Memorex 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 9 — Restructuring and Other Expense

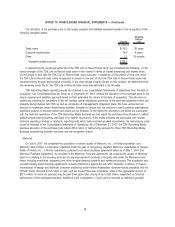

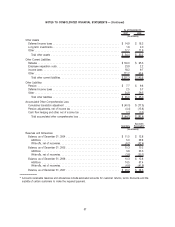

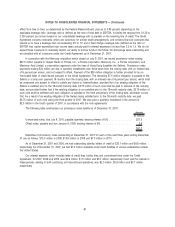

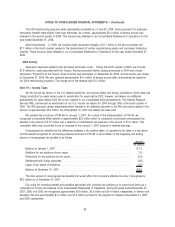

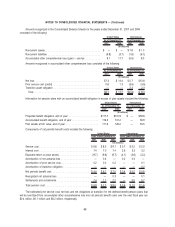

The components of our restructuring and other expense included in the Consolidated Statements of Operations for

the years ended December 31, 2007, 2006 and 2005 were as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Restructuring

Severance and severance related expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23.6 $ 8.6 $ —

Lease termination costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6 1.4 1.6

Reversal of severance and severance related expense from prior restructuring

programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (0.9) (0.4)

Total restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.2 9.1 1.2

Asset impairments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.4 2.8 —

Pension curtailment (Note 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.4 — —

Terminated employment agreement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.7) — —

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $33.3 $11.9 $ 1.2

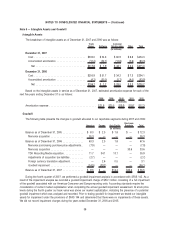

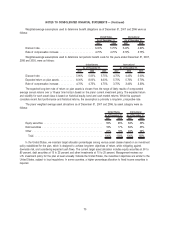

2007 Activity

2007 Cost Reduction Restructuring Program

In 2007, we announced a strategy focused on transforming Imation to a brand and product management company

with a balanced portfolio of strong commercial and consumer brands. Consequently, we started a cost reduction

restructuring program in our manufacturing, research and development (R&D), administrative and sales organizations to

align our resources with our strategic direction. This program includes a reorganization of our magnetic data storage tape

manufacturing operations and changes to our R&D organization to support an increasing focus on engineering and

qualification of new products. We will focus manufacturing on magnetic tape coating operations at our existing plants in

Camarillo, California and Weatherford, Oklahoma, and we will consolidate and outsource all converting operations for

magnetic tape cartridges that are currently spread among three plants. We plan to discontinue all our manufacturing

operations at our Wahpeton, North Dakota plant, which we plan to exit by mid-2009. The R&D organization will be aligned

to focus on key programs in support of future advanced magnetic tape formats and our increased growth and focus on

consumer digital storage products and accessories.

Severance, severance related costs and lease termination costs. During the second quarter of 2007, we recorded

estimated severance and related benefits of $15.1 million related to our cost reduction program for our manufacturing and

R&D organizations. During the third quarter of 2007, we recorded additional restructuring charges of $3.1 million related to

reorganization of certain administrative and sales organizations. The charges in the third quarter of 2007 consisted of

estimated severance and related benefits of $2.9 million and lease termination costs of $0.2 million. During the fourth

quarter of 2007, we recorded additional restructuring charges of $3.3 million for severance and related costs related to

reorganization of certain administrative and sales organizations.

As of December 31, 2007, we estimate that a cumulative total of 835 positions will be eliminated under our cost

reduction restructuring program by mid-2009, primarily in our manufacturing organization. The program is expected to

result in $25 million to $30 million in annualized cost savings once the program is fully implemented, which is intended to

counteract the impact of declining gross margins on tape products. We expect to incur a total of $35 million to $40 million

in restructuring charges over two years related to this cost reduction program.

62

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)