Memorex 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

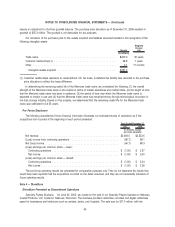

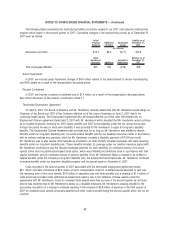

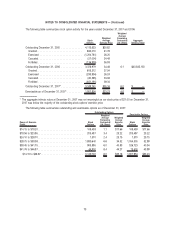

The 2004 restructuring programs were substantially completed as of June 30, 2006. Actual payments for employee

termination benefits were slightly lower than estimated. As a result, approximately $0.4 million of excess accrual was

reversed in the second quarter of 2006. This amount was reflected in our Consolidated Statements of Operations for the

year ended December 31, 2006.

Asset Impairments. In 2006, we incurred asset impairment charges of $1.1 million in the second quarter and

$1.7 million in the fourth quarter, related to the abandonment of certain manufacturing assets and purchased intellectual

property. These amounts were reflected in our Consolidated Statements of Operations for the year ended December 31,

2006.

2005 Activity

Severance, severance related costs and lease termination costs. During the fourth quarter of 2005, we incurred

$1.6 million for costs associated with the Tucson, Arizona production facility closing announced in 2004 and a lease

termination. Production at the Tucson, Arizona facility was terminated on September 30, 2005, and the facility was closed

by December 31, 2005. We also reversed approximately $0.4 million of excess accrual after re-evaluating the needs for

our 2004 restructuring programs. The charge net of the reversal was $1.2 million.

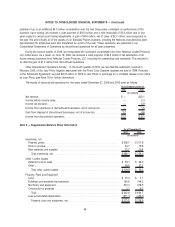

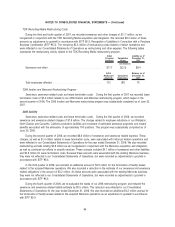

Note 10 — Income Taxes

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. Some state and

foreign jurisdiction tax years remain open to examination for years before 2002; however, we believe any additional

assessments for years before 2002 will not be material to our consolidated financial statements. The Internal Revenue

Service (IRS) commenced an examination of our U.S. income tax returns for 2003 through 2005 in the fourth quarter of

2006. The IRS proposed certain adjustments which resulted in an additional payment to the IRS and various states in the

amount of approximately $3.2 million. As of December 31, 2007 this liability has been paid.

We adopted the provisions of FIN 48 on January 1, 2007. As a result of the implementation of FIN 48, we

recognized a cumulative effect benefit of approximately $2.5 million which is comprised of previously unrecognized tax

benefits in the amount of $1.5 million and a reduction of international tax reserves in the amount of $1.0 million. This

cumulative effect was accounted for as an increase to the January 1, 2007 balance of retained earnings.

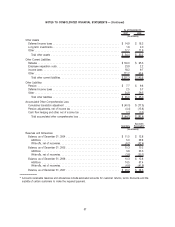

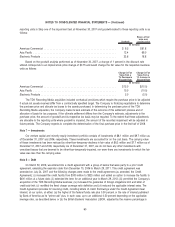

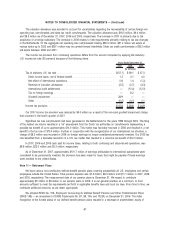

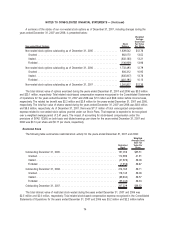

Unrecognized tax benefits are the differences between a tax position taken, or expected to be taken in a tax return,

and the benefit recognized for accounting purposes pursuant to FIN 48. A reconciliation of the beginning and ending

amount of unrecognized tax benefits is as follows:

Amount

(In millions)

Balance at January 1, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7.3

Additions for tax positions of prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.0

Reductions for tax positions of prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.2)

Settlements with taxing authorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.6)

Lapse of the statue of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.0)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9.5

The total amount of unrecognized tax benefits that would affect the Company’s effective tax rate, if recognized is

$9.3 million as of December 31, 2007.

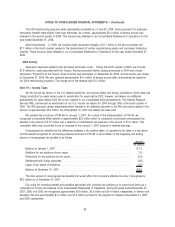

Our policy for recording interest and penalties associated with uncertain tax positions is to record such items as a

component of income tax expense in the Consolidated Statements of Operations. During the years ended December 31,

2007, 2006, and 2005, we recognized approximately $0.6 million, $0.5 million and $0.4 million, respectively, in interest and

penalties. We had approximately $1.0 million and $1.5 million accrued for the payment of interest at December 31, 2007,

and 2006, respectively.

65

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)