider the period over which a majority of the economic benefits provided by the asset will be realized by the Company.

The initial recognition of goodwill and other intangible assets, the determination of useful lives of intangible assets

and subsequent impairment analyses require management to make subjective judgments concerning estimates of how the

acquired assets will perform in the future using valuation methods including discounted cash flow analysis.

Evaluating goodwill for impairment involves the determination of the fair value of our reporting units in which we have

recorded goodwill. A reporting unit is a component of an operating segment for which discrete financial information is

available and reviewed by management on a regular basis. Imation has determined that its reporting units are its segments

with the exception of the Americas data storage segment which is further divided between the Americas-Consumer and

Americas-Commercial reporting units. Inherent in the determination of fair value of our reporting units are certain estimates

and judgments, including the interpretation of current economic indicators and market valuations as well as our strategic

plans with regard to our operations. To the extent additional information arises or our strategies change, it is possible that

our conclusion regarding goodwill impairment could change, which could have a material effect on our financial position

and results of operations.

We performed our annual impairment test of goodwill in the fourth quarter of 2007 and recognized a non-cash

goodwill impairment charge of $94.1 million consisting of a full impairment of the goodwill associated with our Americas-

Consumer and European reporting units. Prior to testing goodwill for impairment we tested our intangible assets for

impairment under the provisions of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, and

determined that there were no impairments of these assets. We did not record impairment charges during the years ended

December 31, 2006 and 2005.

The goodwill impairment in 2007 was due to a significant decline in the estimated fair value of our reporting units,

which resulted from a significant decrease in our stock price during the year. Our stock price declined from $46.97 per

share at January 1, 2007 to $20.07 per share at the date of our annual impairment test at November 30, 2007.

Consequently, at November 30, 2007, the book value of our assets was higher than our market capitalization indicating

potential impairment. While we continually evaluate whether any indications of impairment are present which would require

an impairment analysis on an interim basis, no such indicators were considered present prior to the fourth quarter of 2007

when our market capitalization first fell below our book value for an extended time period. Prior to the fourth quarter,

based on the fact that our market capitalization exceeded our book value and our outlook for future results, we did not

believe there were any indicators of impairment requiring interim testing of goodwill.

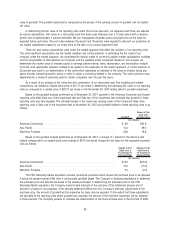

In evaluating whether goodwill was impaired, we compared the fair value of the reporting units to which goodwill is

assigned to their carrying value (Step one of the impairment test). In calculating fair value, we used a weighting of the

valuations calculated using market multiples and the income approach. The income approach is a valuation technique

under which we estimate future cash flows using the reporting units’ financial forecasts. Future estimated cash flows are

discounted to their present value to calculate fair value. The market approach establishes fair value by comparing our

company to other publicly traded guideline companies or by analysis of actual transactions of similar businesses or assets

sold. The summation of our reporting units’ fair values must be compared to our market capitalization as of the date of

our impairment test. In the situation where a reporting unit’s carrying amount exceeds its fair value, the amount of the

impairment loss must be measured. The measurement of the impairment (Step two of the impairment test) is calculated

by determining the implied fair value of a reporting unit’s goodwill. In calculating the implied fair value of goodwill, the fair

value of the reporting unit is allocated to all of the other assets and liabilities of that unit based on their fair values. The

excess of the fair value of a reporting unit over the amount assigned to its other assets and liabilities is the implied fair

34