Memorex 2007 Annual Report Download - page 65

Download and view the complete annual report

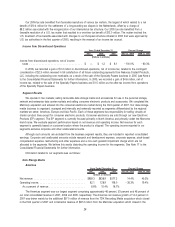

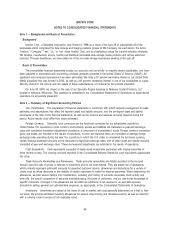

Please find page 65 of the 2007 Memorex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Excess Inventory and Obsolescence Accruals. We write down our inventory for estimated excess and obsolescence

to the estimated net realizable value based upon assumptions about future demand and market conditions. If actual market

conditions are less favorable than those we project, adjustments to these reserves may be required. As of December 31,

2007, the excess inventory and obsolescence accrual was $20.2 million.

Rebates. We maintain an accrual for customer rebates that totaled $104.0 million as of December 31, 2007. This

accrual requires a program-by-program estimation of outcomes based on a variety of factors including customer unit sell-

through volumes and end user redemption rates. In the event that actual volumes and redemption rates differ from the

estimates used in the accrual calculation, adjustments to the accrual, upward or downward, may be necessary.

Recently Issued Accounting Standards

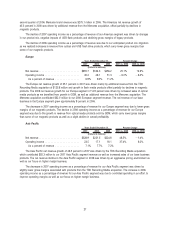

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurement (SFAS 157), which defines fair value,

establishes a framework for measuring fair value and expands disclosures about fair value measurement. Additionally, in

February 2008, the FASB announced it will defer for one year the effective date of SFAS 157 for nonfinancial assets and

liabilities that are recognized or disclosed at fair value in the financial statements on a nonrecurring basis. The FASB also

decided to amend FAS 157 to add a scope exception for leasing transactions subject to SFAS No. 13, Accounting for

Leases, from its application. The adoption of SFAS 157 effective January 1, 2008 did not have a material impact on our

Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities — including an amendment to FAS 115 (SFAS 159). This statement permits companies to choose to measure

many financial instruments and certain other items at fair value. Unrealized gains and losses on items for which the fair

value option has been elected will be recognized in earnings at each subsequent reporting date. Companies are required

to adopt the new standard for fiscal periods beginning after November 15, 2007. We did not apply the fair value option to

any of our outstanding instruments and, therefore, SFAS 159 did not have an impact on our Consolidated Financial

Statements.

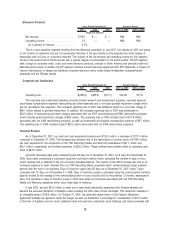

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations, which is a revision of SFAS No. 141.

SFAS 141(R) retains the fundamental requirements in SFAS No. 141 that the acquisition method of accounting be used for

all business combinations and for an acquirer to be identified for each business combination. This statement includes

changes in the measurement of fair value of the assets acquired, the liabilities assumed and any noncontrolling interest in

the acquiree as of the acquisition date, with limited exceptions. This statement requires in general that transaction costs

and costs to restructure the acquired company be expensed and contractual contingencies be recorded at their acquisition-

date fair values. Companies are required to adopt the new standard prospectively for fiscal periods beginning on or after

December 15, 2008. We are currently evaluating the impact of this standard on our Consolidated Financial Statements.

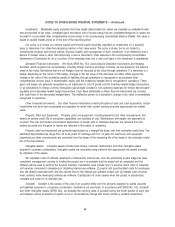

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements —

an amendment of ARB No. 51. This statement clarifies that a noncontrolling interest in a subsidiary is an ownership

interest in the consolidated entity that should be reported as equity in the consolidated financial statements. This statement

also changes the way the consolidated income statement is presented. It requires consolidated net income to be reported

at amounts that include the amounts attributable to both the parent and the noncontrolling interest, with disclosure on the

face of the consolidated statement of income of the amounts of consolidated net income attributable to the parent and the

noncontrolling interest. Companies are required to adopt the new standard for fiscal periods beginning on or after

December 15, 2008. We are currently evaluating the impact of this standard on our Consolidated Financial Statements.

In June 2007, the FASB ratified EITF 06-11, Accounting for the Income Tax Benefits of Dividends on Share-Based

Payment Awards (EITF 06-11). EITF 06-11 provides that tax benefits associated with dividends on share-based payment

awards be recorded as a component of additional paid-in capital. EITF 06-11 is effective, on a prospective basis, for fiscal

years beginning after December 15, 2007. The implementation of this standard did not have a material impact on our

Consolidated Financial Statements.

36