Memorex 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

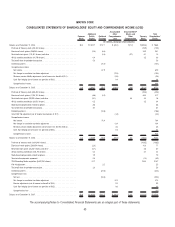

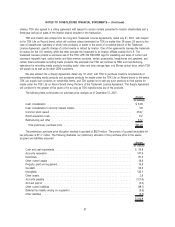

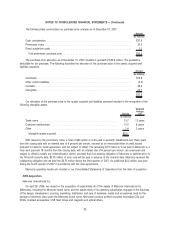

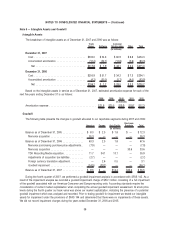

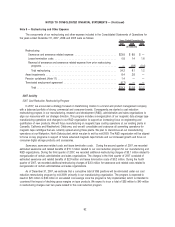

The following table summarizes our purchase price analysis as of December 31, 2007:

Amount

(In millions)

Cash consideration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $31.8

Promissory notes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37.5

Direct acquisition costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.0

Total preliminary purchase price. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $70.3

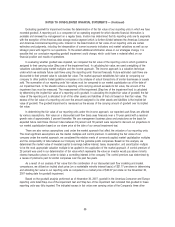

The purchase price allocation as of December 31, 2007 resulted in goodwill of $33.6 million. The goodwill is

deductible for tax purposes. The following illustrates the allocation of the purchase price to the assets acquired and

liabilities assumed:

Amount

(In millions)

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $13.9

Other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.3)

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.6

Intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.1

$70.3

Our allocation of the purchase price to the assets acquired and liabilities assumed resulted in the recognition of the

following intangible assets:

Amount

Weighted

Average

Life

(In millions)

Trade name. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.7 12 years

Customer relationships . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.0 6 years

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.4 3 years

Intangible assets acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $25.1

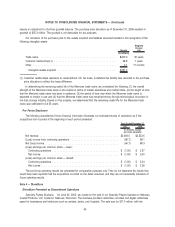

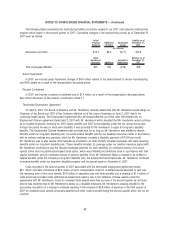

With respect to the promissory notes, a total of $30 million is to be paid in quarterly installments over three years

from the closing date with an interest rate of 6 percent per annum, secured by an irrevocable letter of credit issued

pursuant to Imation’s credit agreement, and not subject to offset. The remaining $7.5 million is to be paid to Memcorp in a

lump sum payment 18 months from the closing date, with an interest rate of 6 percent per annum, are unsecured and

subject to offset to satisfy any indemnification claims; provided that if an existing obligation of Memcorp is satisfied prior to

the 18-month maturity date, $3.75 million of such note will be paid in advance of the maturity date. Memcorp resolved the

outstanding obligation and we paid the $3.75 million during the third quarter of 2007. An additional $2.5 million was paid

during the fourth quarter of 2007 in accordance with the note agreements.

Memcorp operating results are included in our Consolidated Statements of Operations from the date of acquisition.

2006 Acquisition

Memorex International Inc.

On April 28, 2006, we closed on the acquisition of substantially all of the assets of Memorex International Inc.

(Memorex), including the Memorex brand name and the capital stock of its operating subsidiaries engaged in the business

of the design, development, sourcing, marketing, distribution and sale of hardware, media and accessories used for the

storage of electronic data under the Memorex brand name. Memorex’s product portfolio includes recordable CDs and

DVDs, branded accessories, USB flash drives and magnetic and optical drives.

53

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)