Memorex 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our 2006 tax rate benefited from favorable resolutions of various tax matters, the largest of which related to a net

benefit of $10.4 million for the settlement of a long-standing tax dispute in the Netherlands, offset by a charge of

$8.2 million associated with the reorganization of our international tax structure. Our 2005 tax rate benefited from a

favorable resolution of a U.S. tax matter that resulted in a one-time tax benefit of $12.0 million. The matter involved the

U.S. treatment of tax benefits associated with changes to our European structure initiated in 2000 that were approved by

U.S. tax authorities in the first quarter of 2005, resulting in the reversal of an income tax accrual.

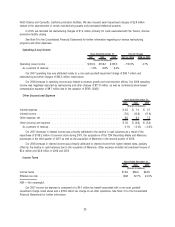

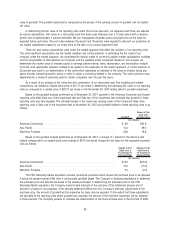

Income from Discontinued Operations

2007 2006 2005 2007 vs. 2006 2006 vs. 2005

(Dollars in millions)

Years Ended December 31, Percent Change

Income from discontinued operations, net of income

taxes ................................... $ — $ 1.2 $ 6.1 ⫺100.0% ⫺80.3%

In 2006, we recorded a gain of $1.2 million in discontinued operations, net of income tax, related to the contingent

consideration of $2.3 million received in full satisfaction of all future outstanding payments from Nekoosa Coated Products,

LLC, including the outstanding note receivable, as a result of the sale of the Specialty Papers business in 2005 (see Note 4

to the Consolidated Financial Statements for further information). In 2005, we recorded a gain of $4.6 million, net of

income tax, related to the sale of the Specialty Papers business and $1.5 million as the after-tax income from operations

of the Specialty Papers business.

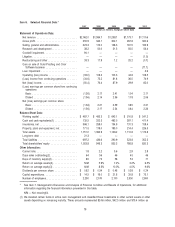

Segment Results

We operate in two markets; selling removable data storage media and accessories for use in the personal storage,

network and enterprise data center markets and selling consumer electronic products and accessories. We completed the

Memcorp acquisition and entered into the consumer electronics market during the third quarter of 2007. Our data storage

media business is organized, managed and internally and externally reported as segments differentiated by the regional

markets we serve: Americas, Europe and Asia Pacific. Each of these segments has responsibility for selling virtually all

Imation product lines except for consumer electronic products. Consumer electronics are sold through our new Electronic

Products (EP) segment. The EP segment is currently focused primarily in North America and primarily under the Memorex

brand name. We evaluate segment performance based on net revenue and operating income. Net revenue for each

segment is generally based on customer location where the product is shipped. The operating income reported in our

segments excludes corporate and other unallocated amounts.

Although such amounts are excluded from the business segment results, they are included in reported consolidated

earnings. Corporate and unallocated amounts include research and development expense, corporate expense, stock-based

compensation expense, restructuring and other expenses and a non-cash goodwill impairment charge which are not

allocated to the segments. We believe this avoids distorting the operating income for the segments. See Note 17 to the

Consolidated Financial Statements for further information.

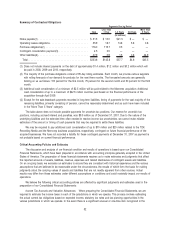

Information related to our segments was as follows:

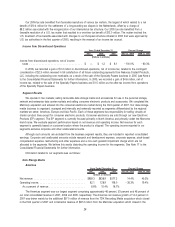

Data Storage Media

Americas

2007 2006 2005 2007 vs. 2006 2006 vs. 2005

(Dollars in millions)

Years Ended December 31, Percent Change

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $959.3 $838.9 $577.3 14.4% 45.3%

Operating income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82.1 128.9 108.0 ⫺36.3% 19.4%

As a percent of revenue . . . . . . . . . . . . . . . . . . . . . . . . 8.6% 15.4% 18.7%

The Americas segment was our largest segment comprising approximately 46 percent, 53 percent and 46 percent of

our total consolidated revenue in 2007, 2006 and 2005, respectively. The Americas net revenue growth of 14.4 percent in

2007 was driven mainly by the additional $57.0 million of revenue from the TDK Recording Media acquisition which closed

in the third quarter of 2007 and incremental revenue of $87.2 million from the Memorex acquisition which closed in the

26