Memorex 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

inflows rather than operating cash inflows on a prospective basis. This amount is shown as excess tax benefit from stock-

based compensation in the Consolidated Statements of Cash Flows.

Comprehensive Income. Comprehensive income (loss) includes net (loss) income, the effects of currency

translation, unrealized gains and losses on cash flow hedges and pension adjustments. Comprehensive income (loss) for

all years presented is included in the Consolidated Statements of Shareholders’ Equity and Comprehensive Income (Loss).

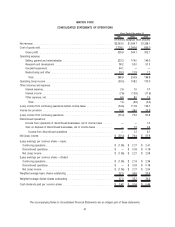

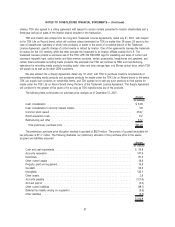

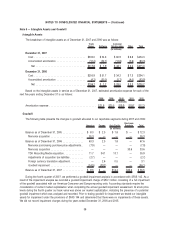

Weighted Average Basic and Diluted Shares Outstanding. Basic earnings per share is calculated using the weighted

average number of shares outstanding during the year. Diluted earnings per share is computed on the basis of the weighted

average basic shares outstanding plus the dilutive effect of our stock-based compensation plans using the “treasury stock”

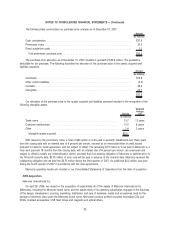

method. The following table sets forth the computation of the weighted average basic and diluted shares outstanding:

2007 2006 2005

Years Ended December 31,

(In millions)

Weighted average number of basic shares outstanding during the year . . . . . . . . . . . 37.0 34.6 33.9

Dilutive effect of stock-based compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . — 0.6 0.7

Weighted average number of dilutive shares outstanding during the year . . . . . . . . . . 37.0 35.2 34.6

Options to purchase approximately 3.1 million, 0.1 million and 0.9 million shares of our common stock were

outstanding as of December 31, 2007, 2006 and 2005, respectively, and were not considered in the computation of

potential common shares because the effect of the options would be antidilutive.

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurement (SFAS 157), which defines fair value,

establishes a framework for measuring fair value and expands disclosures about fair value measurement. Additionally, in

February 2008, the FASB announced it will defer for one year the effective date of SFAS 157 for nonfinancial assets and

liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring basis. The FASB also

decided to amend FAS 157 to add a scope exception for leasing transactions subject to SFAS No. 13, Accounting for

Leases, from its application. The adoption of SFAS 157 effective January 1, 2008 did not have a material impact on our

Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities — including an amendment to FAS 115 (SFAS 159). This statement permits companies to choose to measure

many financial instruments and certain other items at fair value. Unrealized gains and losses on items for which the fair value

option has been elected will be recognized in earnings at each subsequent reporting date. Companies are required to adopt

the new standard for fiscal periods beginning after November 15, 2007. We did not apply the fair value option to any of our

outstanding instruments and, therefore, SFAS 159 did not have an impact on our Consolidated Financial Statements.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations, which is a revision of SFAS No. 141.

SFAS 141(R) retains the fundamental requirements in SFAS No. 141 that the acquisition method of accounting be used for

all business combinations and for an acquirer to be identified for each business combination. This statement includes

changes in the measurement of fair value of the assets acquired, the liabilities assumed and any noncontrolling interest in

the acquiree as of the acquisition date, with limited exceptions. This statement requires in general that transaction costs

and costs to restructure the acquired company be expensed and contractual contingencies be recorded at their acquisition-

date fair values. Companies are required to adopt the new standard prospectively for fiscal periods beginning on or after

December 15, 2008. We are currently evaluating the impact of this standard on our Consolidated Financial Statements.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements —

an amendment of ARB No. 51. This statement clarifies that a noncontrolling interest in a subsidiary is an ownership

interest in the consolidated entity that should be reported as equity in the consolidated financial statements. This statement

also changes the way the consolidated income statement is presented. It requires consolidated net income to be reported

at amounts that include the amounts attributable to both the parent and the noncontrolling interest, with disclosure on the

49

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)