Memorex 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

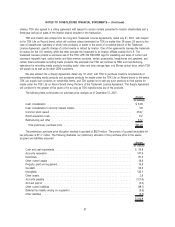

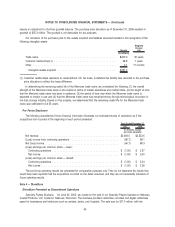

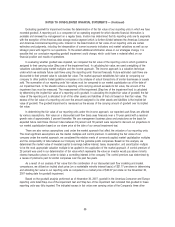

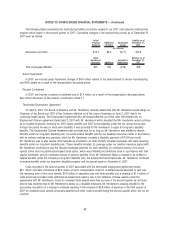

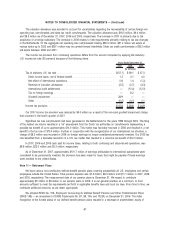

reporting units in Step one of the impairment test at November 30, 2007 and goodwill related to these reporting units is as

follows:

Goodwill

Excess of fair

value over

carrying value

(In millions)

Americas-Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9.5 $81.8

Asia Pacific . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.4 69.0

Electronic Products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.6 18.8

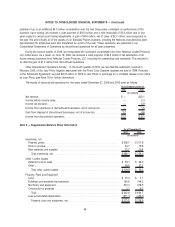

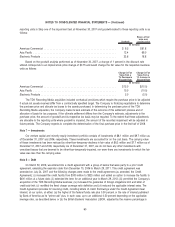

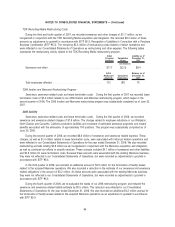

Based on the goodwill analysis performed as of November 30, 2007, a change of 1 percent in the discount rate

utilized corresponds to an implied stock price change of $0.75 and would change the fair value for the respective business

units as follows:

Change in Fair

Value from a

1% Decrease in

Discount Rate

Change in Fair

Value from a

1% Increase in

Discount Rate

(In millions)

Americas-Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15.0 $(15.0)

Asia Pacific . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.0 (10.0)

Electronic Products . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.0 (5.0)

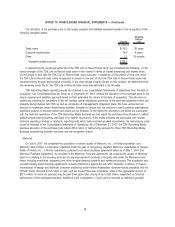

The TDK Recording Media acquisition included contractual provisions which require the purchase price to be adjusted

if actual net assets received differ from a contractually specified target. The Company is finalizing negotiations to determine

the purchase price and allocate tax bases to the assets purchased. In determining the purchase price of the TDK

Recording Media acquisition, the Company made its best estimate of the outcome of this settlement process and of

allocation of basis for tax purposes. If the ultimate settlement differs from the Company’s estimate, adjustments to the

purchase price, the amount of goodwill and its respective tax basis may be required. To the extent that these adjustments

are allocable to the reporting units where goodwill is impaired, the amount of the recorded impairment will be adjusted in

future periods. The Company expects to complete the determination of the final purchase price in the first half of 2008.

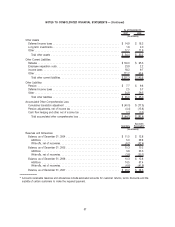

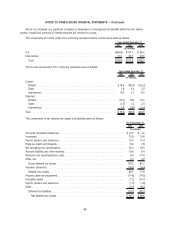

Note 7 — Investments

Our venture capital and minority equity investment portfolio consists of investments of $8.1 million and $9.7 million as

of December 31, 2007 and 2006, respectively. These investments are accounted for on the cost basis. The carrying value

of these investments has been reduced by other-than-temporary declines in fair value of $6.3 million and $7.7 million as of

December 31, 2007 and 2006, respectively. As of December 31, 2007, we do not have any other investments with

unrealized losses that are deemed to be other-than-temporarily impaired, nor were there any investments for which the fair

value was less than the carrying value.

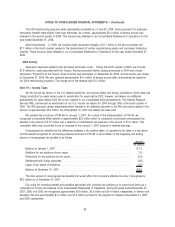

Note 8 — Debt

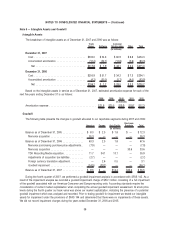

On March 30, 2006, we entered into a credit agreement with a group of banks that were party to a prior credit

agreement, extending the expiration date from December 15, 2006 to March 29, 2011. This credit agreement was

amended on July 24, 2007 and the following changes were made to the credit agreement (as amended, the Credit

Agreement): (i) increased the credit facility from $300 million to $325 million and added an option to increase the facility to

$400 million at a future date; (ii) extended the term for an additional year to March 29, 2012; (iii) permitted the Company’s

acquisition of the TDK Recording Media business; (iv) increased the guarantee of foreign obligations limit and letter of

credit sub-limit; (v) modified the fixed charge coverage ratio definition and (vi) reduced the applicable interest rates. The

Credit Agreement provides for revolving credit, including letters of credit. Borrowings under the Credit Agreement bear

interest, at our option, at either: (a) the higher of the federal funds rate plus 0.50 percent or the rate of interest published

by Bank of America as its “prime rate” plus, in each case, up to an additional 0.50 percent depending on the applicable

leverage ratio, as described below, or (b) the British Bankers’ Association LIBOR, adjusted by the reserve percentage in

60

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)